Introduction

In the dynamic world of finance, option trading has emerged as a powerful tool for savvy investors seeking to navigate market fluctuations and generate substantial earnings. However, predicting option prices accurately requires a deep understanding of complex algorithms and meticulous analysis. This comprehensive article delves into the intricate realm of option trading prediction, providing a roadmap for investors to enhance their profitability and mitigate risk.

Image: www.pinterest.com

Understanding Option Trading Basics

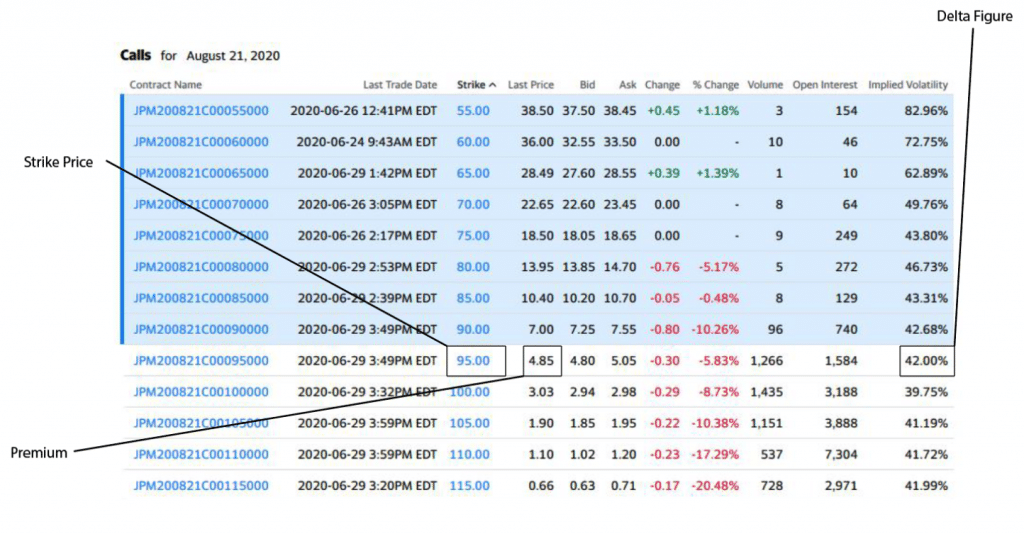

Before delving into prediction techniques, it’s crucial to grasp the foundations of option trading. Options are financial contracts granting the buyer the “right” but not the “obligation” to buy (call option) or sell (put option) an underlying asset (e.g., stocks, currencies) at a predefined price (strike price) before or on a predetermined date (expiration date).

Factors Influencing Option Prices

Numerous factors influence option prices, making prediction a multifaceted endeavor. These include the asset’s underlying price, volatility (the degree of price fluctuations), time to expiration, prevailing interest rates, and market sentiment. Accurately predicting the interplay of these variables is paramount for effective option trading.

Quantitative Models for Option Pricing

One of the primary methods employed for option trading prediction relies on quantitative models. These utilize complex mathematical formulas to determine an option’s “fair value” based on various inputs, such as historical data, implied volatility, and the underlying asset’s price movements. Various models exist, including the Black-Scholes model, which considers factors like time decay and the risk-free rate.

Image: club.ino.com

Technical Analysis

Technical analysis is another widely used approach for option trading prediction. This method focuses on identifying trends and patterns in the underlying asset’s price movements through the study of historical price charts, volume data, and technical indicators. By analyzing these patterns, traders can form predictions about future price movements and adjust option trading strategies accordingly.

Fundamental Analysis

Unlike technical analysis, fundamental analysis delves into the underlying company or sector, assessing factors like financial statements, industry trends, macroeconomic conditions, and geopolitical events. By analyzing these fundamentals, traders aim to gauge the intrinsic value of the underlying asset and make informed predictions about its future price movements.

Expert Advice and Cautionary Considerations

Numerous seasoned experts have shared valuable insights and guidance for successful option trading prediction. One such expert, Professor Nassim Taleb, emphasized the significance of managing risk, highlighting that “option sellers should be humble, knowledgeable, and well-capitalized.” Another renowned expert, Mark Douglas, stressed the importance of emotional control and disciplined risk management. It’s also crucial to remember that option trading involves potential risks, and investors should carefully consider their tolerance for such risks before entering into option trading strategies.

Option Trading Prediction

Conclusion

Option trading prediction is a multifaceted endeavor that necessitates a meticulous understanding of both qualitative and quantitative factors. By employing a combination of analytical tools, including quantitative models, technical analysis, and fundamental analysis, investors can enhance their prediction accuracy, enabling them to make well-informed investment decisions and navigate the financial markets with confidence. However, it’s essential to exercise caution, manage risk effectively, and seek guidance from reputable sources to maximize the potential benefits of option trading.