Introduction

In the fast-paced world of financial markets, where opportunities and risks intertwine, live option trading stands as a dynamic and potentially lucrative avenue for savvy investors. Whether you’re a seasoned veteran or just dipping your toes in the trading arena, understanding the ins and outs of live option trading is essential for success. This comprehensive guide will delve into the intricacies of this exciting realm, providing you with the knowledge and insights you need to make informed decisions and navigate the ever-changing landscape of options trading.

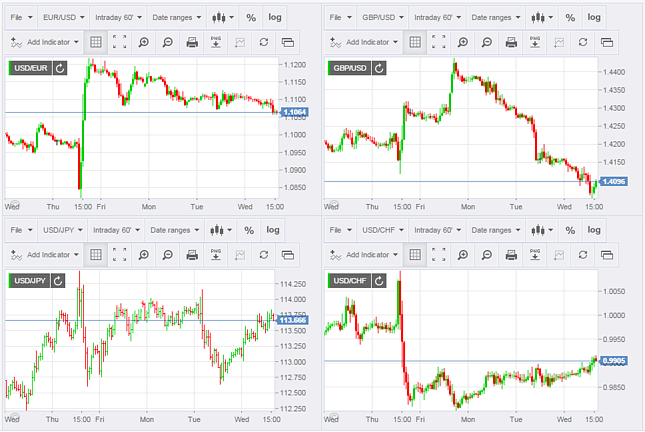

Image: currency-trading-forex.com

Options trading, in essence, involves the buying and selling of contracts that give the holder the right, but not the obligation, to buy or sell an underlying asset at a predefined price on or before a specified date. These contracts, known as options, empower traders to speculate on the future direction of an asset’s price without having to own the underlying asset itself. In live option trading, these contracts are traded in real-time, allowing traders to react swiftly to market movements and capitalize on fleeting opportunities.

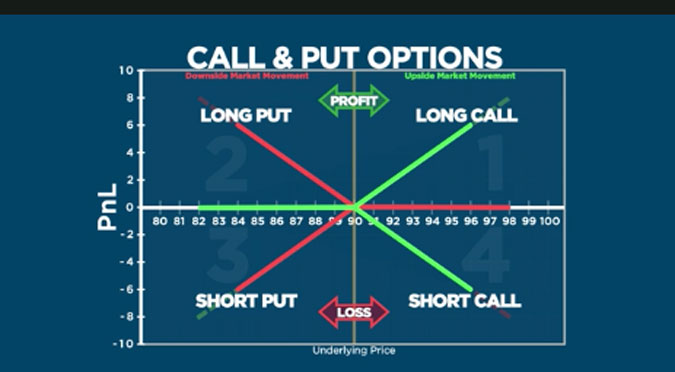

Understanding Options Basics

To fully grasp live option trading, it’s imperative to develop a solid understanding of the fundamental concepts that underpin this market. Options are typically classified into two main types: calls and puts. Call options provide the buyer the right to buy an asset at a predetermined price, known as the strike price, on or before the expiration date of the contract. Put options, on the other hand, grant the buyer the right to sell an asset at the strike price within the same timeframe.

When buying an option, traders pay a premium to the seller of the contract, which represents the upfront cost of acquiring the right to exercise the option at a later date. The premium’s value fluctuates constantly, reflecting changes in the underlying asset’s price, time decay, and market volatility. Understanding the factors that influence option premiums is crucial for making informed trading decisions.

Real-World Applications of Live Option Trading

Live option trading offers a diverse array of opportunities and strategies for investors with varying risk appetites and objectives. Some of the most common applications of live option trading include:

-

Hedging: Options can be used to protect existing investments from price fluctuations. For instance, an investor who owns a stock portfolio can purchase put options to mitigate potential losses in case the market turns bearish.

-

Speculation: Live option trading allows traders to speculate on the future price movements of assets. By correctly predicting market trends, traders have the opportunity to generate significant gains by trading options contracts.

-

Income generation: Option premiums can provide a source of income for traders. By selling options, traders can collect premiums in exchange for granting the buyer the right to exercise the option at a future date.

Expert Insights and Actionable Tips

To enhance your live option trading journey, consider the following insights and tips from industry experts:

-

Embrace Risk Management: Options trading carries inherent risks, so it’s crucial to implement robust risk management strategies. Define your risk tolerance, set stop-loss orders, and diversify your option holdings.

-

Master Market Analysis: Successful live option trading requires a thorough understanding of market dynamics. Study charts, technical indicators, and economic data to gain insights into potential price movements.

-

Seek Education and Mentorship: Continuously educate yourself about options trading and seek guidance from experienced traders. Attend workshops, read articles, and connect with mentors to expand your knowledge and improve your skills.

-

Test Strategies with Paper Trading: Before venturing into live trading, practice your strategies using paper trading accounts, which allow you to trade simulated markets without financial risk.

Image: mapsandmasters.com

Live Option Trading Today

Conclusion

Embarking on the live option trading journey can be both exhilarating and daunting. By embracing the knowledge and insights outlined in this comprehensive guide, you can equip yourself for success in this dynamic and potentially lucrative market. Remember to embrace risk management, continually enhance your market analysis skills, and seek opportunities for learning and growth. With a thoughtful approach and unwavering perseverance, you can harness the power of live option trading to achieve your financial aspirations.