Introduction: Unleashing the Potential of Long Options

In the realm of stock market trading, options contracts offer traders a unique opportunity to amplify their returns and mitigate risk. Among the various options strategies, going “long” on options presents a compelling avenue for potential profit and portfolio enhancement. This article delves into the intricacies of options trading long using the TD Ameritrade platform, empowering you with the knowledge to navigate this dynamic market.

Image: scuba-dawgs.com

Section 1: The Anatomy of a Long Option

When you buy an option contract, you acquire the right, but not the obligation, to either buy (in the case of a call option) or sell (in the case of a put option) the underlying asset at a predetermined price (the strike price) before a specified expiration date. Going “long” on options involves buying the right to buy or sell the underlying asset, anticipating that its price will move in your favor.

Section 2: Understanding the Benefits of Trading Long Options

The primary advantage of trading long options lies in their ability to magnify potential gains. Unlike traditional stock investing, where the maximum potential return is capped at 100% (if the stock price doubles), long options offer the opportunity for unlimited profit potential. Additionally, long options provide leverage, allowing you to control a large number of shares without tying up substantial capital.

Section 3: Varieties of Long Option Strategies

The TD Ameritrade platform offers a wide range of long option strategies tailored to different investment objectives and risk tolerances. Some of the most popular strategies include:

- Bull Call: Buying a call option with the expectation that the stock price will rise.

- Bull Put: Buying a put option with the anticipation that the stock price will fall.

- Covered Call: Selling a call option against an underlying stock position owned by the investor.

- Protective Put: Buying a put option to hedge against potential losses in an underlying stock position.

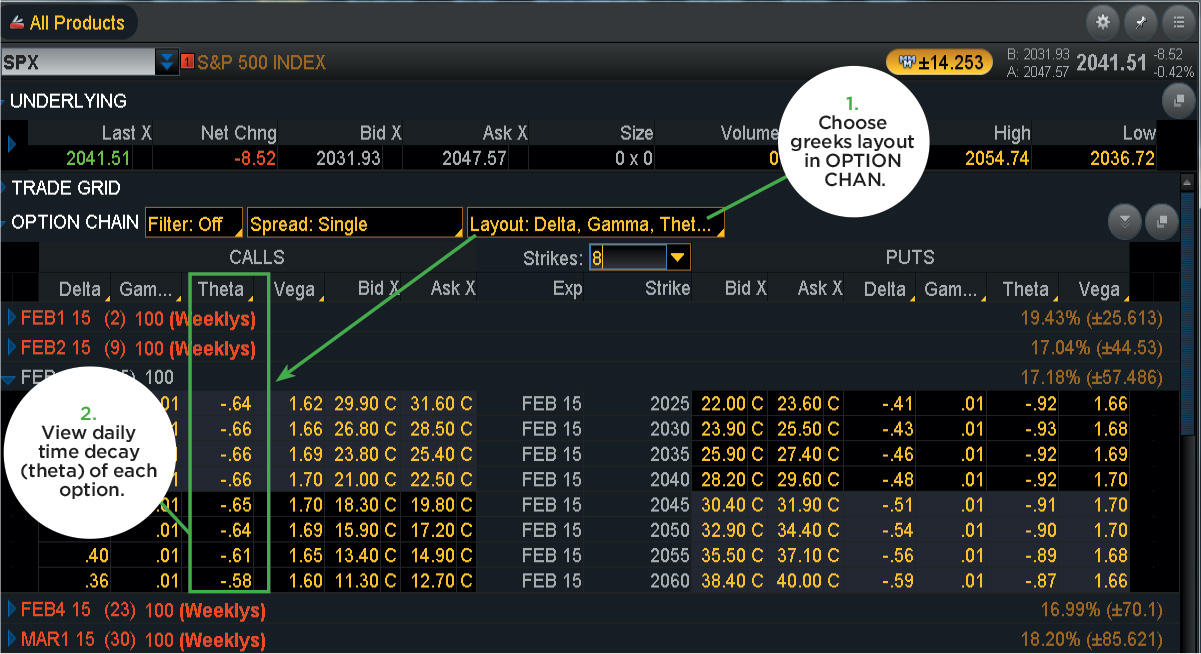

Image: tickertape.tdameritrade.com

Section 4: Tips for Trading Long Options on TD Ameritrade

To maximize your chances of success when trading long options on TD Ameritrade, consider these tips:

- Conduct Thorough Research: Analyze the underlying asset, market trends, and company fundamentals before making any trades.

- Set Realistic Expectations: Understand that options trading involves risk, and you should never invest more than you can afford to lose.

- Manage Your Risk: Use stop-loss orders or limit orders to minimize potential losses.

- Take Advantage of TD Ameritrade’s Resources: The TD Ameritrade platform provides a wealth of educational content, trading tools, and market news to support your decision-making.

Options Trading Long Td Ameritrade

Image: www.youtube.com

Section 5: Conclusion: Empowering Your Options Trading Journey

With its robust functionality and user-friendly interface, TD Ameritrade empowers you to take control of your options trading endeavors. Whether you’re a seasoned trader or just starting your options journey, trading long options on TD Ameritrade offers the potential to enhance your portfolio and navigate the market’s complexities with confidence. By embracing the principles outlined in this guide, you can unlock the opportunities presented by this dynamic and potentially rewarding trading strategy.