Introduction

Have you ever wondered how to trade option legs with TD Ameritrade? I was in the same boat not too long ago until I stumbled upon a wealth of information that completely changed my outlook on options trading.

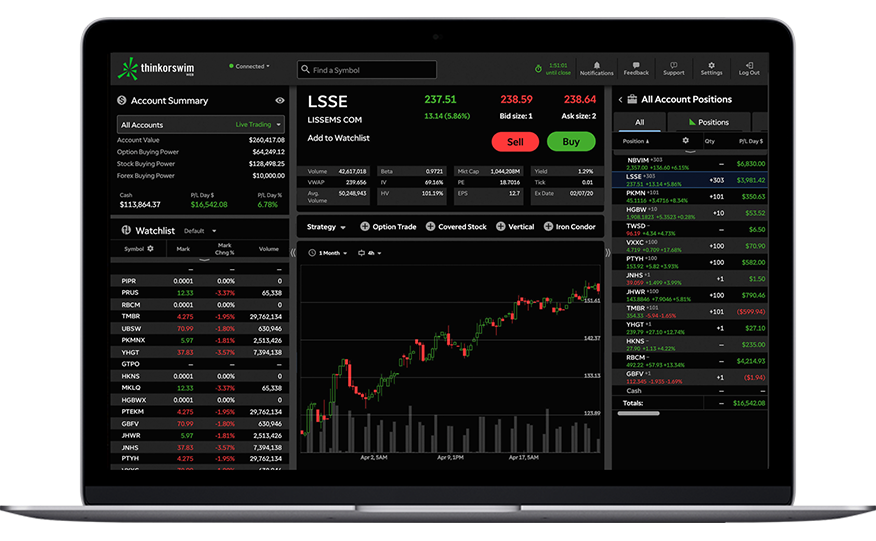

Image: www.tdameritrade.com

Today, I’m excited to share my insights and comprehensive guide on how to navigate the world of option legs with TD Ameritrade. Join me as I unravel the mysteries of this intriguing trading strategy and provide you with everything you need to know to succeed.

Understanding Option Legs

What are Option Legs?

Option legs are the individual components of an option contract, representing the right to buy or sell an underlying asset at a specified price and expiration date.

Types of Option Legs

There are three main types of option legs:

- Call leg: Provides the right to buy the asset.

- Put leg: Grants the right to sell the asset.

- Combination leg: Combines multiple calls or puts to create complex strategies.

Image: www.projectfinance.com

Trading Option Legs with TD Ameritrade

Getting Started

To trade option legs with TD Ameritrade, you’ll need an account approved for options trading. Once you’re set up, head to the trading platform and follow these steps:

- Choose your asset: Select the underlying asset (e.g., stock, ETF) you want to trade.

- Identify your strategy: Determine which option leg strategy you wish to implement.

- Place your order: Specify the type, quantity, and price of the legs you want to trade.

- Monitor your position: Keep an eye on your option legs’ performance and make adjustments as needed.

Latest Trends and Developments

The Rise of Complex Strategies

Traders are increasingly utilizing sophisticated option leg combinations to tailor strategies to their specific risk and reward profiles.

Integration with Trading Platforms

TD Ameritrade is constantly enhancing its platform to seamlessly integrate option leg trading and provide traders with a comprehensive experience.

Tips and Expert Advice

Start Small

Don’t attempt to jump into complex strategies initially. Begin with simple trades until you grasp the fundamentals.

Manage Your Risk

Proper risk management is crucial in option leg trading. Define clear entry and exit points, and never trade with more than you can afford to lose.

FAQs

- Q: Can I trade option legs on the mobile app?

A: Yes, TD Ameritrade’s mobile app supports option leg trading.

- Q: What is the minimum order size?

A: The minimum order size for option legs is typically 1 contract.

- Q: How are option legs priced?

A: Option leg prices are determined by factors such as the underlying asset’s price, volatility, time to expiration, and market conditions.

How To Trading Option Legs With Td Ameritrade

Image: zulassung-pieske.de

Conclusion

Mastering option leg trading with TD Ameritrade opens up a new world of possibilities for discerning traders. By following the insights and strategies outlined in this article, you can embark on this exciting journey with confidence.

So, are you ready to take the leap into the world of option legs? Seize this opportunity to unravel the secrets of this dynamic trading strategy and elevate your financial acumen.