Introduction: Unlocking the Power of emini S&P 500 Options

In the world of financial markets, options trading offers traders a spectrum of opportunities and risks. Among the vast array of options available, emini S&P 500 options stand out as a lucrative and widely traded instrument. Understanding the intricacies of trading emini S&P 500 options is paramount for maximizing profits and navigating the market’s intricacies effectively. This comprehensive guide delves into the fundamentals, strategies, and nuances of emini S&P 500 options trading, empowering traders with the knowledge to make informed decisions and enhance their financial outcomes.

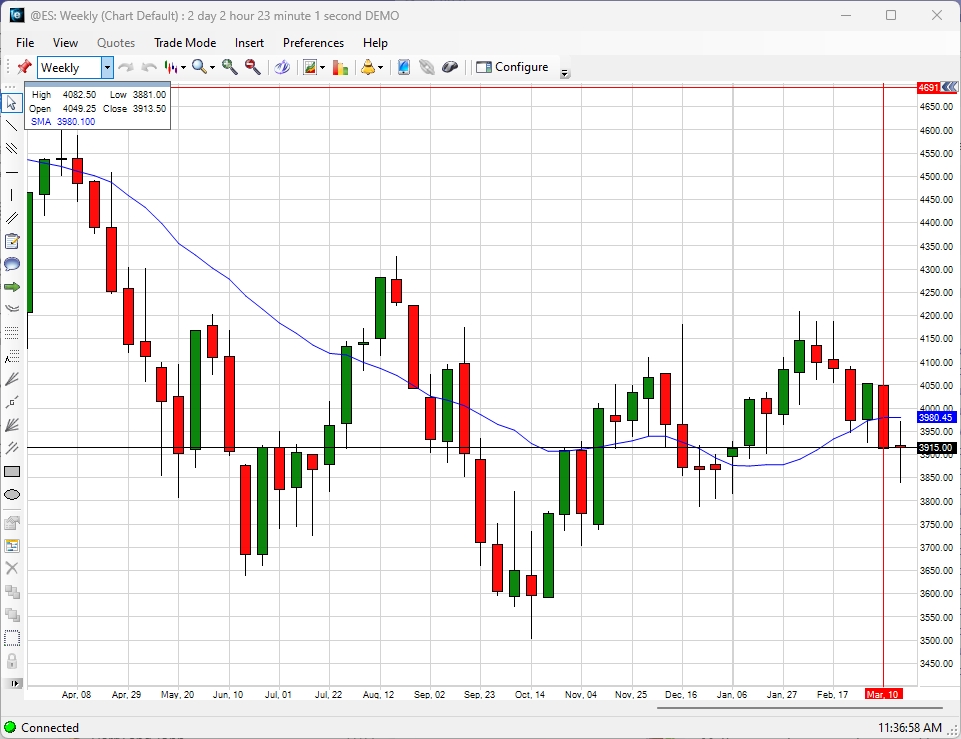

Image: pro-trader.co.uk

Understanding emini S&P 500 Options: A Cornerstone of Options Trading

Emini S&P 500 options are standardized contracts that grant the holder the right, but not the obligation, to buy or sell the underlying S&P 500 index at a predetermined price (strike price) on or before a specified date (expiration date). Unlike futures contracts, options provide traders with flexibility and the potential to limit losses while offering the opportunity for significant gains.

Mechanics of emini S&P 500 Options: Demystifying Key Concepts

To master emini S&P 500 options trading, it is crucial to grasp the core concepts that define this financial instrument. These include the strike price, which represents the price at which the underlying asset can be bought or sold, and the expiration date, which determines the duration within which the option contract can be exercised. Furthermore, the premium, which represents the price paid to acquire an option contract, and the Greeks, which measure various sensitivities of the option’s value to changes in underlying factors, play vital roles in shaping the profitability of emini S&P 500 options trading.

Trading Strategies for emini S&P 500 Options: A Compass in the Market’s Labyrinth

Navigating the emini S&P 500 options market requires a well-defined trading strategy. One of the most popular strategies is buying calls, which grants the holder the right to buy the underlying asset at the strike price. Conversely, selling calls involves granting someone else the right to buy the asset at the strike price, generating income from the premium received. Put options, on the other hand, provide the right to sell the underlying asset at the strike price, while selling puts involves granting someone else the right to sell the asset at the strike price, also generating income from the premium received.

Image: daytradingacademy.com

Risk Management Strategies: Navigating the Perils of Trading

Like any financial instrument, emini S&P 500 options trading carries inherent risks. To mitigate these risks, employing robust risk management strategies is paramount. Setting appropriate stop-loss orders and using margin cautiously can safeguard against excessive losses while maintaining a prudent level of leverage.

The Art of Hedging: Protecting against Market Volatility

Hedging is a crucial technique for managing risk in emini S&P 500 options trading. By purchasing options with opposing positions, traders can effectively reduce their exposure to adverse market movements, thereby safeguarding their capital.

Trading Emini S&P 500 Options

Image: eloisewarner.z19.web.core.windows.net

Conclusion: Embracing the Opportunities in emini S&P 500 Options Trading

Trading emini S&P 500 options presents a world of opportunities and rewards for traders who possess a comprehensive understanding of the underlying concepts, trading strategies, and risk management techniques. By embracing this knowledge, traders can navigate the market’s intricacies with confidence, maximizing their potential for financial success. As with any financial endeavor, continuous learning, practice, and disciplined trading are the keys to unlocking the full potential of emini S&P 500 options trading in pursuit of financial freedom.