Options trading, a versatile and rewarding financial strategy, grants investors the opportunity to enhance their portfolio returns, manage risk, and speculate on market movements. Among the various options strategies, long calls stand out as a potent tool for capitalizing on bullish market sentiments. This comprehensive guide will delve into the intricate world of long calls, empowering you with the knowledge to confidently navigate this lucrative investment avenue.

Image: www.brrcc.org

Understanding Long Calls: An Introduction

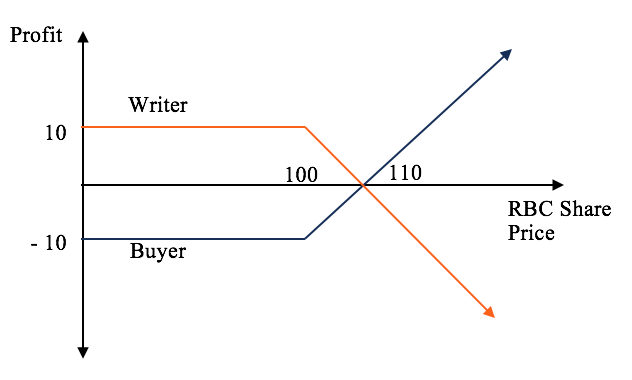

A long call option grants the holder the right, but not the obligation, to buy an underlying asset at a predetermined strike price on or before a specific expiration date. This strategy is aptly suited for investors who anticipate a rise in the underlying asset’s price. Unlike traditional stock ownership, long calls provide leverage, allowing investors to control a significant number of shares with a relatively small upfront investment.

Advantages of Long Calls:

-

- Leverage: Amplify potential returns with a minimal capital outlay.

- Limited Risk: Maximum loss capped at the premium paid for the option.

- Asymmetric Returns: Unlimited profit potential if the underlying asset surges in value.

- Flexibility: Adjust positions or exit trades as market conditions evolve.

Mechanics of Long Calls: Breaking it Down

To establish a long call position, an investor purchases a call option with a strike price higher than the prevailing market price of the underlying asset. The premium paid for the option represents the cost of acquiring this right. Should the underlying asset’s price rise above the strike price before expiration, the long call becomes profitable.

Key Considerations for Long Calls:

-

- Strike Price: Select a strike price that aligns with your market expectations.

- Expiration Date: Choose an expiration date that provides sufficient time for the underlying asset to appreciate.

- Option Premium: Factor in the option premium as a crucial determinant of potential profit.

- Volatility: Understand how implied volatility impacts option pricing and potential returns.

- Brokerage Fees: Account for commissions and fees associated with options trading.

Strategies for Long Calls: Unlocking Profitability

Seasoned options traders employ diverse strategies to maximize profitability and manage risk in long call positions. Two popular strategies include:

- Covered Call: A conservative strategy where the investor owns the underlying asset and sells a call option with a higher strike price against it. This mitigates risk but limits profit potential.

- Naked Call: A riskier but potentially more lucrative strategy where the investor sells a call option without owning the underlying asset. This exposes the investor to unlimited loss if the underlying asset’s price rises sharply.

_121721.png)

Image: optionalpha.com

Risks Associated with Long Calls: Be Informed

While long calls offer substantial potential rewards, it’s crucial to acknowledge the inherent risks involved. Options trading, by its very nature, carries a degree of uncertainty.

-

- Time Decay: Options premiums erode over time as expiration approaches, regardless of market performance.

- Price Volatility: Fluctuations in the underlying asset’s price can amplify gains or losses.

- Margin Requirements: Brokers may require traders to maintain a margin account to cover potential losses.

Options Trading Long Calls

Image: speedtrader.com

Conclusion: Empowered Option Trading

By gaining a thorough understanding of long calls, including their mechanics, strategies, and risks, investors can confidently navigate this dynamic investment arena. Long calls, when employed judiciously as part of a broader trading plan, can enhance portfolio returns and mitigate risk. However, it’s imperative to approach options trading with knowledge and caution, ensuring that your investments align with your individual circumstances and risk tolerance. Whether you’re a seasoned trader or just starting to explore this intriguing market segment, this comprehensive guide equips you with the necessary tools to make informed decisions and unlock the profit potential of long calls.