Navigating the Options Market with Confidence

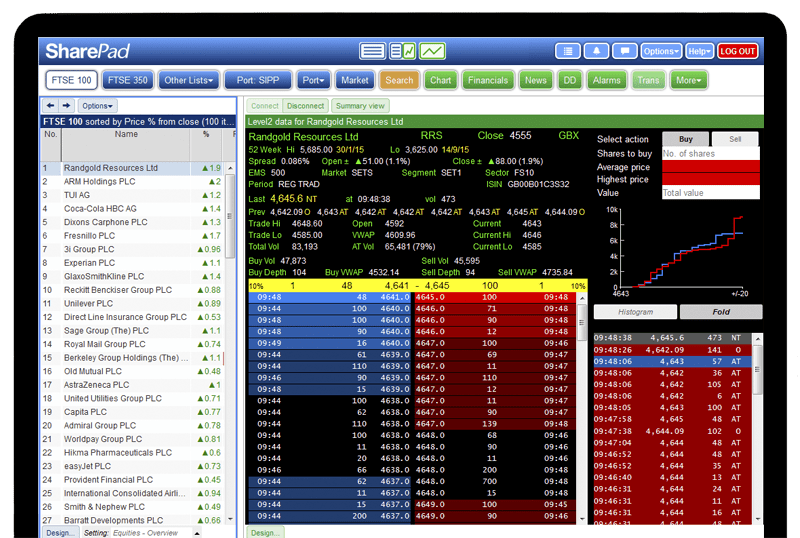

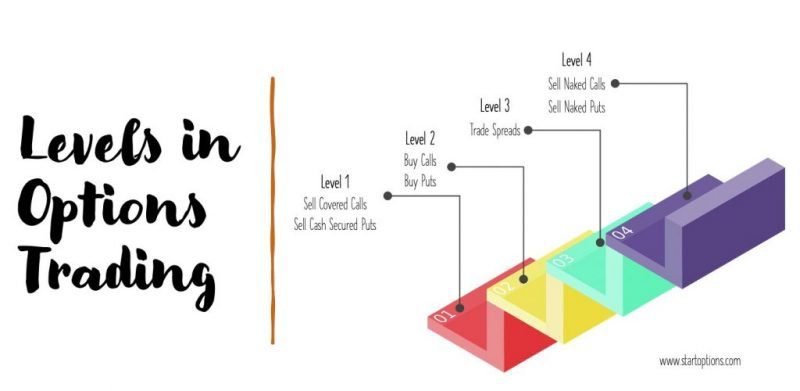

In the realm of financial trading, options play a prominent role. As a derivatives contract, options offer investors the opportunity to participate in the underlying asset’s price movements without directly purchasing it. The options market operates in two distinct levels: Level 1 and Level 2. Understanding the key differences between these two levels is crucial for aspiring options traders.

Image: www.guerillastocktrading.com

Level 1 Options: Understanding the Basics

Level 1 options represent the most basic level of options trading, designed for novice traders with limited experience. It grants traders access to vanilla options, which include call and put options. Call options confer the right to purchase the underlying asset at a predetermined price, while put options grant the right to sell the underlying asset at a specified price. Level 1 options also provide access to a limited set of option strategies, primarily involving long calls, long puts, short calls, and short puts.

Level 2 Options: Expanding Horizons

As traders gain proficiency in Level 1 options, they may choose to transition to Level 2 options for more advanced trading strategies and enhanced market access. Level 2 options provide traders with the ability to trade more complex option strategies, such as spreads, straddles, strangles, and butterflies. These strategies allow traders to express a broader range of market views and potentially generate more sophisticated returns. Additionally, Level 2 options offer access to a wider variety of underlying assets, including futures, indices, and over-the-counter securities.

Expert Guidance for Optimal Trading

Seasoned options traders emphasize the importance of proper education and risk management techniques in both Level 1 and Level 2 options trading. They recommend the following tips for navigating the options market effectively:

- Thorough Research: Conduct thorough research on the underlying asset and the options market before placing trades.

- Risk Management: Understand the potential risks associated with options trading and employ appropriate risk management strategies.

- Strategic Planning: Develop a comprehensive trading plan that outlines your trading goals, risk tolerance, and entry and exit strategies.

- Continuous Education: Stay abreast of market trends and advancements in options trading through ongoing education.

Image: www.shiftingshares.com

FAQs on Options Trading

Q: What are the key differences between Level 1 and Level 2 options?

A: Level 1 options offer basic vanilla options and limited strategies, while Level 2 options grant access to a wider range of strategies and underlying assets.

Q: Which level is more suitable for beginners?

A: Level 1 options are recommended for beginners due to their simplicity and accessibility.

Q: Is it possible to skip Level 1 and directly engage in Level 2 options?

A: While it is possible, it is highly inadvisable as thorough understanding of Level 1 concepts is crucial for success in Level 2 options.

Options Trading Level 1 Vs Level 2

Image: finlightened.com

Conclusion

Options trading presents a wealth of opportunities for both new and experienced traders. Level 1 options provide a solid foundation for understanding the basics, while Level 2 options offer more advanced strategies and enhanced market access. By carefully choosing the appropriate level based on their knowledge and experience, investors can mitigate risks and navigate the options market successfully.

Are you eager to delve deeper into the exciting world of options trading? As you progress through this informative blog post, you will discover the nuances of Level 1 and Level 2 options, empowering you to make informed decisions and seize the opportunities that this dynamic market presents.