In the ever-fluctuating world of finance, I found myself amidst a relentless pursuit to maximize profits and mitigate risks. The allure of options trading beckoned, and I embarked on a journey to decipher its potential for scaled success.

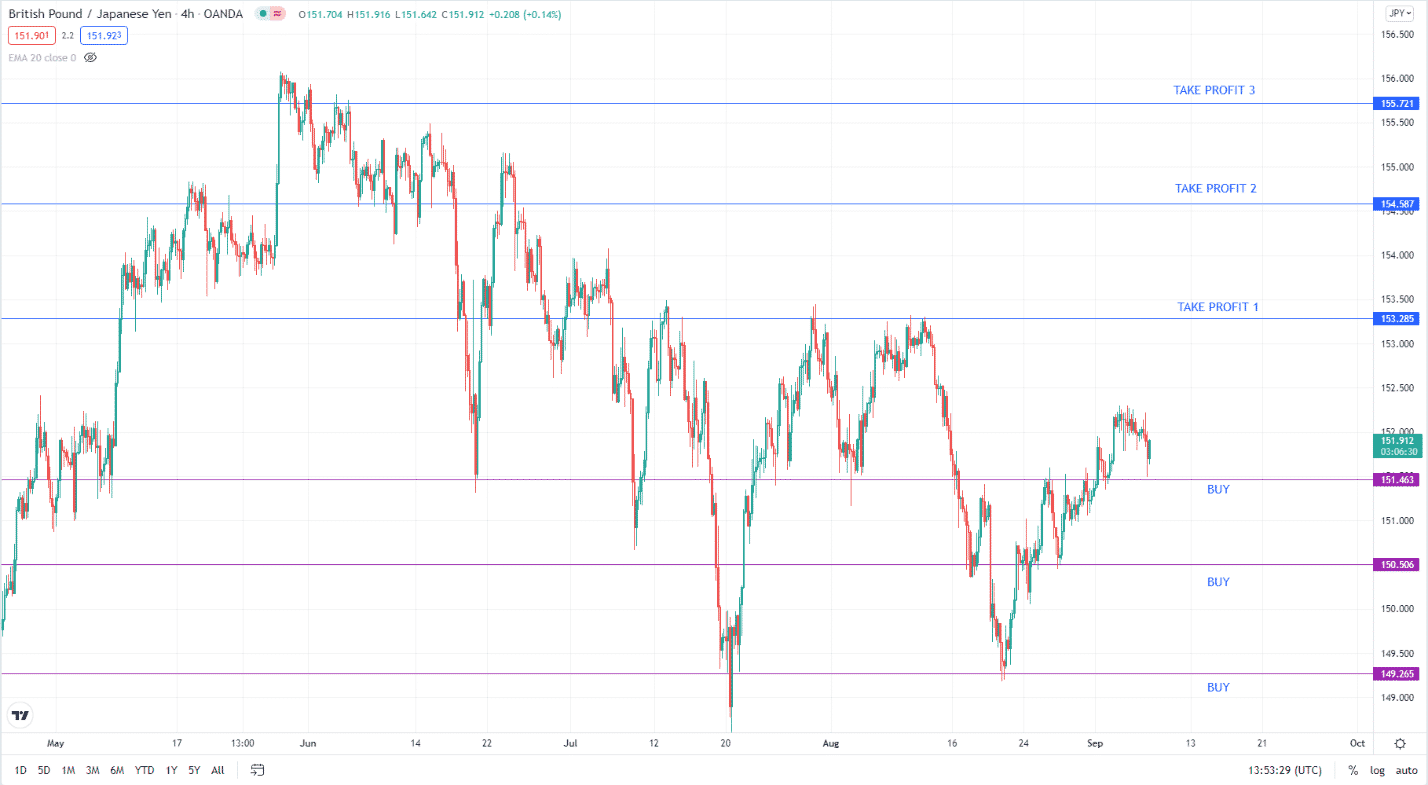

Image: topfxmanagers.com

Options Trading: A Path to Scalability

Options, financial instruments that convey the right, not the obligation, to buy (call) or sell (put) assets, present a lucrative opportunity to amplify portfolio returns. By leveraging leverage, options traders can control a substantial number of underlying assets with a relatively modest investment. This scalability empowers traders to enhance profits and diversify their portfolios.

Scaling the Ladder to Success

Successfully scaling options trading demands a systematic approach. First, define clear trading parameters, such as profit targets and risk appetite, to guide decision-making. Secondly, develop a comprehensive trading strategy based on technical analysis, market sentiment, and risk management techniques.

Thirdly, meticulous position sizing and risk management are paramount. Calculate each position’s optimal size based on your risk tolerance and available capital. Employ protective measures such as stop-loss orders to mitigate potential losses and preserve profits.

Trending Frontiers and Expert Insights

The options trading landscape is constantly evolving. Stay abreast of the latest developments by following industry news, participating in forums, and engaging with experienced traders. Social media platforms offer a wealth of insights and real-time updates, enabling traders to make informed decisions.

Seasoned traders emphasize the significance of developing a clear trading plan, adhering to risk management principles, and continuously refining strategies through backtesting and analysis. They also advocate leveraging technological advancements, such as automated trading tools, to enhance efficiency and optimize trading experiences.

Image: freeforexcoach.com

Tips for Successful Scaling

- Establish precise trading criteria to navigate the complex options market.

- Adopt a structured trading strategy tailored to your risk profile and goals.

- Implement meticulous position sizing and robust risk management techniques.

- Stay informed about market movements and advancements through research and industry engagement.

- Leverage technology to enhance trading efficiency and profit maximization.

By implementing these expert recommendations, you can lay the foundation for successful scaling in options trading, unlocking the potential for substantial returns and a well-diversified portfolio.

Frequently Asked Questions

- What is the most crucial aspect of scaling options trading?

Establish clear trading parameters, develop a comprehensive trading strategy, and implement meticulous risk management techniques.

- How can I stay up-to-date with industry trends?

Follow industry news sources, participate in online forums, engage with experienced traders on social media platforms, and attend industry conferences.

- What role do technology and automation play in scaling options trading?

Technology empowers traders with real-time market data, advanced analytical tools, automated trading capabilities, and portfolio management platforms that streamline the trading process.

Scale Trading Options

Image: www.youtube.com

Conclusion

Scale trading options strategically to maximize profits and diversify portfolios. Embrace a systematic approach, leverage market trends, and heed expert advice to elevate your trading endeavors. Are you ready to embark on the path of scaled trading success?