Introduction

In the realm of financial trading, options trading stands as a multifaceted and potentially lucrative strategy. Options, derivative financial instruments, offer traders a diverse array of profit-generating opportunities. However, navigating the intricate landscape of options trading requires a thorough understanding of its mechanisms, complexities, and potential rewards. This comprehensive guide delves into the intricacies of options trading, exploring its historical origins, fundamental concepts, and how to leverage its potential for financial gains.

Image: tradebrains.in

Understanding Options Trading: A Basic Primer

Options trading involves the buying or selling of contracts that convey the right, but not the obligation, to buy or sell an underlying asset, such as a stock, commodity, or currency, at a predetermined price on or before a specified date. These contracts are traded on designated exchanges or over-the-counter (OTC) markets, and they provide traders with flexible tools to tailor trading strategies according to their risk tolerance and profit objectives.

The Allure of Options Trading: Exploring Potential Profits

The allure of options trading lies in its ability to generate profits through various market conditions. By astutely forecasting market trends and employing appropriate options strategies, traders can potentially reap substantial returns. However, as with any financial endeavor, substantial profits come with inherent risks. Understanding the risks and managing them effectively is crucial for successful options trading.

Types of Options: Exploring the Spectrum of Opportunities

The world of options encompasses two primary types: calls and puts. Call options provide the right to buy an underlying asset at a specific price within a specified time frame. On the other hand, put options offer the right to sell an underlying asset at a designated price before a set expiration date. Each type of option presents unique profit potential, enabling traders to adapt their strategies to different market scenarios.

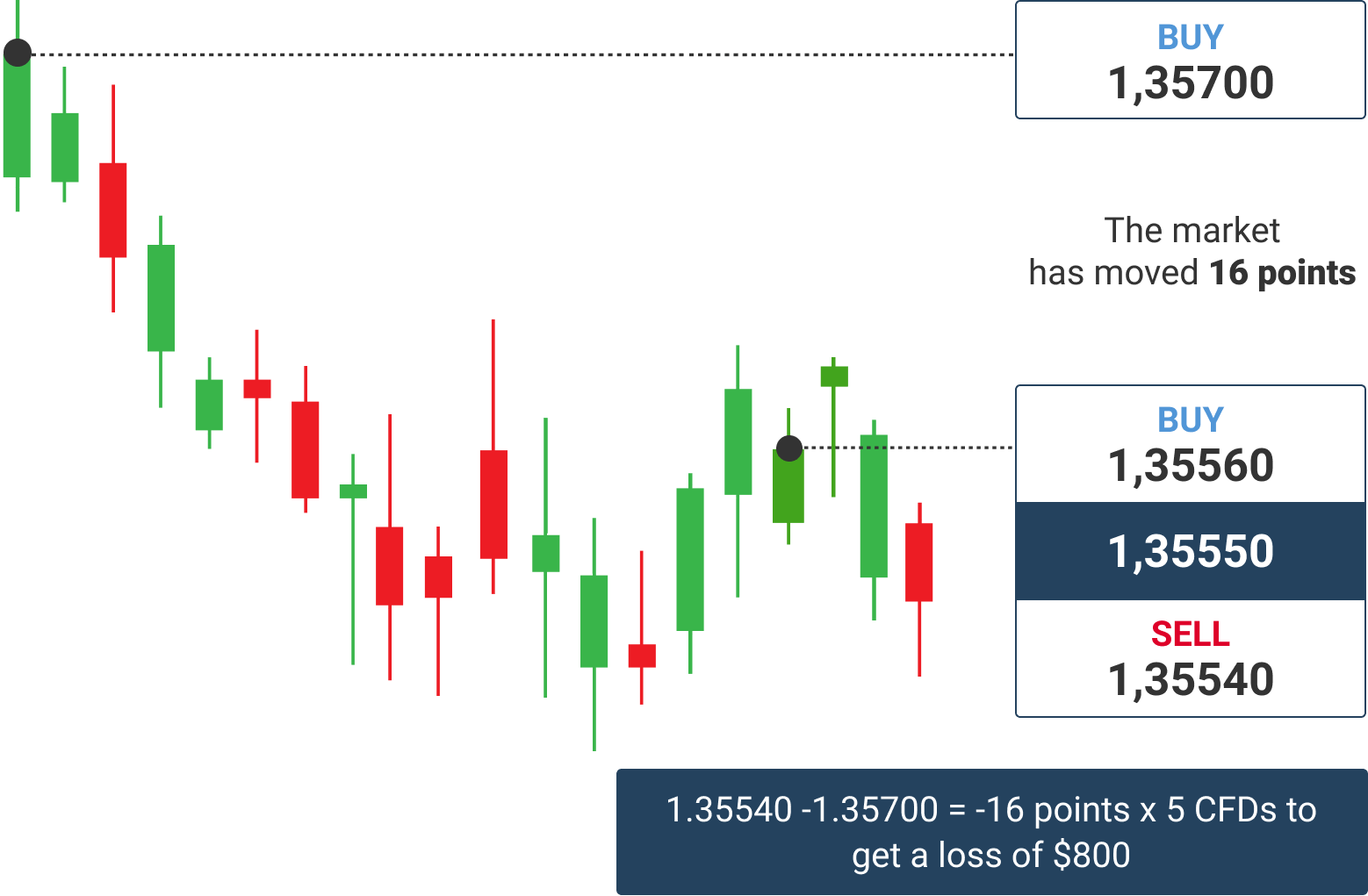

Image: www.monfex.com

Essential Factors Impacting Options Pricing: Unveiling the Determinants

The pricing of options is influenced by a confluence of factors, each contributing to the determination of their value. Volatility, time to expiration, and interest rates play pivotal roles in shaping options premiums. Understanding the impact of these factors is paramount for assessing the risk-reward profiles of different options strategies.

Options Strategies: A Journey Through Profit-Generating Techniques

Options trading offers an array of strategies designed to cater to diverse trading preferences and profit objectives. From basic strategies like buying or selling calls and puts to more complex spread strategies, the options market empowers traders with a versatile toolkit to navigate market dynamics. This article delves into the intricacies of various options strategies, dissecting their mechanics and potential payoffs.

Hedging with Options: Mitigating Risks, Enhancing Returns

Options can serve as powerful tools for hedging against portfolio volatility and mitigating potential losses. By employing options strategies in conjunction with other holdings, traders can reduce the overall risk of their portfolio while simultaneously enhancing their profit potential. This guide explores the art of options hedging, shedding light on its intricacies and effectiveness in risk management.

Real-World Examples: Unveiling Options Trading in Practice

To provide a tangible understanding of options trading, this guide presents real-world examples of how traders have successfully used options strategies to generate profits. These examples illustrate the practical applications of various options strategies, highlighting their efficacy in different market environments.

How Profitable Is Options Trading

https://youtube.com/watch?v=YoT5ulmy_Fs

Conclusion

Options trading offers a vast realm of opportunities for profit-seeking individuals. However, it is imperative to approach this arena with a comprehensive understanding of its underlying mechanisms, potential risks, and rewards. By equipping oneself with the knowledge imparted in this guide, traders can enhance their financial acumen and navigate the complexities of options trading with increased confidence.