In the ever-evolving landscape of financial markets, options trading has emerged as a sophisticated yet lucrative avenue for investors seeking to enhance their portfolio performance. Options, financial instruments with unique risk-reward profiles, empower traders with unparalleled flexibility and leverage. For the uninitiated, options trading may seem daunting, but understanding the mechanics and strategies involved can unlock significant opportunities for profit.

Image: eaglesinvestors.com

Defining Option Trading: A Window into Futuristic Investments

In simple terms, option trading involves the purchase or sale of contracts that convey the right, but not the obligation, to buy or sell an underlying asset at a predetermined price on or before a specific date. These contracts empower traders to speculate on the future direction of asset prices without committing to a direct purchase or sale. Options trading offers traders the ability to amplify gains and protect against potential losses, making it a powerful tool for both seasoned investors and those seeking alternative investment strategies.

Delving into Option Basics: Essential Concepts Demystified

At the core of option trading lie two fundamental types: calls and puts. Call options grant the buyer the right to purchase the underlying asset at the agreed-upon price, known as the strike price. Conversely, put options convey the right to sell the underlying asset at the strike price. The trader’s decision to buy or sell an option depends on their outlook for the asset’s price movement: bullish for calls and bearish for puts.

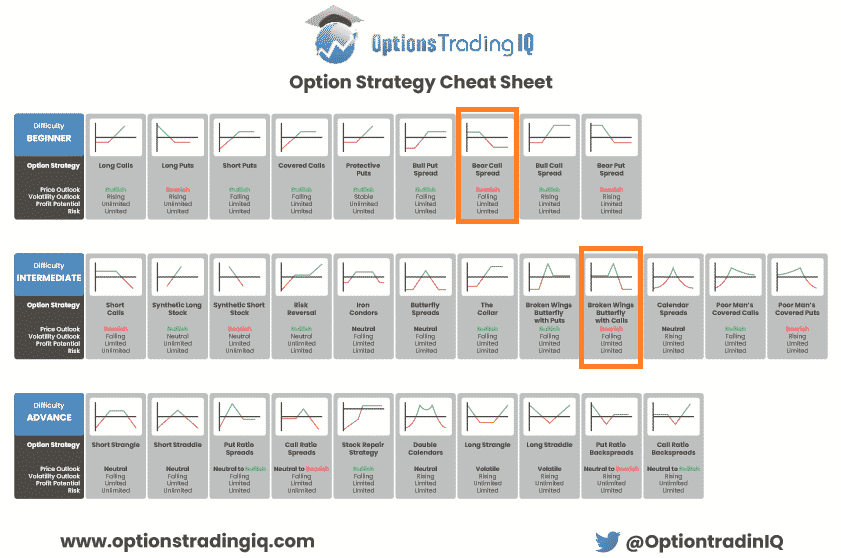

Unveiling Option Strategies: Navigating the Maze of Investment Options

The world of option trading encompasses a vast array of strategies, each tailored to specific investment objectives and risk tolerance levels. Covered calls, a conservative strategy, involve selling a call option while simultaneously owning the underlying asset. This strategy generates income through premiums but limits the potential profit from rising asset prices. In contrast, naked calls, a more aggressive strategy, entail selling a call option without owning the underlying asset. This strategy offers higher profit potential but also exposes the trader to significant risk.

Image: www.youtube.com

Exploring Option Applications: Unveiling the Power of Options

Option trading finds application in diverse investment scenarios. Hedging strategies utilize options to safeguard portfolios against unexpected price fluctuations. Speculative strategies seek to profit from anticipated market movements by employing options as speculative tools. Income-generating strategies leverage options to generate income through premiums, making them appealing to risk-averse investors.

Option Trading Activity

Image: optionstradingiq.com

Conclusion: Unlocking the Potential of Option Trading

Option trading presents a multifaceted investment realm brimming with opportunities for astute traders. By mastering the fundamentals, exploring strategies, and understanding applications, investors can harness the power of options to elevate portfolio performance, adapt to market dynamics, and potentially generate lucrative returns. However, it is crucial to approach option trading with a judicious mindset, acknowledging the inherent risks and approaching the endeavor with thorough research and prudent decision-making.