In the dynamic world of options trading, mastery of various strategies can unlock a trader’s path to success. Among these strategies, the strangle strategy shines as a powerful tool for profiting from market volatility. This article delves into the intricate details of the strangle strategy, equipping you with a comprehensive guide to navigate this lucrative but complex technique.

Image: www.ssveducation.com

Defining the Strangle Strategy:

A strangle is an options trading strategy involving the simultaneous purchase of both a call option and a put option with different strike prices on the same underlying asset. The trader’s aim is to capture profits from significant price movements in either direction, regardless of whether the market moves up or down.

The call option grants the holder the right to buy the underlying asset at the strike price by a specified date. The put option, on the other hand, gives the holder the right to sell the underlying asset at the strike price. By combining these two options, the trader aims to profit from large price swings that push the underlying asset’s price outside of the strike prices.

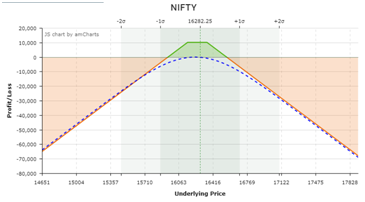

Unlocking the Strangle’s Profit Potential:

The strangle strategy excels in conveying beneficial profits when the underlying asset experiences significant, persistent price volatility within a predetermined time frame. In other words, the trader anticipates that the underlying asset’s price will move in a way that simultaneously surpasses both the call option and puts option’s strike prices.

If the underlying asset undergoes a steep surge in price, ultimately surpassing the call option’s strike price, the trader can effectively exert their right to purchase the asset at a costless price below the current market price and subsequently resell it for a neat profit. Conversely, if the underlying asset plummets in value, breaching the strike price of the put option, the trader can exercise their right to sell the asset at a higher price, again bagging substantial profits.

Harnessing the Power of Volatility:

Volatility serves as the lifeblood of the strangle strategy. Traders seek assets with high implied volatility when implementing this strategy, for such assets display a greater propensity to experience large price swings in either upward or downward trajectories, thereby rendering them more suitable for capitalizing pursuant to this strategy.

For instance, if a stock is hovering around $50 per share and has a projected volatility of 30%, the trader might contemplate purchasing both a call option with a strike price of $55 and a put option with a strike price of $45. If the stock price rockets to $60, the trader can gain from the call option by exercising it and purchasing the shares for $55 and selling them at $60. If the stock price plunges to $40, reaping profits is still possible by exercising the put option, offloading shares at $45 amidst the drop in stock value.

Image: navigationtrading.com

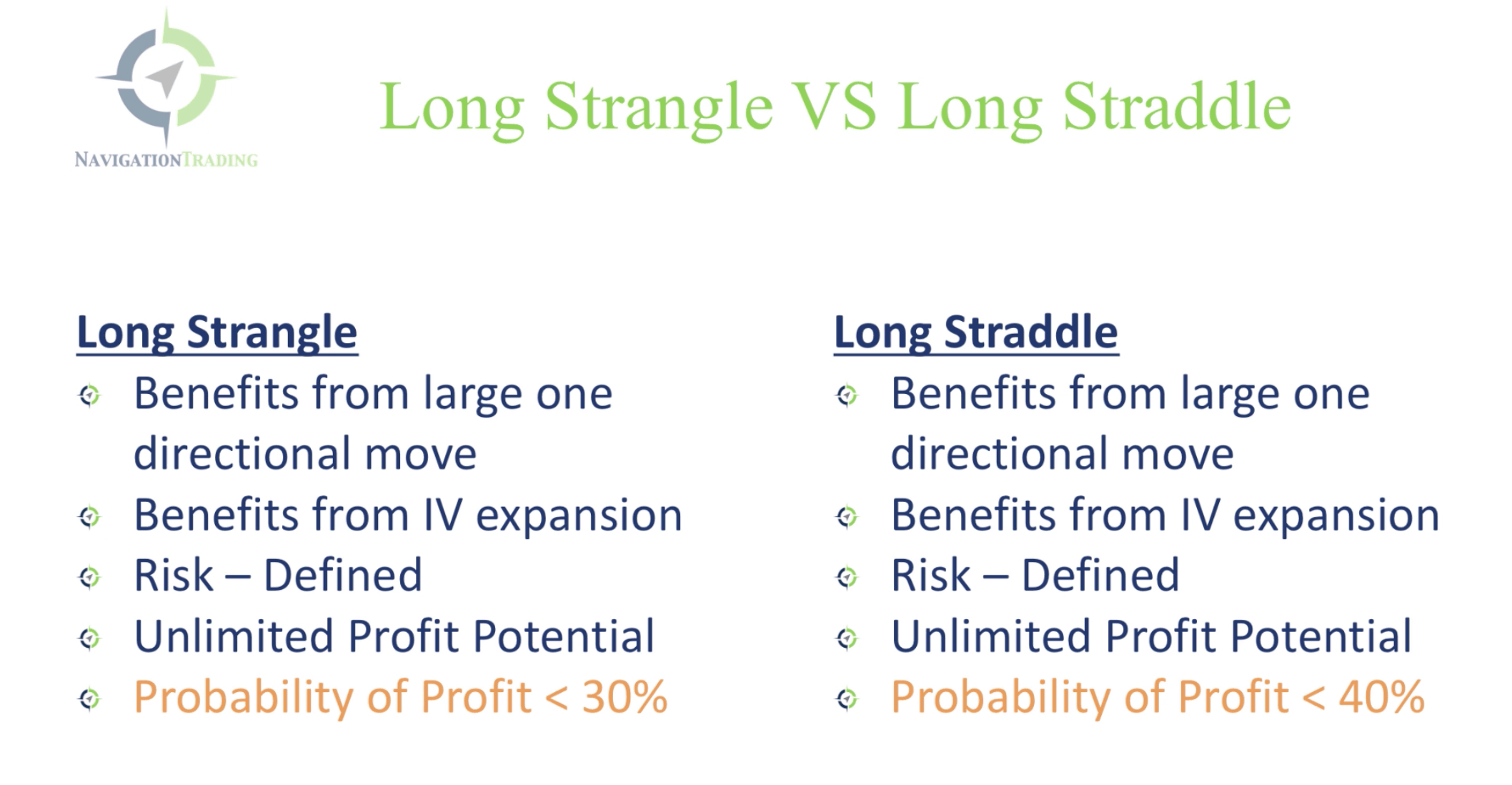

Navigating the Risks of the Strangle Strategy:

Options trading entails inherent risks, and the strangle strategy presents risks peculiar to its design. The trader stands to lose the entire premium paid to acquire both the call option and put option, an event that materializes if the price of the underlying asset does not fluctuate considerably enough to attain either strike price.

Time erosion, or theta, can also diminish the value of an option as its expiration date looms, exerting further pressure on the trader to anticipate significant price movements within the timeframe allotted by the chosen options.

Mastering the Strangle Strategy: Prudence and Precision

Command over the strangle strategy hinges upon a discerning comprehension of implied volatility and measured risk management practices. It’s imperative for traders to thoroughly evaluate historical volatility data and prevailing market conditions before delving into this strategy. Additionally, careful analysis of the premium values for the call and put options is critical for optimizing profit potential and minimizing risk exposure.

To refine your mastery of this strategy, consider commencing with paper trading, enabling you to test your understanding in a risk-free environment. Furthermore, seeking guidance from seasoned options traders or enrolling in educational courses can supplement your knowledge base and propel your trading acumen to greater heights.

Options Trading How To Do A Strangle

Image: www.pinterest.com

Concluding Remarks

The strangle strategy can be a powerful profit-generating tool in the hands of informed traders, an avenue to capitalize on pronounced market fluctuations. Equipping yourself with an in-depth understanding of the strategy’s dynamics, actively managing risks, and staying abreast of market movements will serve as your guiding compass towards successful execution. Remember, the path to mastery demands patience, persistence, and a continuous quest to advance your knowledge and refine your trading skills.