Ever since I ventured into the world of options trading, the Strangle Strategy has captivated me with its alluring potential for harnessing market volatility. Allow me to guide you on a journey to unravel the intricacies of this strategy, empowering you to make calculated decisions in the ever-evolving marketscape.

Image: www.projectfinance.com

A Glimpse into Strangle Strategy

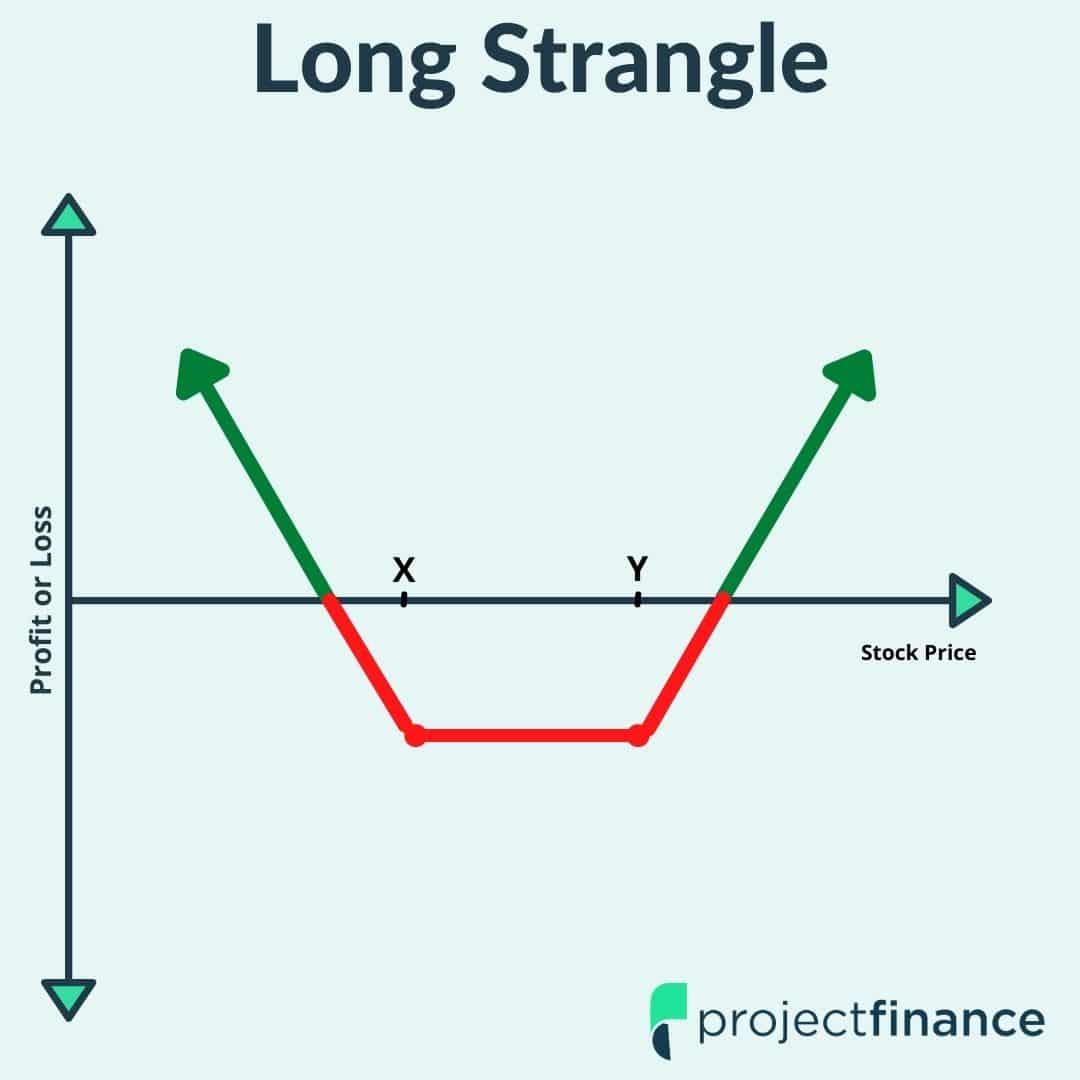

The Strangle Strategy is a non-directional option strategy that involves simultaneously buying one out-of-the-money (OTM) call option and one OTM put option with the same expiration date but different strike prices. The goal of this strategy is to profit from large market movements, regardless of the direction of the underlying asset’s price.

Key Components of a Strangle Strategy

- Out-of-the-Money (OTM) Call Option: This option gives the holder the right to buy the underlying asset at a higher strike price than the current market price.

- Out-of-the-Money (OTM) Put Option: This option gives the holder the right to sell the underlying asset at a lower strike price than the current market price.

- Same Expiration Date: Both the call and put options should expire on the same date.

- Different Strike Prices: The strike prices of the call and put options should be different, creating a “strangle” effect.

Scenario Analysis for Strangle Strategy

The profitability of a strangle strategy hinges on significant market movements. Let’s consider various scenarios:

1. Large Price Increase: If the underlying asset’s price rises substantially, the call option will gain value, and the trader will profit from its exercise. Conversely, the put option will expire worthless.

2. Large Price Decrease: If the underlying asset’s price declines significantly, the put option will gain value, and the trader will profit from its exercise. In this scenario, the call option will expire worthless.

3. Moderate Market Movement: In the event of moderate market movement, both the call and put options may expire worthless, resulting in a loss for the trader.

4. Implied Volatility: It’s crucial to note that the implied volatility of the underlying asset plays a critical role in determining the profitability of a strangle strategy. Higher implied volatility increases the premium of both the call and put options, potentially amplifying the trader’s profits.

Tips for Maximizing Returns

- Set Realistic Expectations: Understand that the strangle strategy is not a risk-free endeavor. It’s essential to set realistic profit targets and manage risk accordingly.

- Choose Liquid Options: Select options with high trading volume to ensure ease of execution and minimize potential slippage.

- Monitor Market Conditions: Keep a close watch on market conditions, including news, economic data, and technical indicators, to make informed decisions about entering or exiting the strategy.

- Manage Your Position: Exercise options or sell them before expiration to secure profits or minimize losses.

FAQ on Strangle Strategy

Q: When is the strangle strategy most effective?

A: It’s suitable when the underlying asset is expected to experience significant volatility, regardless of the direction of the price movement.

Q: What are the risks associated with the strangle strategy?

A: The primary risk is incurring losses due to moderate market movements or a decline in implied volatility.

Q: How do I calculate the profit potential of a strangle strategy?

A: The profit potential depends on the difference between the strike prices of the options multiplied by the number of contracts traded.

Are you intrigued by the potential to harness market volatility and enhance your trading prowess? Embark on this educational journey to master the strangle strategy and unlock new horizons in options trading.

Image: investobull.com

Strangle Strategy In Options Trading

Image: www.rozpaisabanao.com