Introduction:

In the ever-evolving financial landscape, options trading has emerged as a formidable force, empowering investors with the potential to unlock market opportunities. At the forefront of this dynamic realm, options trading hedge fund managers navigate the complexities of the market, leveraging their expertise to generate substantial returns. Enter the world of options trading hedge funds, where strategic insights and skillful execution collide to shape market outcomes.

Image: www.pinterest.com

Understanding Options Trading:

Options trading involves two primary types of contracts: calls and puts. Call options grant the buyer the right (but not the obligation) to purchase an underlying asset (e.g., stock or commodity) at a specified price (strike price) on or before a specific date. In contrast, put options provide the buyer with the right to sell the underlying asset at the strike price. These contracts allow investors to speculate on future price movements, providing leverage and potentially amplifying returns.

The Role of Hedge Fund Managers:

Options trading hedge fund managers are skilled professionals who harness the power of options to create complex investment strategies. Their primary objective is to generate consistent returns for their clients, often within a specific risk profile. These managers typically employ sophisticated models and analytical techniques to identify potential trading opportunities, manage risk, and allocate capital.

Strategies for Success:

Options trading hedge funds employ a diverse arsenal of strategies, each tailored to specific market conditions and risk appetites. Some common strategies include:

- Covered Call: This conservative strategy involves selling call options on an underlying asset that the fund owns. It provides income through the option premiums while limiting potential upside.

- Iron Condor: A volatility-neutral strategy where the fund simultaneously sells an out-of-the-money call and put option while buying an out-of-the-money call and put option at different strike prices.

- Delta-Neutral Hedging: A more complex strategy aimed at neutralizing portfolio volatility. The fund buys or sells options to counterbalance the realized or implied volatility of the underlying asset.

Image: avaicourse.org

Benefits of Hedge Funds:

Investing in options trading hedge funds can offer several advantages, including:

- Diversification: Hedge funds often invest in various asset classes and employ sophisticated risk management techniques, potentially reducing portfolio volatility.

- Access to Expertise: Hedge fund managers provide professional money management services, allowing investors to tap into their knowledge and trading prowess.

- Performance Potential: Well-managed hedge funds have the potential to generate substantial returns, often exceeding those of traditional investments.

Due Diligence and Considerations:

Selecting an options trading hedge fund requires thorough due diligence. Consider the following factors:

- Performance History: Evaluate the fund’s historical performance, including return rates, risk-adjusted measures, and consistency.

- Management Team: Research the experience, credentials, and track record of the management team.

- Investment Strategy: Understand the fund’s investment strategy, including the types of options used, risk management measures, and liquidity considerations.

The Future of Options Trading:

The options trading industry continues to evolve rapidly, with the rise of technological advancements and the emergence of new trading platforms. Options trading hedge funds are well-positioned to capitalize on these trends, harnessing cutting-edge technologies and data analysis to enhance their decision-making capabilities.

Options Trading Hedge Fund Manager

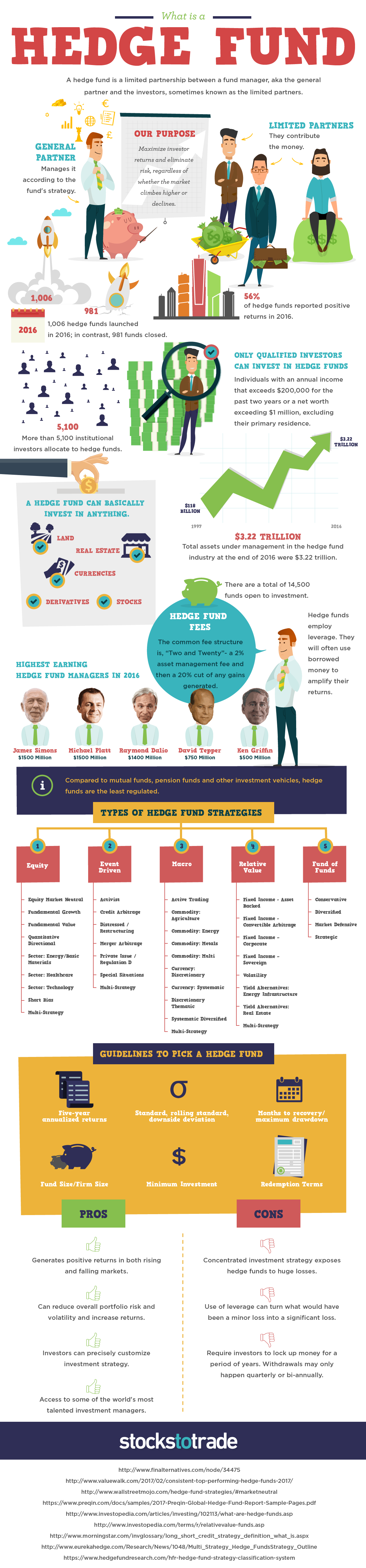

Image: stockstotrade.com

Conclusion:

Options trading hedge funds offer a compelling opportunity for investors seeking to enhance their market returns. By combining strategic insights, precise execution, and risk management expertise, these funds navigate the complexities of the options market, unlocking opportunities for disciplined investors. As the industry continues to innovate, options trading hedge funds remain at the forefront, empowering their clients to capture the transformative power of options trading.