Introduction:

Imagine standing at the cusp of a financial adventure, where the tantalizing allure of options trading beckons you. Options, a versatile instrument in the world of investing, empower you to harness the winds of market volatility and craft strategies that align with your financial aspirations. However, like a master swordsman wielding an array of blades, success in option trading demands a thorough understanding of the strategies and tools at your disposal. Embark on this illuminating journey as we unveil the arsenal of option trading strategies, providing you with the insights and weapons to navigate the financial landscape with confidence.

Image: www.tradethetechnicals.com

Unraveling the Options Landscape: A Primer

Options, in essence, are contracts that bestow the right, but not the obligation, to buy or sell an underlying asset at a predetermined price within a specified time frame. By leveraging options, you can mitigate risk, enhance returns, and express your market views with precision. The two primary types of options are calls, which grant the right to buy an asset, and puts, which confer the right to sell.

The foundation of option trading rests upon two key concepts: option premium and strike price. Option premium represents the price paid to acquire an option contract, while the strike price is the predetermined price at which you can buy or sell the underlying asset. These elements, along with other factors like time to expiration and implied volatility, form the backbone of option pricing and strategy formulation.

Strategy Selection: Tailoring Options to Your Objectives

The diverse array of option trading strategies enables you to tailor your approach to specific market conditions and financial goals. Whether seeking to amplify potential gains, generate consistent income, or hedge against risk, there’s a strategy waiting to untether your trading prowess.

-

Covered Call Strategy: Designed to generate income and reduce the cost basis of underlying assets, the covered call strategy involves selling (or “writing”) call options against stocks you own. By receiving a premium upfront, you cap your potential upside, but you also limit your downside risk.

-

Protective Put Strategy: Embrace peace of mind with the protective put strategy. This strategy involves purchasing (or “buying”) a put option to safeguard your portfolio against significant losses in the underlying asset. In the event of a downturn, the put option acts as a financial cushion, mitigating the impact on your investments.

-

Bull Call Spread Strategy: When optimism fills the air, the bull call spread strategy beckons. This strategy combines buying a lower-strike call option and selling a higher-strike call option, both with the same expiration date. This structured approach amplifies your profit potential while limiting risk compared to simply buying a call option.

-

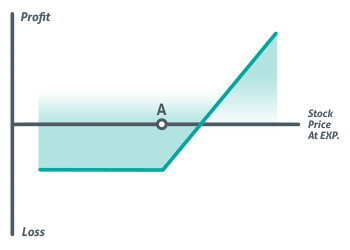

Bear Put Spread Strategy: The bear put spread strategy emerges as your ally when market sentiments turn bearish. By selling a lower-strike put option and simultaneously buying a higher-strike put option, you capitalize on the potential decline in the underlying asset’s price while managing your risk exposure.

-

Iron Condor Strategy: As a neutral strategy, the iron condor strategy seeks to profit from limited price movements in either direction. This strategy entails selling both a call spread and a put spread, striking a balance between risk and return.

Enlisting Technical Tools: Empowering Your Trading Decisions

In the realm of option trading, technical tools elevate your decision-making prowess, empowering you to decipher market trends and make informed choices. These tools, like loyal companions on your financial voyage, provide a window into the ebb and flow of market forces.

-

Implied Volatility (IV): Implied Volatility measures the market’s perception of future price volatility for an underlying asset. High IV indicates that the market anticipates significant price fluctuations, potentially influencing option premiums.

-

Greeks: The “Greeks,” a family of metrics, precisely quantify the sensitivity of option prices to various factors. These metrics, such as Delta, Gamma, Theta, and Vega, empower you to fine-tune your strategies based on their sensitivities to changes in the underlying asset’s price, time decay, and other variables.

-

Option Chains: Option chains provide a visual representation of available option contracts for a given underlying asset. These chains display key information like strike prices, premiums, and Greeks, enabling you to compare and select the most suitable options for your trading strategy.

-

Volatility Indicators: Volatility indicators like Bollinger Bands and the Volatility Index (VIX) shed light on the historical and implied volatility of the underlying asset. By analyzing these indicators, you can assess market sentiment and make informed decisions about your option strategies.

-

Charting and Analysis: Technical charting and analysis techniques, like trendlines, support and resistance levels, and moving averages, provide valuable insights into price action and market trends. By incorporating these techniques into your trading arsenal, you gain a deeper understanding of the market’s behavior and potential trading opportunities.

Image: optionstrategiesinsider.com

Option Trading Strategies Tools

![Options Strategies Cheat Sheet [FREE Download] - How to Trade](https://howtotrade.com/wp-content/uploads/2023/02/options-strategy-cheat-sheet-1536x1086.png)

Image: howtotrade.com

Conclusion: Unlocking Your Trading Destiny

The world of option trading, like a vast ocean, invites you to navigate its boundless depths and uncover its hidden treasures. Arm yourself with the arsenal of strategies and tools presented in this article, and you’ll be equipped to conquer market challenges and harness the winds of financial success.

Remember, as you embark on this exciting journey, seek knowledge, embrace prudent risk management, and let your passion for trading guide your path. May your trading endeavors be marked by both triumph and fulfillment.