In the dynamic world of investing, stock option trading has emerged as a powerful tool offering both opportunities and risks. Imagine owning a ticket that gives you the option to buy or sell a specific stock at a fixed price within a predetermined time frame. That’s the essence of stock option trading, allowing you to leverage market movements without owning the underlying asset.

Image: www.pinterest.com

The allure of stock option trading lies in its inherent flexibility and potential for significant returns. But navigating this complex arena requires a sound understanding of the concepts involved and a strategic approach.

Types of Stock Options

Stock options come in two primary forms:

- Call options: Gives you the right, but not the obligation, to buy a specific stock at a specified price (strike price) before a certain date (expiration date).

- Put options: Grants you the right to sell a specific stock at a strike price before an expiration date.

Fundamentals of Option Pricing

- Stock price: The current market value of the underlying stock.

- Strike price: The predetermined price at which you can buy or sell the stock using the option.

- Time to expiration: The remaining time until the option expires.

- Volatility: The expected movement of the stock price in the future.

- Interest rates: The cost of borrowing money, which affects option valuations.

Strategies for Success in Option Trading

Maximizing your success in stock option trading hinges on employing a well-defined strategy that aligns with your investment objectives. Some key approaches encompass:

Image: www.fool.com

Tips for Enhancing Trades

To elevate your stock option trading outcomes, heed expert advice and implement these practical tips:

- Educate yourself: Immerse yourself in the complexities of option trading through books, online courses, and workshops.

- Practice in a simulated environment: Experiment with different options strategies in a paper trading account before venturing into real-world trading.

- Manage risk: Set predefined stop-loss orders to safeguard your capital from sharp market swings.

- Stay informed: Monitor financial news and market trends to make astute trading decisions.

Frequently Asked Questions (FAQs)

To dispel common queries surrounding stock option trading, consider these answers:

- Q: What’s the minimum capital required for option trading? A: It varies with brokers, but typically a few hundred or thousand dollars can suffice.

- Q: Can I lose more money than initially invested? A: Yes, options trading involves leverage, so losses can exceed your initial investment.

- Q: Is option trading suitable for all investors? A: No, it’s not ideal for beginners or highly risk-averse individuals.

- Q: How do I determine the profitability of an option trade? A: Consider factors like the option’s premium, strike price, expiration date, and expected stock price movement.

- Q: What are the potential benefits of option trading? A: Increased flexibility, enhanced income generation, and asset protection capabilities.

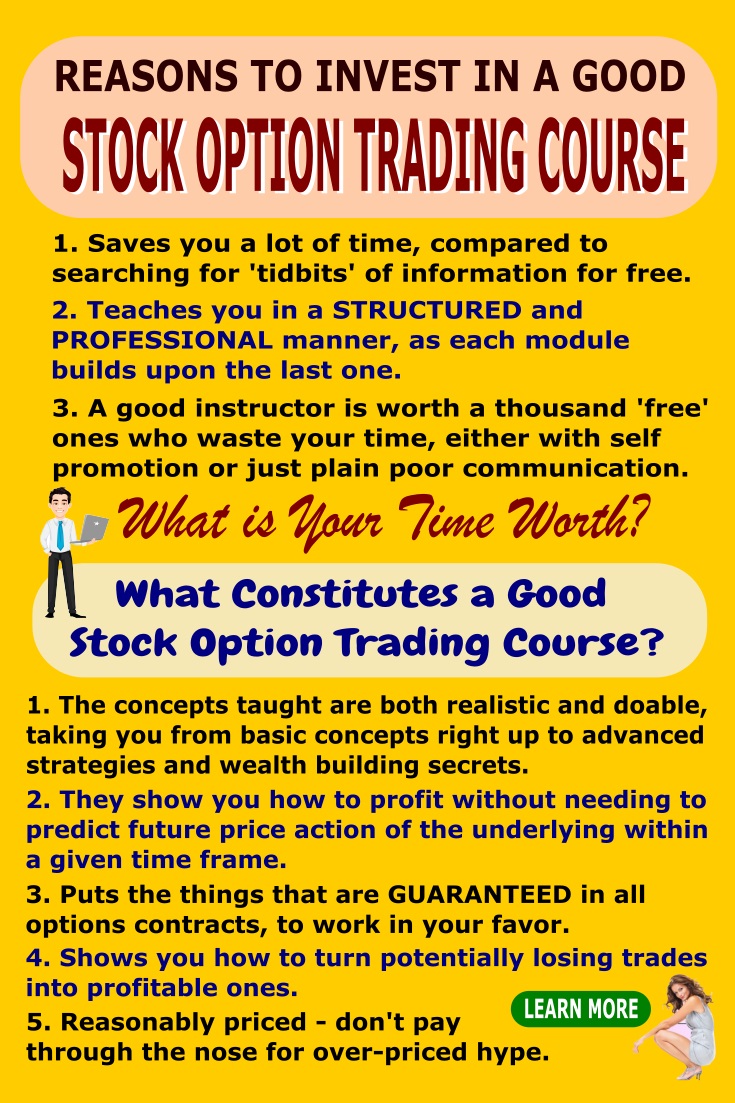

Stock Option Trading Adalah

Image: www.options-trading-mastery.com

Conclusion

Understanding the nuances of stock option trading empowers you to tap into its lucrative possibilities. While understanding the intricacies and risks involved is crucial, so is tailoring your approach to your personal goals. Embrace stock option trading as a potential path to financial success, but always proceed with caution, seeking education and expert guidance along the way. Are you intrigued by the world of options?