In today’s dynamic financial landscape, options trading has emerged as a potent investment strategy, offering the potential for substantial returns alongside calculated risk management. For aspiring traders seeking to capitalize on this lucrative market, selecting the right US options trading broker is paramount. This comprehensive article will guide you through the intricacies of the options market, empowering you with the knowledge and insights to make an informed decision.

Image: www.btcc.com

What is Options Trading?

Options are financial contracts granting the buyer the right, but not the obligation, to buy or sell an underlying asset at a predetermined price (strike price). They provide flexibility and versatility, enabling traders to speculate on price fluctuations, hedge existing positions, or generate income through premium collection. Options trading offers the potential for both limited risk and high rewards, making it an attractive option for investors of varying experience levels.

Choosing a US Options Trading Broker: Essential Considerations

Selecting a reliable US options trading broker is crucial for success in this market. Consider the following factors to guide your decision-making process:

-

Regulation and Compliance: Verify that the broker is appropriately licensed and regulated by reputable authorities such as the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC). This ensures the broker operates within legal and ethical frameworks.

-

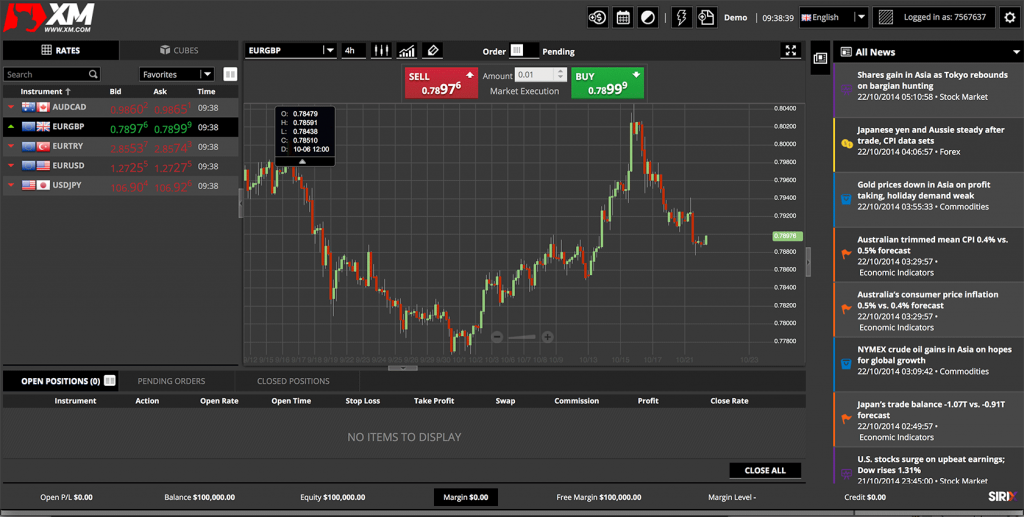

Trading Platform: The trading platform is the hub of your trading activities. Look for a platform that aligns with your trading style, offering features such as fast execution, advanced order types, and real-time market data. Compatibility with desktop, mobile, and web interfaces is also a valuable feature for flexibility and convenience.

-

Fees and Commissions: Transaction costs can significantly impact your profitability. Determine the broker’s fee structure for options trades, including commissions, spreads, and any additional fees. Competitive pricing and transparent fee schedules are desirable.

-

Customer Service and Support: When navigating the complex world of options trading, access to reliable customer service is invaluable. Look for a broker that provides prompt, knowledgeable, and professional support through multiple channels such as phone, email, and live chat.

-

Product Offerings: Consider the broker’s product offerings beyond basic options trading. Some brokers provide specialized services such as margin trading, advanced strategies, and research reports, which can enhance your trading capabilities.

Expert Insights and Actionable Tips for US Options Trading

To maximize your success in US options trading, heed the following insights from seasoned experts:

-

Understand Your Trading Objectives: Define your investment goals and risk tolerance before entering trades. Options trading can be both rewarding and risky, so it’s crucial to align your strategies with your financial aspirations.

-

Master Risk Management: Options trading carries inherent risks. Employ effective risk management techniques such as position sizing, stop-loss orders, and hedging to mitigate potential losses.

-

Stay Informed and Educate Yourself: Continuous learning and market analysis are essential for success in options trading. Keep abreast of economic news, technical indicators, and trading strategies to make informed decisions.

-

Seek Professional Guidance (Optional): Consider seeking guidance from a qualified financial advisor to navigate the complexities of options trading, particularly if you’re a novice trader.

Image: millennialmoney.com

Us Options Trading Broker

Image: www.slideshare.net

Conclusion

Selecting a reputable US options trading broker is the cornerstone of a successful trading journey. By considering the factors outlined in this article and leveraging the expert insights provided, aspiring traders can make informed decisions, maximize their potential, and capitalize on the exciting opportunities in the options market. Remember to proceed with due diligence, invest wisely, and always consult a qualified professional to address any specific financial concerns.