In the realm of investment strategies, barrier options present a unique proposition for investors seeking both potential gains and the management of risk. Barrier options are a type of financial derivative that grants the holder the option to buy (call option) or sell (put option) an underlying asset at a specified price, known as the strike price, as long as the asset’s price remains above (for a call option) or below (for a put option) a predetermined barrier level. These innovative instruments offer investors a powerful mechanism to structure complex strategies, optimize risk management, and potentially capitalize on market movements while defining their risk appetite.

Image: heavenlymassage.com

Delving into Barrier Options: A Comprehensive Guide

Barrier options encompass various types, namely up-and-out, down-and-out, up-and-in, and down-and-in options, each offering distinct risk profiles and potential rewards. Up-and-out and down-and-out options allow the exercise of the option only as long as the underlying asset’s price remains outside the specified barrier level. Conversely, up-and-in and down-and-in options become exercisable once the underlying asset’s price penetrates the predefined barrier level. This flexibility in determining the barrier level and the direction of boundary penetration empowers investors with the ability to tailor their strategies to match their specific investment objectives.

Understanding the Mechanics of Barrier Options

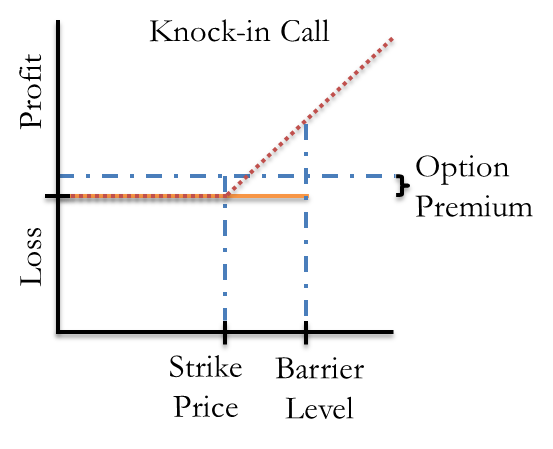

The intricate yet intuitive mechanics of barrier options involve the interplay of three key elements: barrier level, strike price, and premium. The barrier level serves as the pivotal threshold, controlling the activation or termination of the option’s exercise window. The strike price represents the designated price at which the option can be exercised, and it interacts with the barrier level to determine the option’s potential profitability. Lastly, the premium paid by the holder of an option encompasses the cost for the acquisition of these contractual rights. The strategic balancing of these elements forms the cornerstone of successful barrier options trading.

Empowering Investors with Risk Management and Profit Potential

Harnessing the versatility of barrier options grants investors a powerful toolkit for risk management and profit optimization. Seeking to limit losses? An up-and-out or down-and-out option can provide a safety net, protecting against adverse price movements that breach the barrier level. Aiming to capture upside potential while controlling risk? An up-and-in or down-and-in option can grant access to potential gains if the asset’s price penetrates the defined boundary. Furthermore, by combining barrier options with other financial instruments, such as stocks or futures, investors can build sophisticated strategies that align with their risk tolerance and investment goals.

Image: www.referenceforbusiness.com

Exploring Practical Barrier Options Applications

In the diverse world of financial markets, barrier options find myriad applications that reflect the needs of various investor profiles. Here are a few examples that showcase their versatility:

-

Income Generation through Barrier Options Selling: Seasoned traders may generate income by selling barrier options, earning the premium paid by buyers while managing the potential risks involved.

-

Unveiling Profit Potential with Knock-In/Knock-Out Options: Barrier options with knock-in/knock-out features offer attractive opportunities for tapping into market movements. These options become exercisable or expire if the underlying asset’s price breaches the predetermined barrier level.

-

Hedging Strategies with Barrier Options: Individuals and institutions can effectively employ barrier options as hedging instruments to shield against potential losses or enhance portfolio returns. For instance, an investor holding a stock position can balance their exposure by utilizing an up-and-out put option, offering downside protection if the stock price falls below a specified threshold.

Barrier Options Trading

Conclusion: Embracing the Power of Barrier Options

In conclusion, barrier options trading presents a powerful realm of opportunities for investors seeking advanced risk management techniques and profit optimization tactics. These options empower holders with the ability to dynamically manage their market exposure, protect against adverse price movements, and potentially capture upside potential within defined risk parameters. As with any financial instrument, a thorough understanding of barrier options and a strategic approach are essential for successful implementation. By delving into this comprehensive guide, investors can unlock the benefits of barrier options trading, enhancing their ability to navigate the ever-evolving financial markets.