Introduction

Image: www.tradingview.com

The unprecedented global crisis sparked by the COVID-19 pandemic has sent shockwaves through the financial markets, leaving investors grappling with uncertainty and volatility. Option trading, a sophisticated investment strategy, has emerged as a potential tool to navigate these turbulent times and either protect existing investments or capitalize on market swings. To fully comprehend the intricacies of option trading in the context of the pandemic, let’s dive into its fundamentals and explore strategies tailored to navigate this challenging market landscape.

What is Option Trading?

Options are financial contracts that grant the buyer the right, but not the obligation, to buy (call option) or sell (put option) an underlying asset at a specified price on or before a particular date. By acquiring an option contract, investors can hedge against potential losses or speculate on future price movements of the underlying asset. They provide leverage, allowing investors to control a larger amount of the underlying asset with a smaller capital outlay.

Call Options vs. Put Options

Understanding the distinction between call and put options is crucial. Call options grant the buyer the right to buy the underlying asset at the specified price, thereby profiting from a potential price increase. Conversely, put options grant the buyer the right to sell the underlying asset at the specified price, profiting from a potential price decrease.

Option Trading Strategies for a Volatile Market

In the midst of the COVID-19 pandemic, embracing a cautious approach to option trading is prudent. Here are some strategies designed to mitigate risk and maximize potential gains:

- Covered Calls: For investors who own an underlying asset, selling a covered call can generate income while limiting downside risk. The investor sells a call option with a strike price higher than the current market price, obligating them to sell the underlying asset if the strike price is reached.

- Protective Puts: As a hedge against potential losses, purchasing a protective put option provides downside protection for investors with existing positions. The investor buys a put option with a strike price below the current market price, granting them the right to sell the underlying asset at a specified price.

- Condor Spread: This neutral strategy involves selling a call option at a higher strike price and simultaneously purchasing a call option at an even higher strike price, along with selling a put option at a lower strike price and purchasing a put option at an even lower strike price. It profits from a narrow trading range.

Additional Tips for Option Trading During COVID-19

- Research and Due Diligence: Conduct thorough research on the underlying asset and the option contracts you intend to trade. Understand the risks and potential rewards.

- Manage Risk: Avoid overleveraging and always consider the potential losses. Implement proper risk management techniques, including stop-loss orders and position sizing.

- Monitor Market Conditions: Stay informed about the latest economic data, news, and market trends that could impact the price of the underlying asset. Adjust strategies accordingly.

- Seek Professional Advice: If uncertain, consult a certified financial advisor or options specialist to guide your decision-making.

Conclusion

Option trading can be a valuable tool for investors seeking to navigate the volatility associated with the COVID-19 pandemic. By adopting a cautious approach, implementing appropriate strategies, and employing diligent risk management practices, investors can potentially mitigate losses, enhance returns, and make informed decisions amidst uncertain market conditions. Remember, thorough research and proactive monitoring are key to unlocking the potential benefits of option trading during these challenging times.

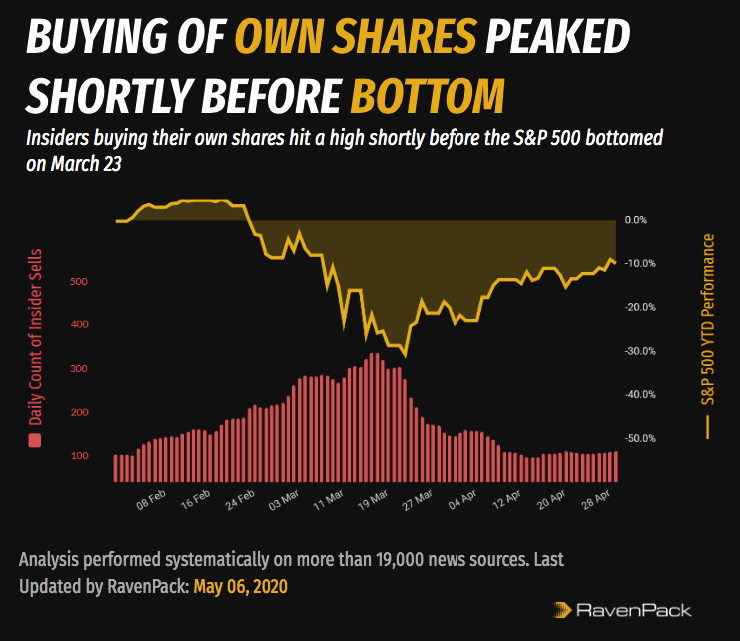

Image: www.ravenpack.com

Option Trading Corona Virus

Image: br.tradingview.com