In the realm of financial markets, options trading can be a daunting concept for many. However, with the advent of user-friendly trading platforms, this once-complex maneuver has become increasingly accessible to aspiring investors. Embark on a journey to unveil the easiest option trading platforms that will empower you to navigate the world of options with confidence and ease.

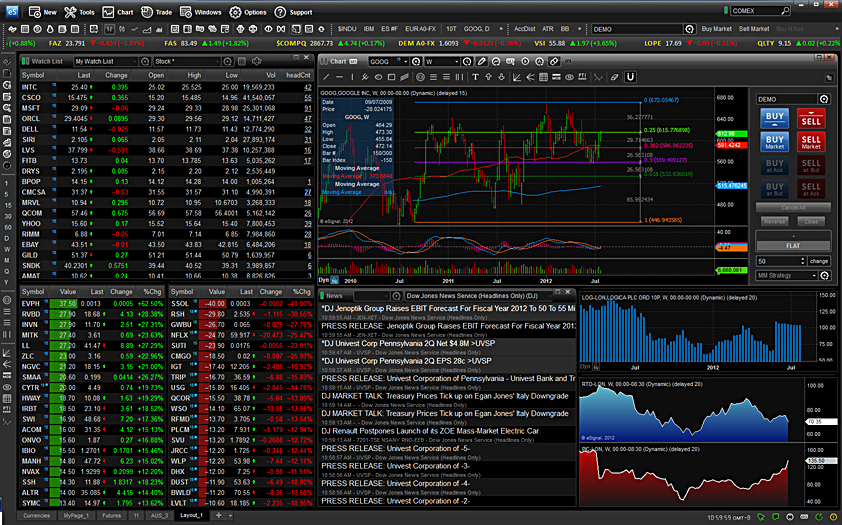

Image: niyudideh.web.fc2.com

A Path Unraveled: Understanding Option Trading

Options, in their essence, are financial instruments that offer the flexibility to either buy or sell an underlying asset, such as a stock or index, at a predetermined price within a specified timeframe. This unique duality presents boundless possibilities for investors seeking to profit from market movements. The advent of user-friendly platforms has transformed what was once a challenging endeavor into an approachable and empowering experience.

Simplifying the Maze: Unveiling the Easiest Option Trading Platforms

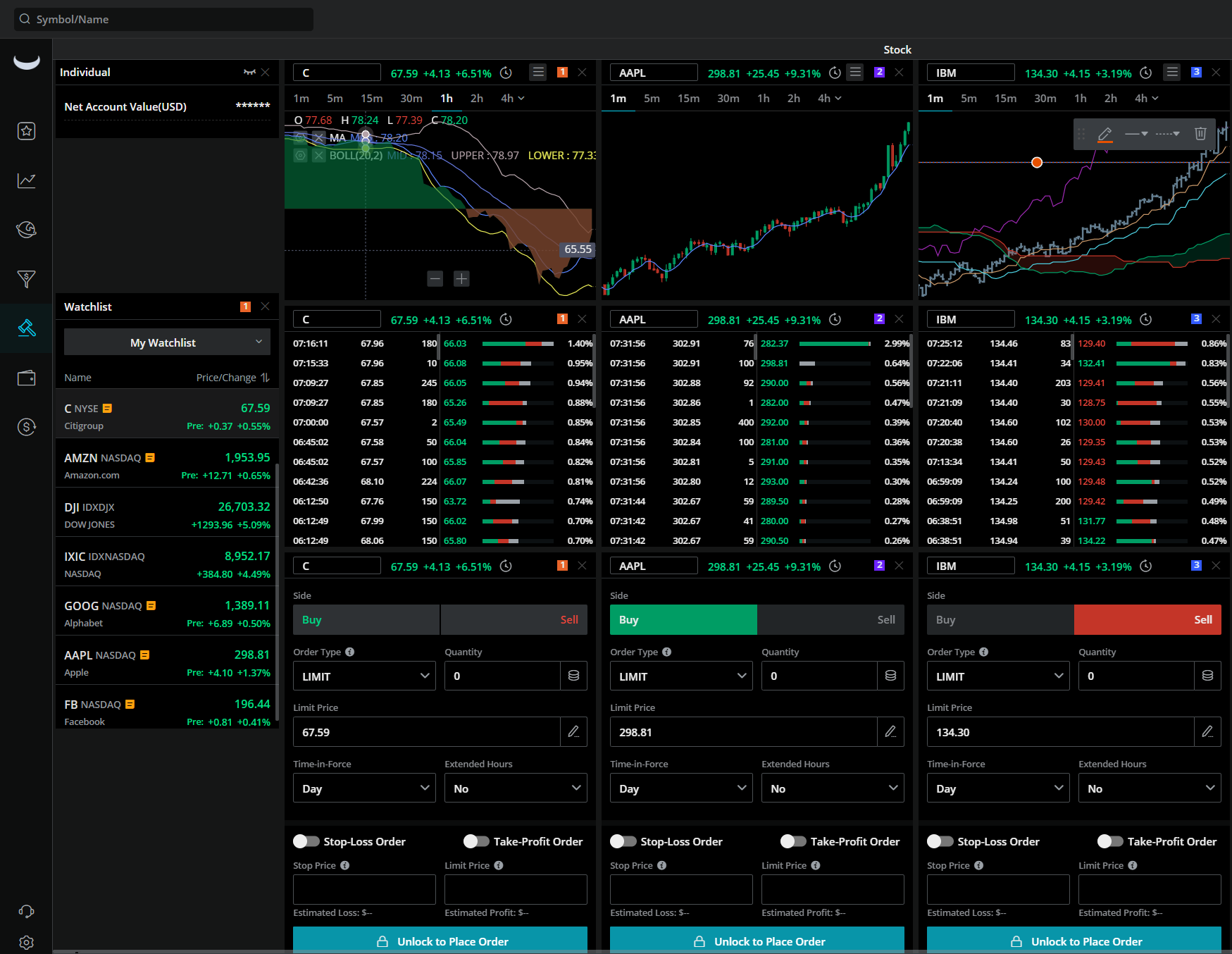

Amidst the array of available option trading platforms, a select few stand out for their intuitive interfaces and comprehensive features, catering to the needs of both novice and experienced traders. To unravel the complexities of options trading, we present a meticulous examination of these user-friendly platforms:

-

Thinkorswim: Unveiling a powerhouse platform, Thinkorswim seamlessly blends an array of advanced trading tools with an exceptionally user-friendly interface. Designed by TD Ameritrade, this platform empowers traders with real-time data, customizable charts, and comprehensive research capabilities. Its thoughtfully crafted interface allows even novice traders to navigate the world of options with confidence and precision.

-

Tastyworks: Embracing a mission to simplify options trading, Tastyworks has emerged as a formidable contender in the realm of user-friendly platforms. Its intuitive design, coupled with an array of educational resources, makes it an ideal choice for traders seeking to delve into the intricacies of options. Tastyworks has garnered acclaim for its exceptional customer support, providing a helping hand to traders every step of the way.

-

WeBull: As a rising star in the trading realm, WeBull distinguishes itself through its user-centric approach. This platform has garnered a loyal following among novice traders, attributing its success to its intuitive interface and compelling social trading features. Commission-free trading further enhances the appeal of WeBull, making it a cost-effective gateway for aspiring options traders.

-

Interactive Brokers: Established as a leader in the industry, Interactive Brokers has earned its reputation for offering a comprehensive suite of trading tools and advanced trading capabilities. While catering to experienced traders, Interactive Brokers also extends a welcoming hand to beginners through its user-friendly platform. ItsTrader Workstation, renowned for its immense flexibility and customization options, empowers traders to adapt the platform to their unique preferences and trading styles.

Empowering the Aspiring: Unveiling the Simplest Option Trading Strategy

As a novice venturing into the world of options trading, simplicity reigns supreme. One strategy that has gained traction among beginners is the covered call strategy. This technique involves selling a call option against an underlying asset that you already own. By doing so, you garner a premium payment upfront, potentially generating income while maintaining the flexibility to retain your underlying asset.

To illustrate the covered call strategy, consider the following example:

- You purchase 100 shares of Apple stock at $100 per share, resulting in a total investment of $10,000.

- Simultaneously, you sell a call option with a strike price of $105 and an expiration date of one month, collecting a premium of $2 per share.

- In this scenario, you receive $200 upfront and maintain ownership of your Apple shares.

- If the price of Apple stock rises above $105 on the expiration date, your call option will be exercised, and you will be obligated to sell your shares at $105. However, you will have already profited from the premium you collected, and your maximum profit will be limited to the difference between the strike price and the price at which you purchased the stock, minus the premium received.

- On the other hand, if the price of Apple stock falls or remains below $105, your call option will expire worthless, and you will retain ownership of your shares, potentially benefiting from any future appreciation in the stock price.

Remember that this is merely a basic example, and the outcome of any trading strategy can vary depending on market conditions. It is crucial to thoroughly research and understand all aspects of options trading before venturing into this arena.

Image: www.ira-reviews.com

Easiest Option Trading Platform

Embark on Your Option Trading Journey with Simplicity and Confidence

Navigating the world of option trading doesn’t have to be a daunting endeavor. By choosing the easiest option trading platforms, you can empower yourself with user-friendly interfaces, comprehensive educational resources, and the ability to execute trades with simplicity and confidence. Remember to approach options trading with a prudent mindset, thoroughly research and understand the underlying strategies, and always manage your risk effectively. With the right tools and knowledge at your disposal, you can unlock the boundless opportunities that the world of options trading holds in store