I still remember the near-blinding surge of euphoria when the first option trade I ever made paid off. It was like I had been given a treasure map to riches beyond my wildest dreams. But as the days went by, I began to realize that options trading is a complex beast that even experienced traders can find tricky.

Image: www.youtube.com

Navigating the Labyrinth of Options Trading

Options, a type of financial derivative, offer the tantalizing possibility of outsize returns. However, before you dive headfirst into this exhilarating world, there are crucial things you need to know.

Options Explained

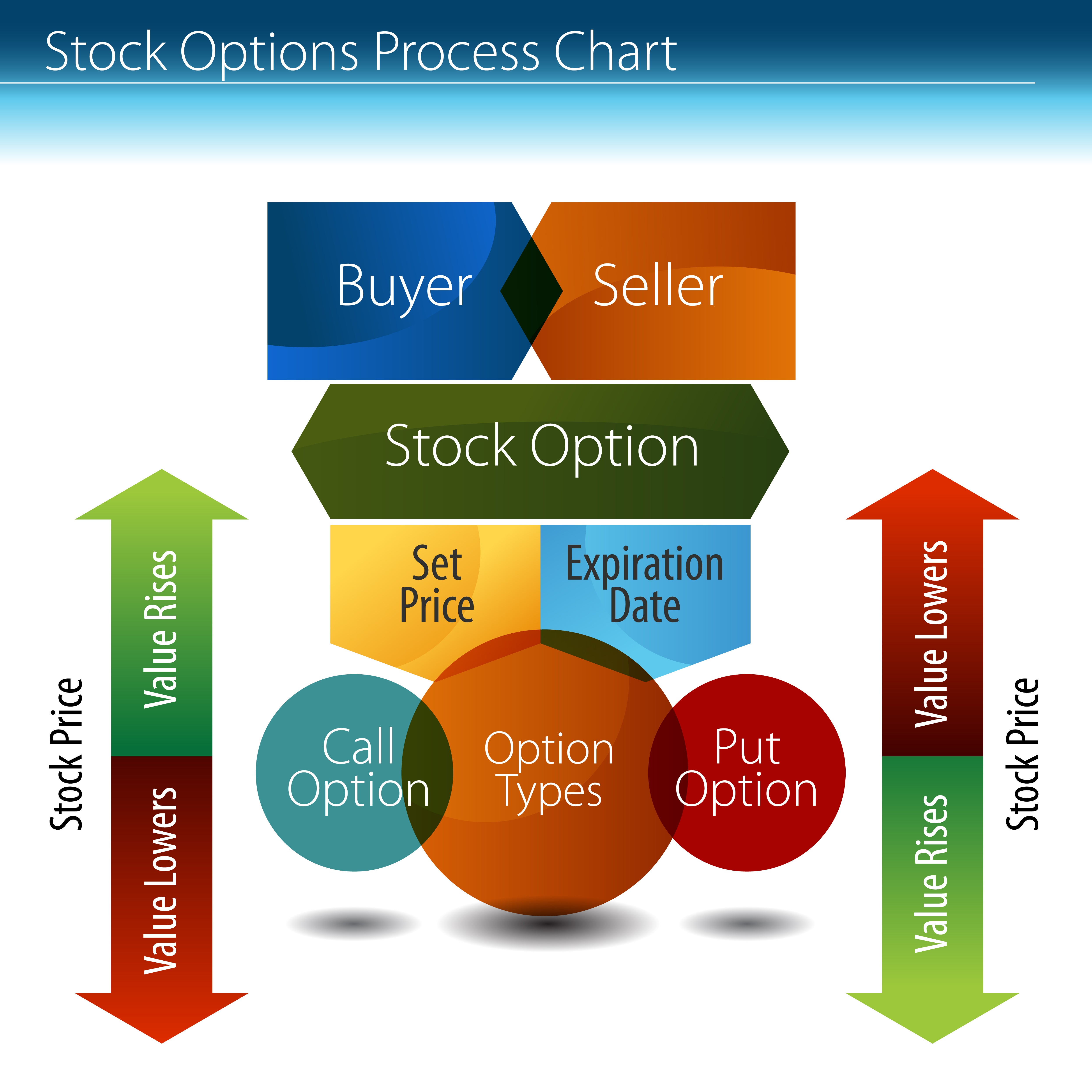

Imagine you’re shopping for a car. You can either buy the car outright or lease it. Options trading works in a similar way. When someone buys an option, they are essentially paying for the right to either buy (call) or sell (put) an underlying asset, such as a stock, at a set price on a predefined date. The price of an option premium, paid by the buyer, is like a refundable deposit on that future transaction.

Call options: Give the buyer the right to purchase the underlying asset at the predetermined price (known as the “strike price”). The catch? You only have this right until the set expiry date. Call options are ideal when you anticipate the value of that underlying asset rising.

Put options: Grant you the right to sell an underlying asset at the strike price by the expiry date. These come in handy if you predict a drop in its value.

Types of Options Trading

There are two main types of options trading:

Trading for speculation: With this tactic, you’re banking on the stock price moving in your favor by a specific date. Predicting this correctly can potentially lead to substantial rewards; however, there’s a substantial risk involved and you can end up losing your entire investment.

Hedging: This strategy employs options to mitigate potential losses from other investments or trades. Hedging can safeguard your investments. It does this by reducing the overall risk of your portfolio, so while you likely won’t see significant gains, losses may be minimized.

Image: www.binarytradingforbeginners.com

Tips and Strategies for Novice Options Traders

If you’re ready to embark on the exciting and unpredictable journey of options trading, here are some tips to guide you:

- Start small: Don’t go all-in with your entire fortune. Dedicate a small portion of your capital until you start grasping the nuances of options trading.

- Learn from the pros: Immerse yourself in books, articles, and online resources that can teach you the ropes.

- Find a mentor: A veteran options trader can guide you along the way, sharing knowledge and helping you avoid common pitfalls.

- Practice with a simulator: Many online platforms offer virtual trading environments where you can test your strategies risk-free before you commit real capital.

- Manage your risks: Thoroughly research the factors that influence your underlying asset’s price. Staying informed will help you make informed decisions and mitigate potential losses.

FAQs on Options Trading

Q: What’s the difference between options trading and stock trading?

A: In stock trading, you directly buy or sell shares of a company. With options trading, you purchase the right, but not the obligation, to buy or sell an underlying asset at a specific price on a set date.

Q: Can I make a lot of money with options trading?

A: Options trading has the potential for significant financial rewards, but it also carries substantial risk. You can just as easily lose your entire investment.

Q: How do I get started?

A: Educate yourself, start small, and practice until you develop a firm understanding of options trading and its inherent risks.

The Only Options Trading

Image: www.facebook.com

Conclusion

The world of options trading is not for the faint of heart but is alluringly lucrative. It’s like a financial roller coaster that rewards you handsomely for making the right predictions while punishing you swiftly for being wrong. So, if you’re ready to embrace the thrill of a calculated risk, buckle yourself in and dive into the exhilarating realm of options trading. Are you ready to make your fortune?