Cryptocurrencies have captured the world’s attention with their fast-paced evolution, significant price fluctuations, and potential for high returns. While many investors have traditionally traded crypto via spot markets, the emergence of crypto options trading brings novel possibilities for experienced investors and institutions alike.

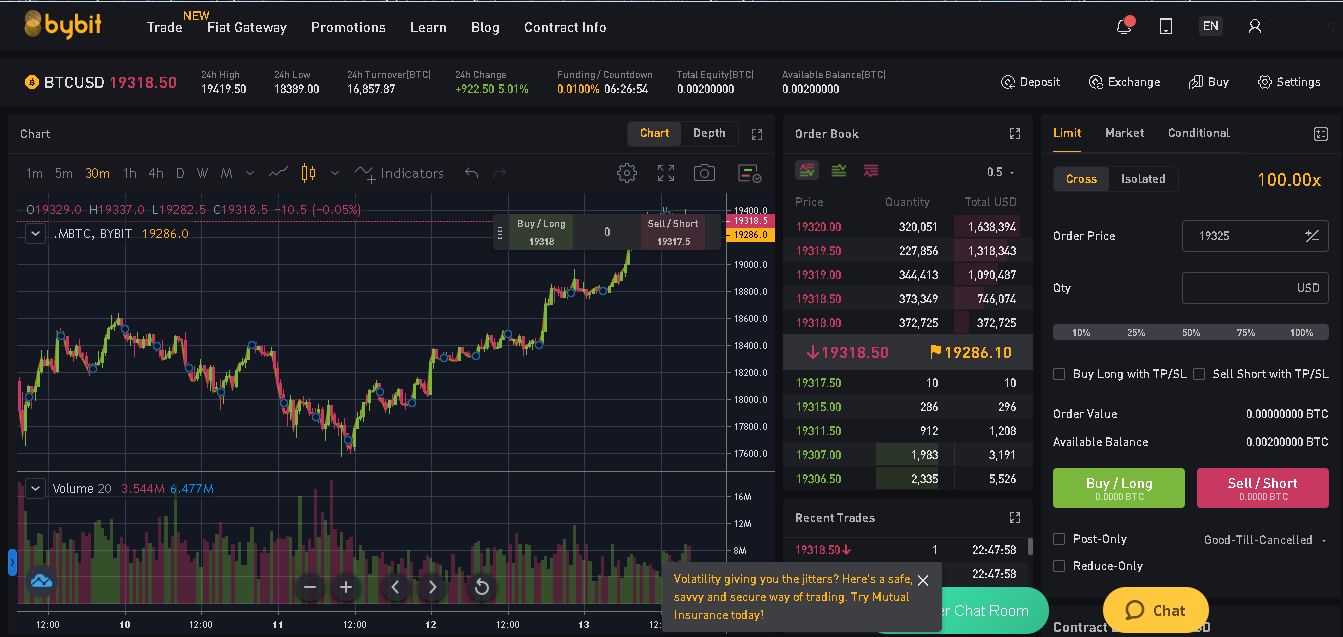

Image: ccoingossip.com

Crypto options are derivatives that grant the buyer the right but not the obligation to buy (call option) or sell (put option) an underlying crypto asset at a predetermined price (strike price) within a specified time frame (expiry date). This flexibility offers investors the ability to speculate on price movements, hedge against market fluctuations, generate income from premiums, and design tailored investment strategies.

Understanding Crypto Options Trading

Unlike spot markets, where traders buy or sell crypto assets directly, options trading introduces the concept of contracts with specific terms. These contracts represent an agreement between the buyer and seller, defining the rights and responsibilities of each party.

The buyer of an option pays a premium to the seller in exchange for the option to exercise the right to buy or sell the specified cryptocurrency at the strike price on or before the expiry date. The premium is determined by various factors, including the expected volatility of the underlying asset, time to expiry, and supply and demand for the option.

Benefits of Crypto Options Trading

Crypto options offer a range of benefits that make them attractive to investors:

- Flexibility: Options provide investors with the flexibility to express specific market views and tailor their investment strategies. By combining calls and puts, investors can design complex strategies to suit their risk appetite and return objectives.

- Hedging: Options can be used as a hedging tool to mitigate risk in crypto portfolios. Investors can hedge against potential price downturns by purchasing put options, ensuring the ability to sell their assets at a predetermined price.

- Income Generation: Selling options can be a source of income for investors. By selling options, investors earn the premium, which compensates them for taking on the obligation to buy or sell the underlying asset at the predetermined price.

- Access to Leverage: Options provide investors with leveraged exposure to the underlying crypto assets. This allows investors to tap into larger market potential without investing large amounts of capital. However, it’s crucial to note that leverage can amplify both gains and losses.

Evolution of Crypto Options Trading in the US

The crypto options market has undergone rapid growth in the US, with a surge in trading volume and the establishment of new platforms. This growth is attributed to growing institutional participation, recognition of crypto as an investable asset class, and the increasing demand for sophisticated investment instruments.

US-based exchanges, such as Coinbase, FTX.US, and Kraken, have played a significant role in advancing the crypto options market. They have obtained regulatory approvals, implemented robust trading infrastructure, and introduced user-friendly platforms, attracting a broader pool of investors.

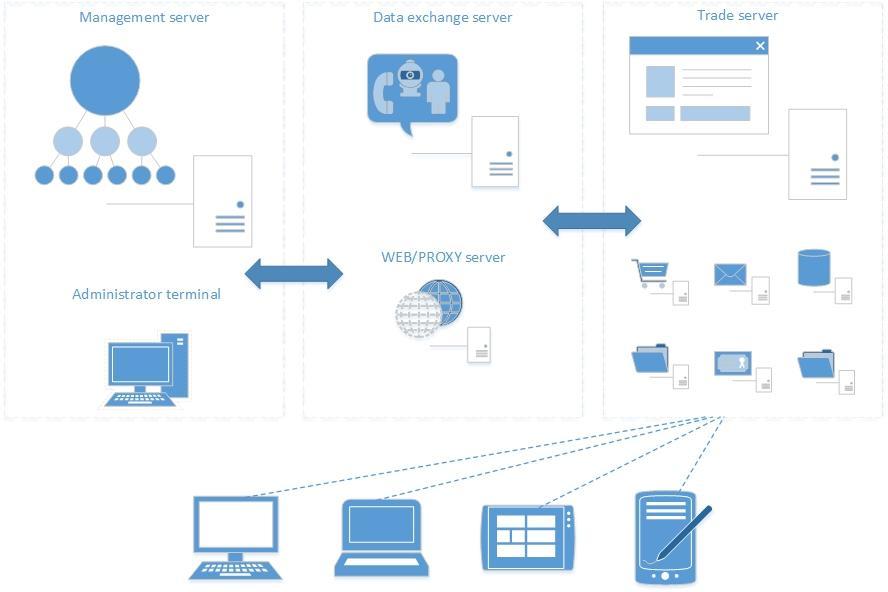

Image: www.tradetoolsfx.com

Crypto Options Trading Platform Us

Image: www.fameex.com

Current Landscape and Future Outlook

The US crypto options trading landscape is still evolving, with ample opportunities for further growth and innovation. New players are entering the market, bringing competition and diversifying the product offerings. The regulatory landscape is also shaping the future of crypto options trading, with discussions ongoing at both federal and state levels to establish clear guidelines and protect investors.

As the market matures, investors can expect increased liquidity, enhanced trading tools, and the development of more complex options strategies. With the growing acceptance and adoption of cryptocurrencies, the demand for crypto options is expected to continue to rise, making it an essential component of sophisticated investment portfolios.