Introduction

Have you ever heard of the option paycheck SPX trading plan? It’s a popular trading strategy that has the potential to generate consistent income. In this article, we’ll provide a comprehensive overview of the option paycheck SPX trading plan, including its definition, history, and meaning. We’ll also discuss the latest trends and developments related to the plan and share tips and expert advice to help you get started.

Image: optionstradingauthority.com

Understanding the Option Paycheck SPX Trading Plan

The option paycheck SPX trading plan is a strategy that involves selling weekly covered calls on the SPDR S&P 500 ETF (SPY). The goal of the plan is to generate a consistent income by selling options premiums. Here’s a breakdown of how the plan works:

- Sell a covered call: Sell a call option on the SPY ETF that expires in one week.

- Receive a premium: Collect a premium from the buyer of the call option.

- Hold until expiration: Hold the call option until it expires worthless or is assigned.

- Repeat: Repeat the process the following week.

The profit potential of the option paycheck SPX trading plan is limited to the premium received from selling the call option. However, the plan can generate a consistent income over time, especially if the underlying market remains relatively stable.

Tips and Expert Advice

Here are a few tips and pieces of expert advice to help you get started with the option paycheck SPX trading plan:

- Manage risk: Selling covered calls involves some risk. Be sure to understand the risks involved before trading.

- Use a trading platform: Use a trading platform that makes it easy to trade options.

- Start small: Start by trading with a small amount of capital. This will help you to learn the ropes and mitigate your risk.

- Be patient: The option paycheck SPX trading plan is not a get-rich-quick scheme. It takes time and patience to build a successful trading business.

FAQs

Here are some frequently asked questions about the option paycheck SPX trading plan:

- What is the profit potential? The profit potential is limited to the premium received from selling the call option.

- What are the risks? Selling covered calls involves some risk. Be sure to understand the risks involved before trading.

- How do I get started? Start by trading with a small amount of capital and use a trading platform that makes it easy to trade options.

- Is the plan right for me? The plan is not suitable for everyone. Be sure to do your research and understand the risks involved before trading.

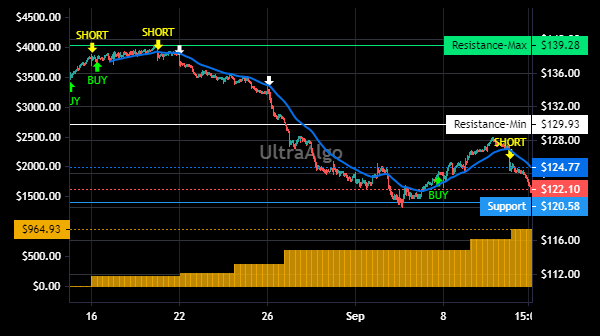

Image: www.ultraalgo.com

Option Paycheck Spx Trading Plan

Image: www.hourglass-trader.com

Conclusion

The option paycheck SPX trading plan is a popular strategy that can provide investors with a consistent income. However, it’s important to understand the risks involved before trading. By following the tips and advice in this article, you can increase your chances of success with the plan.

We would love to hear your thoughts. Are you interested in learning more about the option paycheck SPX trading plan?