As a devout Muslim, I’ve always strived to adhere to the teachings of Islam in all aspects of my life. One such aspect is financial transactions, where I’ve often wondered about the permissibility of option trading. After extensive research and consultation with Islamic scholars, I’ve come to the conclusion that option trading is indeed haram (forbidden) in Islam.

Image: quranwork.com

My journey to this understanding began with the realization that option trading involves a great degree of uncertainty and speculation. Options are financial instruments that give the buyer the right, but not the obligation, to buy or sell an underlying asset at a specified price on a specific date. This inherently speculative nature goes against the core Islamic principles of certainty and transparency, making option trading impermissible.

The Prohibition of Gharar (Uncertainty)

One of the primary reasons why option trading is haram is due to the prohibition of gharar (uncertainty) in Islamic law. Gharar refers to any transaction that involves a significant element of risk or uncertainty, leaving one or both parties unaware of their liabilities or potential losses. Option trading, with its dependence on unpredictable market fluctuations, is considered a highly uncertain and speculative form of investment, thus falling under the category of gharar.

This prohibition is firmly established in Islamic jurisprudence. The Prophet Muhammad (PBUH) explicitly forbade transactions involving gharar, saying, “Do not sell what you do not possess.” This Hadith clearly indicates that any contract or transaction that hinges on an unknown outcome or uncertain event is impermissible in Islam.

The Absence of Real Ownership

Another reason why option trading is considered haram is the absence of genuine ownership over the underlying asset. In conventional option trading, the buyer acquires the right to buy or sell the asset but does not immediately own it. This lack of direct ownership violates the Islamic principle of “bay’ al-‘inah,” which prohibits the sale of a commodity that one does not possess.

Moreover, the buyer of an option pays a premium upfront without acquiring an actual asset in return. This can be seen as a violation of the Islamic principle of “al-ma’dum,” which forbids the sale of a non-existent commodity. Therefore, the speculative nature of options, coupled with the absence of real ownership, makes the trading of options impermissible in Islam.

The Lure of Speculation and Gambling

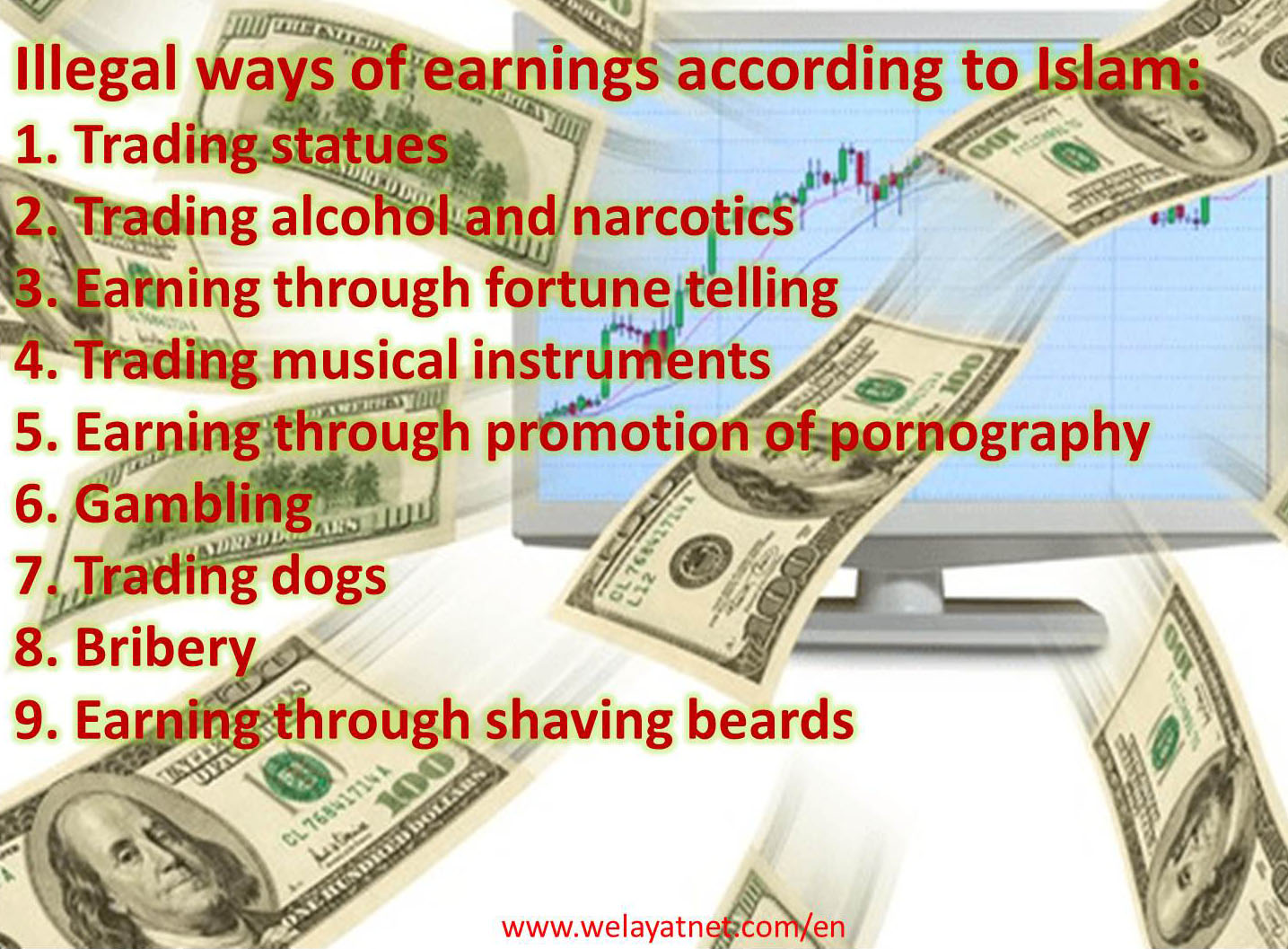

Option trading often attracts speculators who seek to make quick profits without any underlying investment or ownership. This speculative aspect of option trading is another reason why it is forbidden in Islam. Gambling and excessive speculation are strongly discouraged in Islamic law and are considered sinful, as they lead to addiction, greed, and the erosion of societal values.

The excessive risk inherent in option trading can also lead to financial ruin, leaving individuals in severe economic hardship. This is particularly dangerous in an economic climate where many people live paycheck to paycheck.

Image: ruangmenggambar344.blogspot.com

Alternatives to Option Trading

While conventional option trading is haram in Islam, there are permissible investment opportunities that align with Islamic values and ethics. These include:

- Stock Trading: Purchasing shares of a publicly traded company, representing direct ownership in the company.

- Sukuk: Shariah-compliant financial instruments that provide fixed returns and are backed by underlying assets.

- Real Estate Investment: Investment in physical property, providing tangible ownership and potential rental income.

Choosing investment options that adhere to Islamic principles helps ensure that one’s financial activities comply with religious teachings and contribute to a more just and ethical society.

Why Option Trading Is Haram In Islam

Conclusion

In conclusion, option trading is impermissible in Islam due to its speculative nature, the prohibition of gharar (uncertainty), the absence of real ownership, the prevalence of speculation and gambling, and the availability of ethical alternatives. Seeking financial gain is not forbidden in Islam, but it must be balanced with ethical values and the avoidance of harmful elements such as gharar and gambling.

Are you interested in learning more about Shariah-compliant investment options?