As an adventurer in the stock market, I’ve faced countless forks in the road that demanded bold choices. One particular decision – venturing into non-equity options trading – has forever altered my journey.

Image: www.cmegroup.com

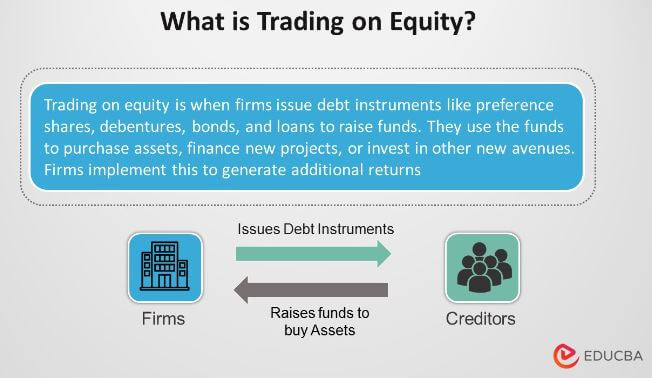

Options provide the flexibility to navigate market intricacies with finesse. Unlike equity trading, non-equity options don’t directly involve buying or selling stocks – instead, they represent a contract that grants the trader the right (but not the obligation) to buy or sell an underlying asset at a specified price within a predefined time frame.

The Art of Non-Equity Options Trading

Non-equity options encompass a vast array of instruments, including index options, currency options, and futures options. These diverse choices empower traders to tailor strategies that align with their risk tolerance and market outlook.

Index options offer leverage to speculate or hedge on the performance of a specific market index, such as the S&P 500 or NASDAQ Composite. Currency options grant the right to bet on exchange rate fluctuations, presenting opportunities for both speculation and currency risk management. Futures options provide the ability to secure the price of a commodity or financial instrument for future delivery, offering potential protection against price volatility.

Decoding the Options Contract

Each non-equity option contract comprises several key elements:

- Underlying Asset: The security or financial instrument that the option represents (e.g., index, currency).

- Option Type: Call (right to buy) or put (right to sell).

- Option Price (Premium): The price paid to acquire the option.

- Strike Price: The specified price at which the trader can buy or sell the underlying asset.

- Expiration Date: The date on which the option expires and becomes worthless if not exercised.

The option’s value is determined by various factors, including the price of the underlying asset, time to expiration, and market volatility. Understanding these dynamics is crucial for successful non-equity options trading.

Latest Trends and Market Insights

The non-equity options market is constantly evolving. Emerging trends include:

- Increased Use of Algorithmic Trading: Computerized systems automate option trading strategies, reducing latency and enhancing efficiency.

- Growing Popularity of Volatility Options: Options that speculate on the volatility of underlying assets offer protection against market fluctuations.

- Rise of Binary Options: All-or-nothing options that pay a fixed return if the underlying asset meets or exceeds a certain price level.

Stay abreast of these developments to optimize your trading strategies.

Image: www.youtube.com

Expert Tips and Proven Advice

Based on my experience as a veteran options trader, here are some invaluable tips:

- Plan Your Trades Carefully: Define your risk parameters, set profit targets, and account for potential market fluctuations.

- Manage Your Risk: Employ stop-loss orders, diversify your portfolio, and avoid exceeding your trading limits.

- Master Technical Analysis: Leverage technical indicators and chart patterns to identify trading opportunities and manage risk.

- Seek Professional Guidance: Consider consulting with a financial advisor or taking educational courses to enhance your knowledge.

- Practice and Learn Continuously: The market is dynamic – ongoing professional development is key to staying ahead.

Adhering to these guidelines can significantly improve your chances of success in non-equity options trading. Embrace a data-driven and disciplined approach.

FAQ: Simplifying Non-Equity Options

- Q: Which type of non-equity option is suitable for bullish markets?

A: Call options are appropriate for a bullish outlook, as they provide the right to buy the underlying asset at a higher price.

- Q: How do I calculate the profit from an options trade?

A: The profit is the difference between the option’s selling price and the premium paid.

- Q: Are there any risks involved in non-equity options trading?

A: Yes, options trading carries the potential for significant losses. It’s essential to manage risk effectively.

- Q: Is non-equity options trading a suitable option for beginners?

A: While not recommended for complete novices, those with a solid understanding of the market and a willingness to learn can approach options trading with caution.

- Q: Where can I find educational resources for non-equity options trading?

A: Brokers, online platforms, and financial institutions provide educational materials, courses, and seminars.

Non-Equity Options Trading

Image: www.educba.com

Conclusion: Embrace the Power, Trade with Knowledge

Non-equity options trading is a potent tool for savvy traders seeking to enhance their market acumen. By mastering the intricacies of options contracts and applying expert advice, you can unlock new horizons of trading success.

The journey to becoming a successful options trader requires dedication, continuous learning, and risk management. If you are drawn to the thrill of market navigation and believe in the pursuit of knowledge, embrace the captivating world of non-equity options trading. The next chapter in your financial adventure awaits – are you ready to push the boundaries?