Introduction: The Allure of Black Gold

In the realm of finance, few assets hold as much allure as crude oil. As a non-renewable resource that fuels global economies, oil’s price fluctuations have a ripple effect on industries and markets worldwide. Recognizing this potent influence, investors seek opportunities to capitalize on oil’s volatility, and one avenue that has gained significant traction in India is crude oil option trading.

Image: www.spglobal.com

Options, as financial instruments, provide traders with the right, but not the obligation, to buy or sell an underlying asset at a predetermined price on or before a specified date. In the context of crude oil option trading, traders can speculate on the future price direction of oil by purchasing call options (betting that prices will rise) or put options (expecting a decline). This flexibility, paired with the inherent price volatility of oil, makes option trading an attractive option for traders seeking potential profits.

Understanding the Basics: A Trader’s Lexicon

To venture into the world of crude oil option trading effectively, a solid understanding of the fundamental concepts is paramount. Here’s a quick glossary to get you started:

-

Underlying Asset: The underlying asset in crude oil option trading is the price of oil itself, typically benchmarked against global reference points like Brent or WTI.

-

Call Option: A call option grants the buyer the right to purchase a certain amount of oil at a predetermined price (strike price) on or before a specific date (expiration date). The buyer expects the price of oil to rise above the strike price to profit.

-

Put Option: Conversely, a put option gives the buyer the right to sell a specified amount of oil at the strike price before the expiration date. Traders purchase put options when they anticipate oil prices will fall below the strike price.

-

Premium: The premium is the price paid by the option buyer to the option seller for the right to buy or sell the underlying asset.

-

Expiration Date: The expiration date marks the final day when the option can be exercised (bought or sold).

Real-World Applications: Where the Action Unfolds

Crude oil option trading provides traders with a versatile tool to navigate the complexities of the oil market. Here are some common strategies employed by traders:

-

Hedging: Option contracts can be used by producers and consumers of oil as a means of hedging against price fluctuations. By buying put options, for instance, producers can protect themselves from potential price declines, while consumers can use call options to mitigate the impact of rising prices.

-

Speculation: Traders leveraging option trading for speculative purposes attempt to predict the direction of oil prices based on market analysis and economic indicators. Correctly anticipating price movements can yield substantial profits.

-

Arbitrage: Arbitrage involves exploiting price discrepancies between different markets or contracts to generate risk-free profits.

Market Trends and Dynamics: Shaping the Landscape

The crude oil option market in India is influenced by several key trends that traders should monitor closely:

-

Global Supply and Demand: The balance between global oil supply and demand plays a critical role in determining prices. Factors like increased shale production, OPEC decisions, and geopolitical tensions affect demand-supply dynamics.

-

Economic Growth: The overall health of the global economy, particularly in major oil-consuming regions like China and India, has a significant impact on crude oil prices. Economic growth typically leads to higher demand and upward price pressures.

-

Geopolitical Factors: Geopolitical events in oil-producing regions, such as political instability, conflicts, and natural disasters, can disrupt supply and influence prices.

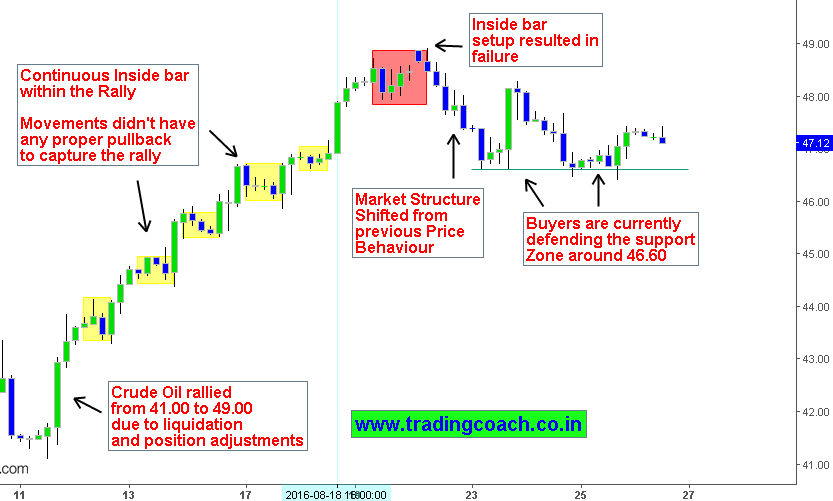

Image: tradingcoach.co.in

The Role of Regulatory Bodies: Ensuring Market Integrity

The Securities and Exchange Board of India (SEBI) regulates crude oil option trading in India. This ensures market transparency, protects investor interests, and prevents market manipulation. SEBI has established guidelines for trading, clearing, and settlement of oil options contracts.

Crude Oil Option Trading In India

Image: www.researchgate.net

Conclusion: Embracing the Ups and Downs

Crude oil option trading presents a compelling opportunity for investors to participate in the dynamic oil market. With its inherent volatility and the potential for substantial returns, option trading demands a comprehensive understanding of the underlying concepts, market trends, and regulatory framework. By equipping themselves with the right knowledge and adopting a disciplined trading approach, traders can navigate the ups and downs of the oil market effectively.