Unveiling the Intricacies of Nasdaq Futures Options

The relentless pursuit of financial success has paved the way for innovative financial instruments, and Nasdaq futures options have emerged as a beacon of opportunity. Understanding the nuances of these options is paramount for savvy traders seeking to navigate the ever-evolving markets.

Image: www.youtube.com

Overview: Nasdaq Futures and Options Explained

Nasdaq futures contracts are agreements to buy or sell a specific quantity of the Nasdaq-100 index at a predetermined price on a future date. These futures provide exposure to the performance of the Nasdaq-100, which comprises 100 of the largest non-financial companies listed on the Nasdaq stock exchange.

Nasdaq futures options, on the other hand, offer the right, but not the obligation, to buy (call option) or sell (put option) Nasdaq futures contracts at a predetermined strike price before a specific expiration date. The buyer of an option pays a premium to the seller, giving them the flexibility to capitalize on market movements without the full commitment of buying or selling the underlying Nasdaq futures contract.

Market Hours and Trading Sessions

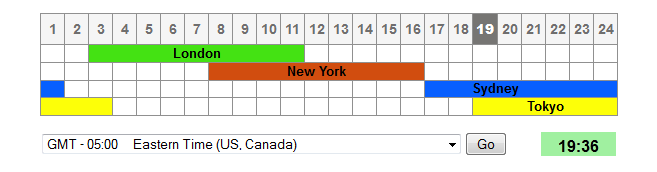

The Nasdaq futures options market is open for trading from 7:00 AM to 11:59 PM ET, Monday through Friday. However, the most active trading occurs during the regular trading session from 9:30 AM to 4:00 PM ET, when the majority of market participants are active.

Key Trading Considerations

-

Contract Size: Each Nasdaq futures contract represents $100 multiplied by the Nasdaq-100 index.

-

Tick Size: The minimum price movement for Nasdaq futures contracts is 0.25 index points, equating to $25.

-

Premium and Expiration: The premium paid for an option contract varies depending on factors such as the strike price, time to expiration, and implied volatility. Options expire on the third Friday of each month.

Image: s3.amazonaws.com

Tips for Successful Futures Options Trading

Harness the wisdom of experienced traders to enhance your trading strategies:

-

Understand Market Trends: Stay abreast of economic news, company announcements, and geopolitical events that may impact Nasdaq-100 companies.

-

Choose Options Wisely: Select options with strike prices and expiration dates that align with your market outlook and risk tolerance.

-

Monitor and Manage Risks: Futures options can be complex, so carefully monitor your positions and implement risk management strategies to mitigate potential losses.

FAQ: Unraveling the Mysteries

Q: What are the advantages of trading Nasdaq futures options?

A: Nasdaq futures options offer flexibility, leverage, and the ability to hedge against market fluctuations.

Q: How do I calculate the value of an option?

A: Option pricing models, such as the Black-Scholes model, are used to determine the fair value of an option based on factors like the strike price, time to expiration, and implied volatility.

Q: Are Nasdaq futures options suitable for all investors?

A: Futures options are complex and can involve substantial risk. They are more appropriate for experienced traders with a solid understanding of market dynamics and risk management strategies.

Nasdaq Futures Options Trading Hours

Image: optimusfutures.com

Conclusion: Unveiling the Power of Nasdaq Futures Options

Nasdaq futures options are a powerful tool for skilled traders seeking to navigate the complexities of the financial markets. By mastering their intricacies, investors can unlock the potential for substantial returns and enhance their overall investment strategies.

Are you intrigued by the world of Nasdaq futures options trading? Immerse yourself in further research and seek the guidance of experienced professionals to elevate your trading capabilities and unleash the full potential of this dynamic asset class.