An Essential Guide for Strategic Investments

In the dynamic world of financial markets, options trading has emerged as a powerful tool for investors seeking to mitigate risk, enhance returns, and profit from market volatility. When it comes to options trading in India, choosing the right stocks is crucial, and liquidity plays a pivotal role in successful trading strategies.

Image: www.youtube.com

Liquidity refers to the ease with which a stock can be bought or sold without significantly impacting its price. High-liquidity stocks offer several advantages, including tighter bid-ask spreads, faster order execution, and reduced market risk. In this comprehensive guide, we will explore the most liquid stocks in India for options trading, empowering you with the knowledge to make informed investment decisions.

Defining Liquidity in Options Trading

Liquidity in options trading measures the ease of buying or selling options contracts without causing significant price fluctuations. When there are ample willing buyers and sellers, a stock exhibits high liquidity, resulting in smoother transactions and reduced trading costs.

Several factors influence a stock’s liquidity, including market capitalization, trading volume, and the presence of institutional investors. Large-cap stocks with high trading volumes tend to have greater liquidity, making them more suitable for options trading strategies.

Identifying the Most Liquid Stocks for Options Trading

Selecting the most liquid stocks for options trading requires a comprehensive understanding of the Indian stock market. Here are some key considerations:

- Market Capitalization: Stocks with a market capitalization of over ₹10,000 crores are generally considered liquid.

- Trading Volume: Stocks with an average daily trading volume of over 1 crore shares are highly liquid.

- Open Interest: This measures the number of outstanding options contracts for a particular stock. Higher open interest indicates increased liquidity.

- Institutional Ownership: Stocks with significant institutional ownership tend to have greater liquidity due to the presence of large, long-term investors.

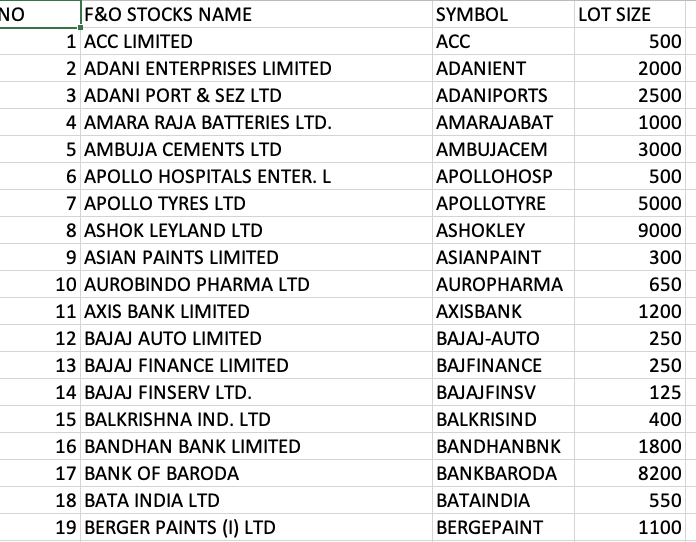

Top Liquid Stocks for Options Trading in India

Based on the above criteria, here’s a list of the most liquid stocks in India for options trading:

- Reliance Industries

- HDFC Bank

- Infosys

- ICICI Bank

- Adani Ports and Special Economic Zone

- Tata Consultancy Services

- State Bank of India

- Bharat Petroleum

- Larsen & Toubro

- Kotak Mahindra Bank

Image: marketscanner.in

Advantages of Trading Liquid Stocks

High-liquidity stocks offer several benefits for options traders:

- Tighter Bid-Ask Spreads: Liquid stocks have narrow bid-ask spreads, minimizing trading costs.

- Faster Order Execution: High liquidity ensures quick and efficient order execution, especially during market volatility.

- Reduced Market Risk: Liquid stocks are less susceptible to large price swings, reducing the risk of significant losses.

Expert Advice for Successful Options Trading

While choosing liquid stocks is crucial, other factors contribute to successful options trading:

- Understand Options Greeks: Mastering options Greeks (Delta, Gamma, Vega, and Theta) is instrumental in analyzing and managing risk.

- Manage Risk Effectively: Set clear entry and exit points, use stop-loss orders, and employ risk management strategies to minimize potential losses.

- Choose the Right Strike Price: Selecting the optimal strike price is crucial for profit maximization.

- Study Market Trends: Continuously monitor market trends, news, and economic events to make informed trading decisions.

- Paper Trade Before Trading Live: Practice options trading in a simulated environment to gain experience and refine strategies before investing real money.

FAQ on Options Trading in India

-

Q: What is the minimum capital required for options trading in India?

A: While there is no specific minimum capital requirement, it is recommended to start with an account balance of at least ₹100,000.

-

Q: Is intraday options trading profitable in India?

A: Intraday options trading can be profitable but requires advanced trading skills, risk management strategies, and a deep understanding of the markets.

-

Q: Which trading platform is best for options trading in India?

A: Reputable trading platforms like Zerodha, Upstox, and ICICI Direct offer user-friendly platforms with advanced charting tools and research capabilities.

Most Liquid Stocks For Options Trading In India

Image: ournifty.com

Conclusion

Options trading can be a powerful financial instrument when executed strategically. Choosing the most liquid stocks for options trading in India is a critical step toward maximizing returns and mitigating risk. By leveraging the information provided in this guide, investors can make well-informed decisions, capitalize on market opportunities, and enhance their trading performance. Remember, the most effective way to succeed in options trading is to continuously learn, manage risk effectively, and adapt to evolving market dynamics.

Are you interested in learning more about options trading in India? Leave a comment below with your questions or insights, and let’s engage in a discussion.