Table of Contents

- Introduction

- Understanding Money Management

- Position Sizing

- Risk Management

- Managing Losses

- Controlling Emotions

- Maintaining Discipline

- Conclusion

Introduction

The allure of options trading lies in its potential for substantial gains. However, the intoxicating pursuit of profits can often cloud one’s judgment, leading to premature exuberance and potentially devastating financial consequences. To navigate the turbulent waters of options trading and secure long-term success, aspiring traders must master the art of money management. This article will provide an in-depth exploration of money management strategies, empowering you with the knowledge and techniques to protect your capital and maximize your returns.

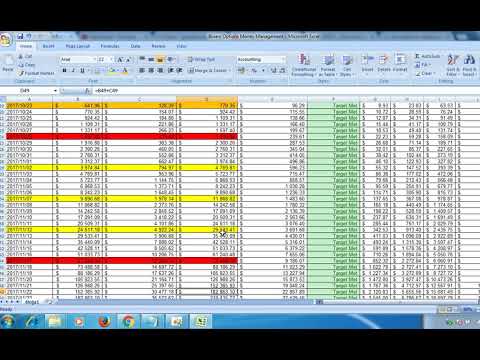

Image: www.youtube.com

Understanding Money Management

Money management encompasses a set of principles and practices designed to preserve capital, prevent excessive losses, and optimize profits in financial trading. In the context of options trading, money management involves allocating your trading capital wisely, determining appropriate position sizes, implementing risk management strategies, and maintaining discipline throughout the trading process.

Position Sizing

The first step in effective money management is determining the appropriate size for your options positions. This delicate balance requires consideration of factors such as your trading capital, risk tolerance, and the volatility of the underlying asset. The goal is to strike a harmonious equilibrium between potential returns and acceptable risk.

Risk Management

Risk management is the cornerstone of successful options trading. Before entering any trade, you must thoroughly assess the potential risks involved. Analyze the underlying asset’s historical volatility, study market conditions, and identify potential catalysts that could impact the option’s value. By proactively anticipating risks, you can formulate strategies to mitigate their impact and protect your hard-earned capital.

Image: dividendonfire.com

Managing Losses

Even the most experienced traders endure losing trades. The key to success lies in managing these losses effectively. Establish a strict stop-loss level before entering a trade and adhere to it religiously. By cutting your losses short, you prevent them from spiraling out of control and preserve your trading capital for future opportunities. Accept losses as an inherent part of trading and learn from them to improve your future performance.

Controlling Emotions

The emotional rollercoaster of options trading can lead to impulsive decisions that compromise your long-term success. Greed can tempt you to hold on to losing positions in the misguided hope of a miraculous turnaround. Fear can lead you to prematurely exit profitable trades, leaving potential gains unrealized. The key is to trade with a clear mind, suppressing emotions and relying on sound judgment.

Maintaining Discipline

Discipline is the bedrock of consistent trading success. Establish a set of trading rules that outline your entry and exit points, position sizing, and risk management strategies. Adhere to these rules with unwavering resolve, even when faced with conflicting emotions or market noise. Discipline fosters consistency, minimizes errors, and empowers you to weather the inevitable storms of the financial markets.

Money Management In Options Trading

Image: www.pinterest.com

Conclusion

Money management is the foundation upon which successful options trading is built. By understanding and implementing these principles, you can navigate the turbulent waters of the markets with greater confidence and control. Remember, success in options trading is not merely about maximizing profits but about preserving capital and managing risks effectively. Embrace the journey, refine your strategies through experience, and cultivate the discipline to rise above emotional pitfalls. Consistent adherence to sound money management practices will pave the path to long-term trading success.