Introduction

In the fast-paced world of finance, momentum options trading has emerged as a powerful technique for harnessing market trends and generating substantial profits. This comprehensive manual will guide you through every aspect of momentum options trading, from foundational concepts to advanced strategies, equipping you with the knowledge and tools to navigate this exhilarating arena with confidence and success. By employing momentum strategies, traders aim to identify and exploit trends in stock or index movements, enabling them to potentially capture explosive gains while mitigating risk through well-defined parameters.

Image: fxpipsgainer.com

Understanding Momentum

Momentum in finance measures the velocity of an asset’s price movement over a specific period. Strong momentum, whether positive or negative, often indicates an underlying trend that can be leveraged for profitable trading opportunities. Momentum traders seek to identify these trends early on and align their positions accordingly, capturing gains by riding the wave of price momentum.

Core Concepts of Momentum Options Trading

Momentum options trading involves the use of options contracts, financial instruments that grant the holder the right but not the obligation to buy (call option) or sell (put option) an underlying asset at a predetermined price (strike price) on or before a specific date (expiration date). Key to momentum options trading is understanding the concept of time decay; as the option nears its expiration date, its value will gradually diminish, emphasizing the importance of timely execution.

Trading Strategies for Momentum Options

There exists a vast array of momentum options trading strategies, ranging from simple to complex, each tailored to different market conditions and trader risk profiles. Some popular strategies include:

Image: www.cmcmarkets.com

Trend Following

This strategy involves identifying and trading in the direction of a prevailing trend. Traders may buy call options when an uptrend is anticipated or purchase put options in anticipation of a downtrend.

Breakouts

Breakouts occur when an asset’s price moves beyond a significant resistance or support level, indicating potential trend reversals. Momentum options traders often enter positions in line with the breakout direction, aiming to capitalize on the anticipated trend continuation.

Pullbacks

Pullbacks are temporary price declines that occur within a larger uptrend. Pullbacks offer entry opportunities for traders to purchase options at potentially favorable prices.

Risk Management

Managing risk is paramount in momentum options trading, as significant losses can accumulate if trades move against the trader’s position. Effective risk management involves:

Position Sizing

Limiting the size of each trade in relation to the trader’s account size helps prevent excessive drawdowns.

Stop-Loss Orders

Predefining exit points through stop-loss orders mitigates potential losses by automatically closing positions when the price reaches specified levels.

Options Selection

Carefully selecting options with appropriate expiration dates and strike prices helps manage the impact of time decay and reduce the risk of substantial losses.

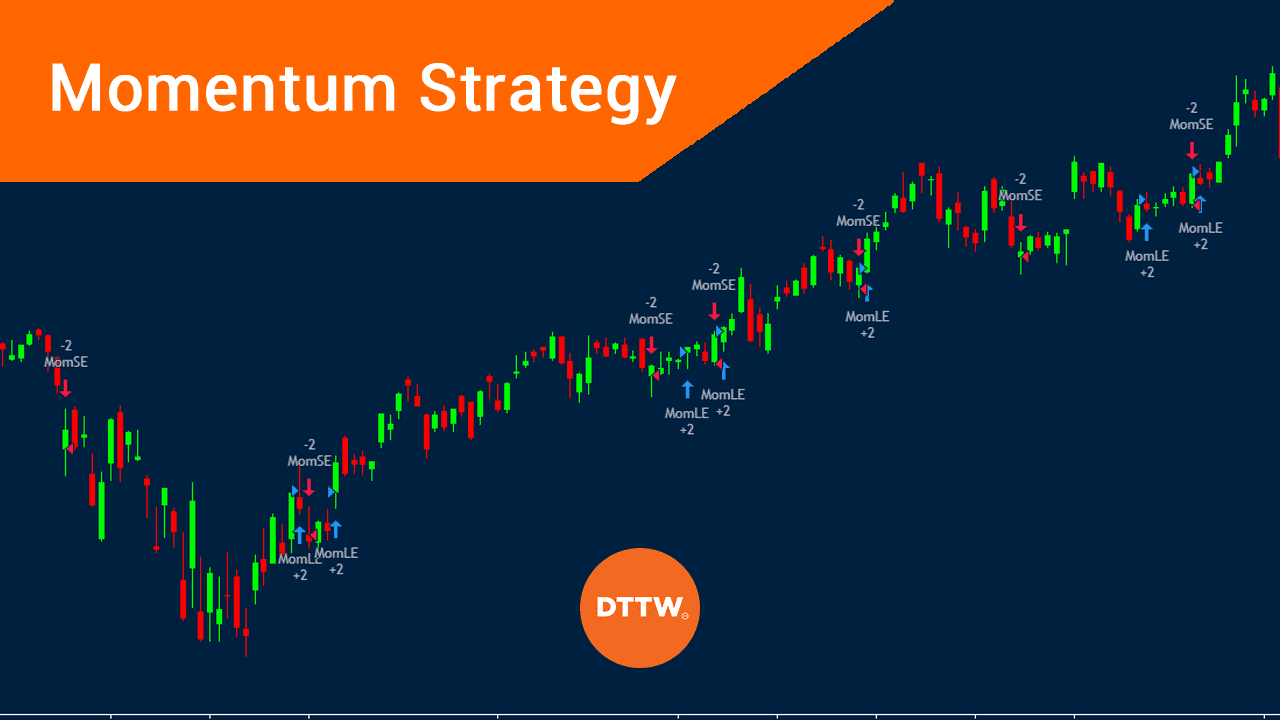

Momentum Options Trading Manual

Image: www.daytradetheworld.com

Conclusion

Momentum options trading presents both tremendous opportunities and inherent risks. This comprehensive manual has provided a thorough understanding of the foundational concepts, strategies, and risk management techniques involved in momentum options trading. By diligently applying the knowledge and insights contained herein, traders can position themselves to harness market momentum and potentially achieve significant financial success within this exhilarating arena. Remember, as with any form of trading, prudent risk management practices are crucial to safeguard capital and ensure long-term profitability.