Introduction: The Thrill and Risks of Options Trading

Options trading, with its potential for high rewards and equally high risks, has always fascinated me. It’s like a high-stakes poker game where you can leverage a small investment to generate substantial profits. I remember starting out, overwhelmed by the complex terminology and strategies. It took time and research to understand the intricacies of option trading and how to navigate its volatile landscape. This article aims to guide you through the best strategies for success in this exciting but challenging field.

Image: www.pinterest.com

Understanding the Mechanics of Option Trading

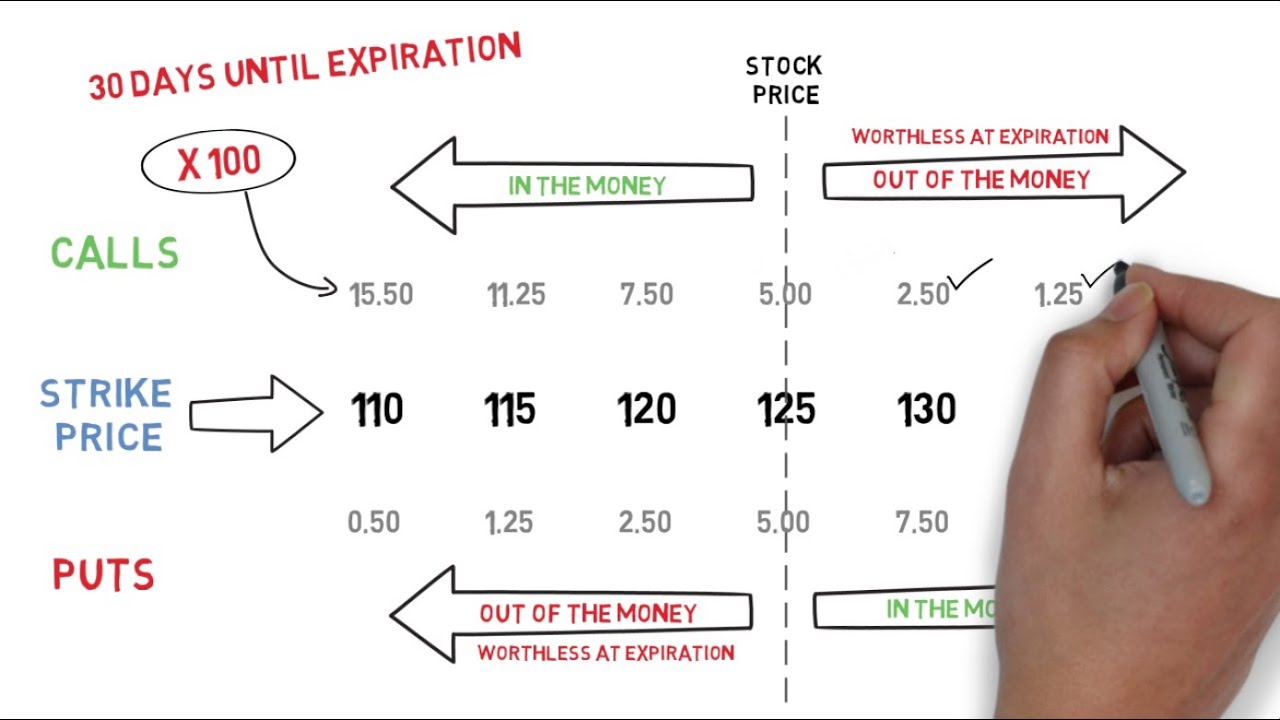

Options are financial instruments that give the holder the right, but not the obligation, to buy or sell an underlying asset at a predetermined price (the strike price) on or before a specified date (the expiration date). They come in two main varieties: calls and puts. A call option gives you the right to buy the underlying asset, while a put option gives you the right to sell it.

The Power of Leverage

The key advantage of options trading lies in leverage. With a relatively small investment, you can control a larger amount of the underlying asset. For example, you might purchase a call option on 100 shares of a company for a premium of $100, giving you the right to buy those shares at $100 per share. If the stock price rises to $120, you can exercise your option and buy the shares at $100, then immediately sell them in the market at $120, making a profit of $2,000.

Balancing Risk and Reward

While the potential for profits is high, so is the risk. Options expire, and if the price of the underlying asset does not move in your favor, you lose the premium you paid for the option. This is known as a “loss of premium”. Understanding this risk-reward dynamic is crucial for successful option trading.

Image: www.youtube.com

Strategies for Navigating the Options Market

Covered Call Writing: A Conservative Approach

This strategy involves selling a call option on a stock you already own. You receive a premium for selling the option, generating income. However, if the stock price rises above the strike price, you are obligated to sell your shares at the lower strike price, limiting your potential gains. Covered call writing is a conservative approach suitable for investors seeking income while retaining partial ownership of the stock.

Cash-Secured Put Writing: Generating Premium Income

Similar to covered call writing, this strategy allows you to generate premium income by selling a put option. You are obligated to buy the underlying stock at the strike price if the put option expires in-the-money. This strategy requires you to have sufficient cash in your account to cover the potential purchase of the stock.

Bullish Call Spread: Betting on Price Increases

The bullish call spread strategy is designed to profit from rising stock prices. You buy a call option with a lower strike price and sell a call option with a higher strike price. This strategy limits your potential losses but also caps your potential gains. It is ideal for investors who are cautiously optimistic about a particular stock but want to manage their risk.

Bearish Put Spread: Profiting from Price Decreases

The bearish put spread strategy is designed to profit from falling stock prices. You buy a put option with a lower strike price and sell a put option with a higher strike price. Like the bullish call spread, this strategy limits potential losses and gains.

Long Straddle: A Neutral Strategy

The long straddle strategy is a neutral strategy used when you expect a significant price movement, but are unsure in which direction the price will move. This strategy involves buying both a call and a put option with the same strike price and expiration date. It offers the potential for large profits if the stock price moves significantly in either direction.

Stay Ahead of the Curve: Trends and Developments in Option Trading

The world of options trading is constantly evolving, driven by technological advancements and changing market dynamics. Here are some prominent trends shaping the landscape:

- Growing Popularity of Options: Options are becoming increasingly popular among investors of all experience levels, thanks to their leverage potential and flexible nature.

- The Rise of Options Trading Platforms: User-friendly online platforms have made it easier than ever for individuals to engage in options trading.

- The Role of Artificial Intelligence: AI-powered trading tools are gaining traction, offering insights and automating trading decisions.

Expert Tips for Optimizing Your Option Trading Strategies

- Start Small and Scale Gradually: As a beginner, it’s wise to start with small investments and gradually increase your position size as you gain experience and confidence.

- Thorough Research is Key: Before engaging in any option trading strategy, meticulously research the underlying asset, its potential price movements, and the current market conditions.

- Utilize Risk Management Tools: Always employ stop-loss orders to limit your potential losses and manage your risk effectively.

- Stay Updated with Market News: Keep abreast of economic news, industry developments, and regulatory changes impacting the market.

- Consider a Trading Journal: Document your trades, your rationale behind each decision, and the outcomes to identify patterns and improve your strategy over time.

Frequently Asked Questions

Q: What are the risks associated with option trading?

A: Options trading carries inherent risks, including the potential for significant losses, especially if the underlying asset’s price moves against your expectations. It’s crucial to understand these risks fully before engaging in options.

Q: What is the best option trading strategy for beginners?

A: For beginners, covered call writing and cash-secured put writing are relatively conservative strategies to consider. They offer a less risky way to generate income while understanding the basics of option trading.

Q: How can I improve my option trading skills?

A: You can improve your trading skills by studying, practicing, and continually learning about the market and your chosen strategies. Consider taking online courses, reading books on option trading, and joining online communities to gain insights from experienced traders.

Best Strategy In Option Trading

Conclusion: Embark on Your Options Trading Journey Today

Option trading presents both exciting opportunities and formidable challenges. With a solid understanding of the strategies, risk management principles, and market dynamics, you can navigate this complex world more effectively. This guide provides a starting point for exploring the various options and developing your trading strategy. Are you ready to embark on your own options trading journey and uncover the potential for high returns? Let us know in the comments below!