Delving into the World of Twilio Option Trading

In today’s competitive market, savvy investors are constantly seeking ways to enhance their returns and minimize risks. Twilio option trading has emerged as an attractive strategy for traders of all experience levels, offering a unique blend of flexibility and potential rewards. This article will delve into the intricate world of Twilio option trading, providing a comprehensive guide to help you maximize your investment returns.

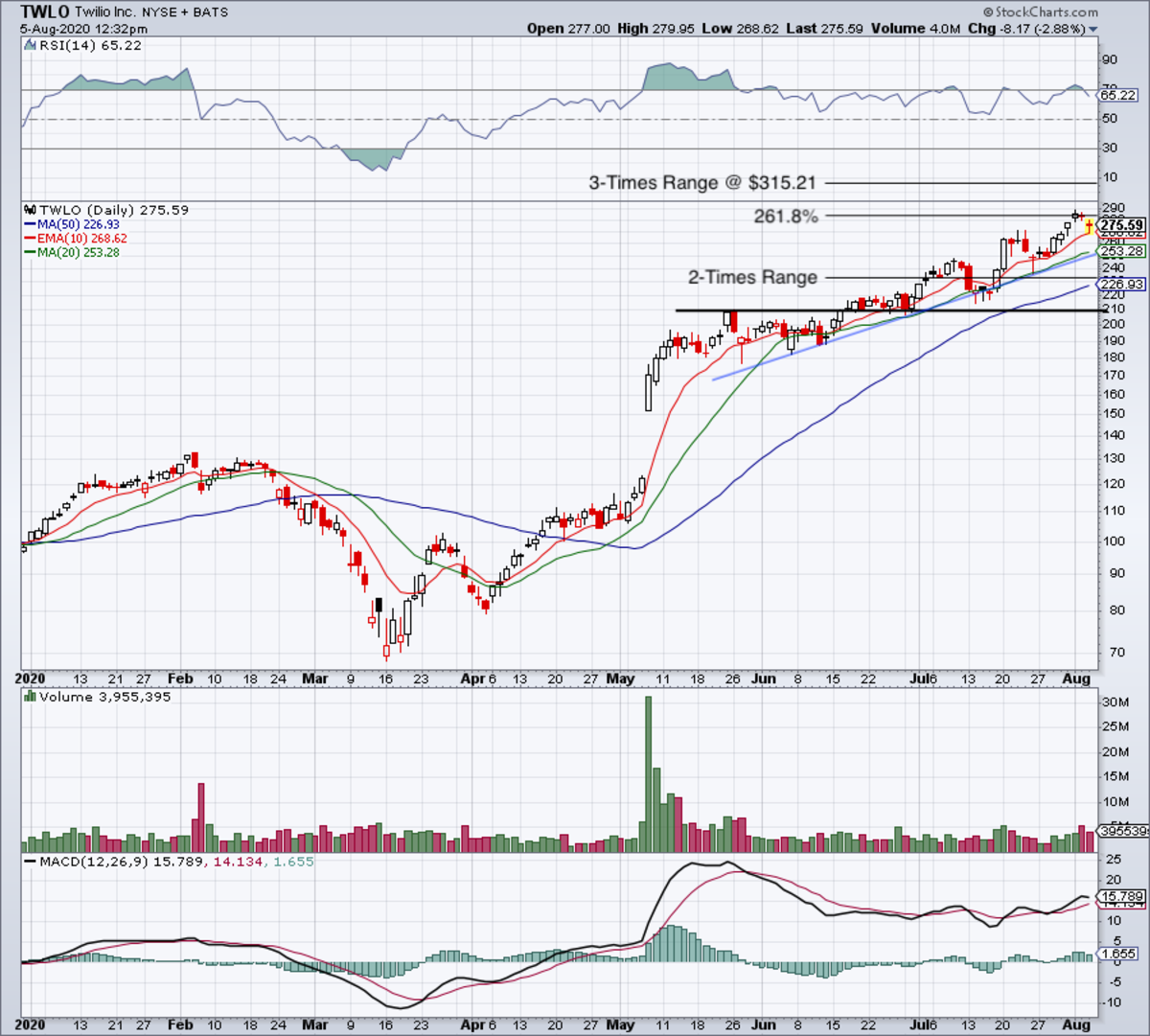

Image: investorplace.com

What is Twilio Option Trading?

Twilio option trading involves the buying and selling of Twilio (TWLO) options, which are financial instruments that grant the holder the right, but not the obligation, to buy or sell a certain number of Twilio shares at a predefined price (strike price) on or before a specified date (expiration date). Options are typically used to hedge against risk, speculate on price movements, or generate income through premium decay.

Types of Twilio Options

There are two primary types of Twilio options:

- Calls: Grants the holder the right to buy Twilio shares at the strike price.

- Puts: Grants the holder the right to sell Twilio shares at the strike price.

Each option contract represents 100 shares of Twilio.

Key Concepts in Twilio Option Trading

Understanding the following concepts is essential for successful Twilio option trading:

- Strike Price: The predetermined price at which you can buy (in the case of a call) or sell (in the case of a put) Twilio shares.

- Expiration Date: The last date on which the option can be exercised.

- Option Premium: The amount you pay to purchase an option contract.

- Intrinsic Value: The difference between the current Twilio stock price and the strike price, if the option was exercised immediately.

- Extrinsic Value: The additional value of an option contract beyond its intrinsic value, which is determined by factors such as time to expiration and volatility.

- Greeks: Metrics used to measure an option’s sensitivity to various factors, such as the underlying stock price, volatility, and time to expiration.

Image: www.thestreet.com

Strategies for Twilio Option Trading

There are numerous Twilio option trading strategies, each with its own risk and reward profile. Some popular strategies include:

- Buy Calls: Purchasing calls when you expect Twilio’s stock price to rise.

- Buy Puts: Purchasing puts when you expect Twilio’s stock price to fall.

- Sell Calls (Covered Call): Selling calls when you own Twilio shares and want to generate income.

- Sell Puts (Cash-Secured Put): Selling puts when you have the funds available to purchase Twilio shares at the strike price.

- Spreads: Combining options with different strike prices and expiration dates to create more complex strategies.

Risks of Twilio Option Trading

As with any investment, there are risks associated with Twilio option trading. These risks include:

- Loss of Premium: If the option expires worthless, you will lose the premium you paid to purchase it.

- Option Assignment: If you sell an option (e.g., sell a call when you do not own Twilio shares), you may be obligated to buy or sell Twilio shares at the strike price.

- Market Risk: Twilio’s stock price can fluctuate significantly, which can impact the value of your options.

- Volatility Risk: Options are particularly sensitive to changes in volatility, which can amplify both gains and losses.

Twilio Option Trading

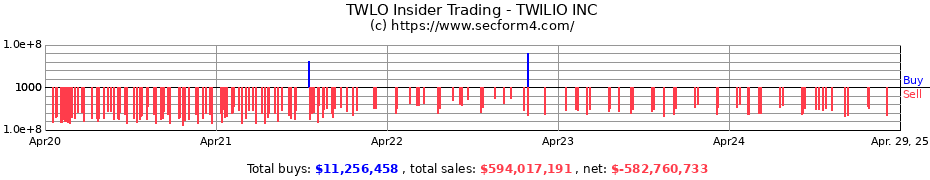

Image: www.secform4.com

Conclusion

Twilio option trading offers a wide range of opportunities for investors to capitalize on the performance of Twilio’s stock. By understanding the basic concepts, key strategies, and potential risks involved, you can navigate the world of Twilio option trading with confidence. Remember to conduct thorough research, manage your risk prudently, and avoid making emotional or impulsive decisions. Whether you are a seasoned trader or a novice seeking to enhance your investment returns, Twilio option trading can be a valuable addition to your financial toolkit.