Embrace the Future of Communication with Twilio Option Trading

Twilio, a leading cloud communications platform, has revolutionized the way businesses communicate with their customers. Its robust suite of APIs has empowered countless enterprises to create personalized, scalable, and cost-effective omnichannel experiences. Now, with the introduction of Twilio option trading, businesses can unlock even greater possibilities in the world of communication.

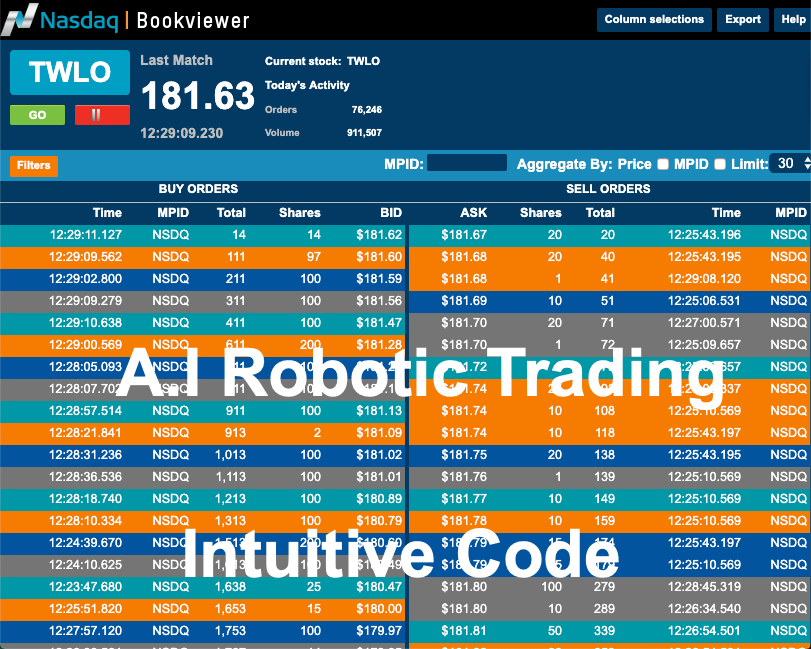

Image: stockmarket.com

Unveiling the Potential of Twilio Option Trading

Twilio option trading grants businesses the flexibility to trade options contracts on Twilio’s stock, TWLO. These contracts give them the option, but not the obligation, to buy or sell TWLO shares at a predetermined strike price on a specified expiration date. This innovative offering empowers investors with new ways to manage risk, enhance returns, and speculate on the future performance of Twilio.

Understanding the Nuances of Twilio Option Trading

- Types of Options: Twilio offers two types of options contracts, calls, and puts. Call options give the holder the right to buy TWLO shares, while put options confer the right to sell them.

- Expiration Dates: Options contracts have specific expiration dates, ranging from weekly to monthly. Traders can choose an expiration date that aligns with their investment or hedging strategy.

- Strike Prices: The strike price is the price at which the underlying asset can be bought (for call options) or sold (for put options) on the expiration date.

Expert Insights and Market Analysis

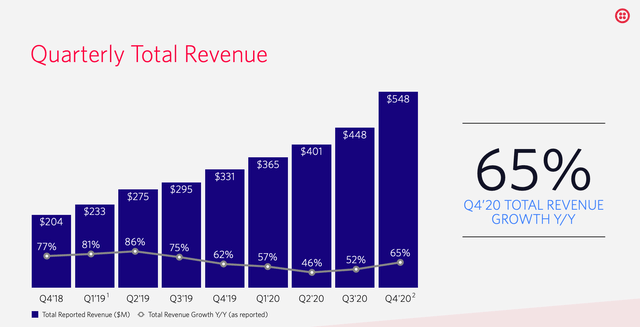

The introduction of Twilio option trading has garnered significant attention in the financial markets. Analysts believe that this move will further fuel the company’s growth and create new opportunities for investors. Twilio’s strong financial performance, expanding market share, and commitment to innovation make it an attractive investment choice.

Image: blog.autonomoustrading.io

Unlocking the Benefits of Twilio Option Trading

- Tailored Risk Management: Options provide businesses with a flexible tool to manage risk by hedging against potential price fluctuations in TWLO.

- Enhanced Return Potential: Traders can potentially enhance their returns by speculating on the future direction of Twilio’s stock price.

- Increased Flexibility: The variety of option contract types and expiration dates allows traders to tailor their strategies to meet their specific needs.

FAQ on Twilio Option Trading

Q: What is the minimum investment amount for Twilio option trading?

A: Minimum investment amounts may vary depending on the brokerage used. It is recommended to check with individual brokers for specific requirements.

Q: What factors should I consider when choosing an expiration date?

A: When selecting an expiration date, consider the volatility of TWLO shares, your investment horizon, and the potential time decay of the option contract.

Twilio Option Trading 2019

Image: seekingalpha.com

Conclusion: Empowering the Future of Business Communication

Twilio option trading presents a compelling opportunity for businesses and investors to embrace the future of business communication. By providing tailored risk management, enhanced return potential, and increased flexibility, this innovative offering empowers businesses to thrive in the dynamic communications landscape. Are you ready to unlock the potential of Twilio option trading?