Imagine yourself as a seasoned stock market trader, navigating the intricate world of options trading. Options contracts offer unique opportunities to capitalize on price movements, but understanding the mathematical complexities that govern these instruments is essential for success. Embark on a journey into the realm of mathematical options trading, deciphering the equations that empower traders to make informed decisions.

Image: www.youtube.com

Options, financial instruments that grant the right but not the obligation to buy or sell an underlying asset at a predetermined price, are often shrouded in a veil of complexity. However, by unraveling the mathematical formulas that underpin these contracts, you can gain a profound understanding of how they function, unlocking their full potential for profitability.

The Black-Scholes Model: A Cornerstone of Options Pricing

The Black-Scholes model, developed by Fischer Black and Myron Scholes in 1973, stands as the cornerstone of options pricing. This mathematical framework evaluates the fair value of an option contract, considering several crucial factors:

- Underlying asset price

- Strike price

- Time to expiration

- Risk-free interest rate

- Volatility

By incorporating these parameters into a sophisticated mathematical equation, the Black-Scholes model calculates the theoretical value of an option, empowering traders to make informed decisions about buying, selling, or holding contracts. This model serves as a foundation for advanced options trading strategies, enabling traders to optimize their risk and reward profile.

Greeks: Unraveling the Sensitivity of Options Prices

Greeks, a suite of mathematical parameters, provide invaluable insights into the sensitivity of options prices to changes in underlying variables. These metrics, derived from the Black-Scholes model, include:

- Delta

- Gamma

- Theta

- Vega

- Rho

Understanding the significance of Greeks allows traders to fine-tune their trading strategies, adjusting positions based on market conditions and risk tolerance. By analyzing how Greeks interact with each other, traders can make informed decisions about hedging, managing risk, and maximizing profit potential.

Tips and Expert Advice for Mathematical Options Trading

Mastering mathematical options trading requires a blend of theoretical knowledge and practical experience. Here are some valuable tips and expert advice to guide your journey:

- Gain a solid understanding of the Black-Scholes model: This mathematical cornerstone is crucial for comprehending options pricing.

- Familiarize yourself with Greeks: Understanding the sensitivity of options prices to underlying variables empowers you to make informed decisions.

- Use historical data and technical analysis: By studying past market movements and price patterns, you can identify potential trading opportunities.

- Manage risk effectively: Utilize stop-loss orders, position sizing, and hedging strategies to mitigate potential losses.

- Seek professional guidance: Consult with experienced brokers or financial advisors for personalized advice and support.

As you continue your journey into mathematical options trading, remember to stay updated with the latest market trends and developments. Join industry forums, follow financial news sources, and engage with other traders to expand your knowledge and enhance your trading strategies.

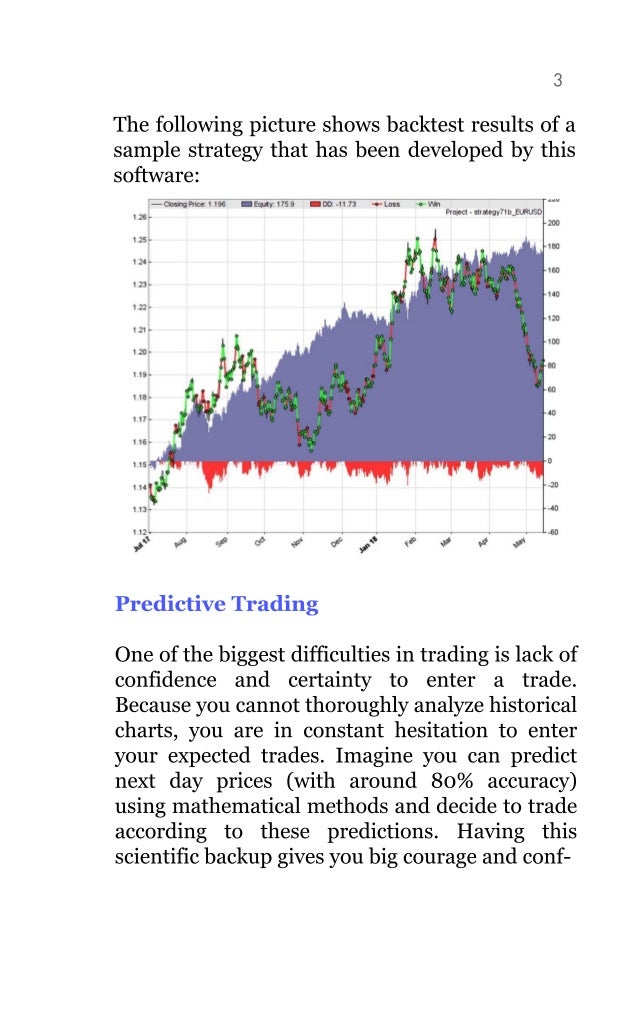

Image: www.mql5.com

Frequently Asked Questions on Mathematical Options Trading

Q: Why is mathematical proficiency important in options trading?

A: Understanding the mathematical equations that govern options pricing is essential for making informed decisions about buying, selling, or holding contracts. It enables traders to accurately assess risk and reward, optimizing their trading strategies.

Q: How do Greeks help traders in options trading?

A: Greeks provide insights into the sensitivity of options prices to changes in underlying variables. By analyzing Greeks, traders can fine-tune their positions, adjust risk exposure, and maximize profit potential.

Q: Is it possible to be successful in options trading without mathematical skills?

A: While it is possible to participate in options trading with limited mathematical proficiency, it significantly limits your ability to fully understand and evaluate risk and return potential. A strong grasp of mathematical concepts empowers traders to navigate the complexities of options markets effectively.

Mathematical Options Trading

Image: tradersdynamicindexforexsystem.blogspot.com

Conclusion

Mathematical options trading empowers you to unlock the full potential of these financial instruments, potentially generating significant returns. By mastering the equations that govern options pricing, understanding Greeks, and incorporating expert advice, you can navigate the complexities of options markets with confidence. As you delve deeper into this fascinating world, remember to stay informed, embrace continuous learning, and seek guidance when needed.

Are you interested in exploring mathematical options trading further? Share your thoughts and questions in the comments section below.