Stepping into the World of Options Trading

Options trading, a complex and versatile financial strategy, offers both opportunities and risks for savvy investors. But before you dive into the options market, it’s crucial to grasp its intricacies and equip yourself with the essential knowledge. This guide will illuminate the basics of options trading, empowering you to make informed decisions and potentially reap its rewards.

Image: worldmags.net

Fundamentals of Options

Options represent a type of financial contract that grants the buyer the right, but not the obligation, to buy or sell an underlying asset at a predetermined price (strike price) within a specified timeframe. The underlying asset can be stocks, commodities, indices, or currencies. There are two primary types of options: calls and puts.

- Call options confer the right to buy the underlying asset at the strike price, while

- Put options give the right to sell the asset.

The decision to buy a call or put option hinges on your market outlook. If you anticipate a rise in the asset’s price, a call option is suitable; for a predicted decline, a put option is the appropriate choice.

Understanding Option Premiums

The price you pay to acquire an option is known as the premium. This premium consists of two components: intrinsic value and time value. Intrinsic value is the current difference between the strike price and the underlying asset’s price. Time value reflects the premium’s remaining lifespan. Premiums tend to decline as the expiration date nears.

Managing Options

Once you’ve acquired an option, you have three primary management strategies:

- Exercise: You can exercise your right to buy or sell the underlying asset at the strike price.

- Sell to close: You can sell your option contract back to the market to retrieve your invested premium, in part or in full.

- Hold until expiration: You can maintain your option until its expiration date, hoping the underlying asset’s price moves in a favorable direction.

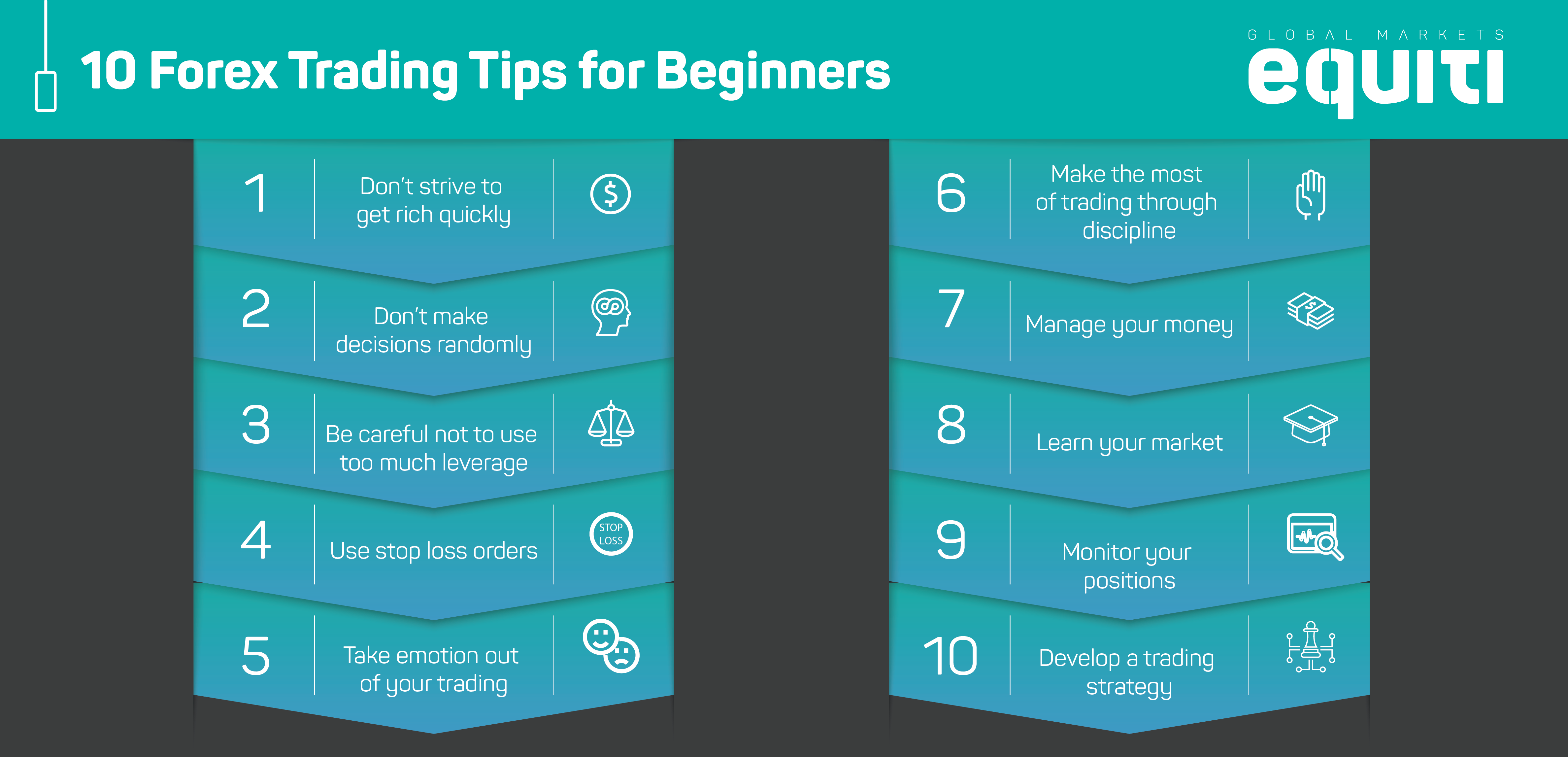

Image: www1.equiti.com

Risk and Reward in Options Trading

Options trading carries both the potential for significant gains and substantial losses. It’s essential to meticulously evaluate your risk tolerance and invest only what you can afford to lose. Prudent investors begin with small trades and gradually increase their involvement as they gain experience and confidence.

Essential Strategies for Beginners

As a novice options trader, consider these fundamental strategies:

- Covered call: Sell call options on stocks you own. This strategy generates income if the stock’s price remains below the strike price.

- Cash-secured put: Sell put options while holding sufficient cash to buy the underlying asset at the strike price. You earn a premium if the stock’s price remains above the strike price.

- Protective collar: Implement this strategy by buying at-the-money put options and selling a corresponding number of call options. This provides downside protection while capping potential upside.

Essential Options Trading Guide

Image: businessblogdaily.com

Embarking on Your Options Trading Journey

Delve into options trading with a strategic mindset, embracing both possibilities and risks. Conduct diligent research, consult reliable resources, and practice disciplined trading decisions. With perseverance and a sound understanding, you can harness the power of options to potentially enhance your financial prosperity.