Introduction:

Image: www.chegg.com

In the realm of finance, navigating complex financial instruments is crucial for discerning investors. Amidst this arena, options trading stands as an intricate yet rewarding endeavor that can amplify returns and protect against market volatility. However, to unravel the intricacies of this specialized trade and conquer the coveted 65 exam, a comprehensive understanding is paramount.

This article will embark on an illuminating journey, delving into the depths of option trading. We will explore its foundational principles, empowering you with a comprehensive arsenal of knowledge to unlock the gateway of the 65 exam. From basic concepts to advanced strategies, we will illuminate the path to mastery, ensuring your triumphant ascent in the realm of options trading.

Unleashing the Power of Option Trading:

Option trading emerges as a sophisticated investment strategy that endows traders with unparalleled flexibility. Options, akin to financial instruments, confer the right – but not the obligation – to purchase (call option) or sell (put option) an underlying asset at a predefined price (strike price) on or before a specific date (expiration date). Comprehending the nuanced world of options bestows upon traders the prowess to speculate on the price movements of assets, hedge against market risks, and even generate income through premium collection.

Deciphering the ABCs of Option Trading:

To venture into the captivating world of option trading, it is imperative to grasp its foundational pillars. Options are characterized by four key elements:

-

Underlying Asset: The asset upon which the option contract is predicated. This may encompass stocks, bonds, commodities, or currencies.

-

Strike Price: The predetermined price at which the underlying asset can be bought (call option) or sold (put option).

-

Expiration Date: The terminal date by which the option contract must be exercised or expires worthless.

-

Premium: The upfront payment made by the option buyer to the option seller in exchange for the option contract.

Mastering the 65 Exam: A Roadmap to Success:

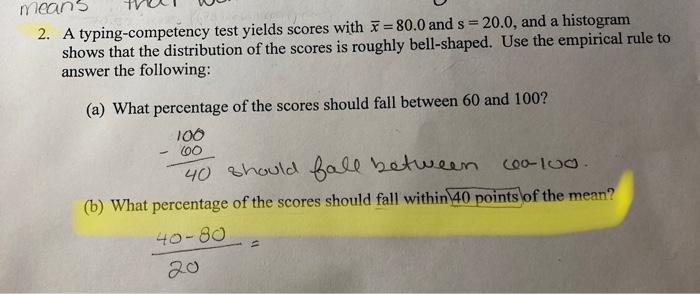

The 65 exam, administered by FINRA, stands as a rigorous examination designed to assess candidates’ proficiency in options trading. To emerge victorious, a thorough grasp of the following concepts is indispensable:

-

Types of Options: Familiarize yourself with call and put options, indispensable instruments for profiting from rising and falling asset prices, respectively.

-

Option Pricing: Comprehend the multifaceted factors that influence option pricing, including the underlying asset’s price, volatility, time to expiration, and interest rates.

-

Option Strategies: Delve into a repertoire of option strategies, ranging from simple to complex, empowering you to adapt to diverse market conditions and objectives.

-

Risk Management: Learn to manage risk effectively by employing hedging techniques and calculating Greeks, quantitative measures that quantify option risk and sensitivity.

Navigating the Ethereal World of Options Trading:

To traverse the uncharted waters of options trading, a discerning eye and a calculated approach are imperatives. Consider the following strategies to maximize your trading prowess:

-

Technical Analysis: Scrutinize historical price data to discern patterns and trends, enabling informed trading decisions.

-

Fundamental Analysis: Evaluate the intrinsic value of an underlying asset by scrutinizing financial statements, industry trends, and economic indicators.

-

Risk Management: Implement robust risk management strategies to mitigate potential losses and safeguard your trading capital.

Embracing the Triumph of Knowledge:

Embarking on the path of option trading is an endeavor brimming with opportunities and rewards. However, conquering the intricacies of this domain demands dedication, a thirst for knowledge, and a steadfast commitment to continuous learning. By harnessing the insights gleaned from this comprehensive guide and embracing a proactive approach to education, you will undoubtedly unlock the secrets of option trading and emerge triumphant in your endeavor to master the 65 exam.

Image: www.chegg.com

Learning Option Trading For 65 Exam

Image: traderslanding.net