In the ever-evolving world of finance, interest rate option trading has emerged as a popular strategy for investors seeking to hedge against market volatility and generate profit from interest rate fluctuations. This article aims to provide a comprehensive overview of interest rate option trading strategies, encompassing their definition, history, and various techniques employed by seasoned investors.

Image: unofficed.com

Navigating the Dynamics of Interest Rate Options

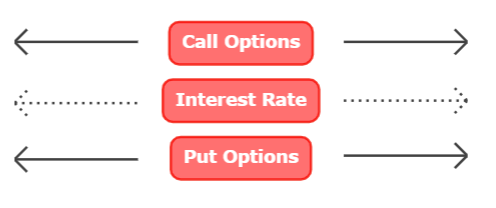

Interest rate options are derivative financial instruments that grant their holders the right, but not the obligation, to buy or sell an underlying fixed income security at a specified price within a certain timeframe. These options offer investors either a bullish or bearish position on interest rates, allowing them to speculate on future movements in the underlying market.

Deciphering Interest Rate Option Strategies

Seasoned investors utilize a wide array of interest rate option trading strategies to achieve their respective investment goals. Some of the most commonly employed techniques include:

- **Bull Call Spread:** Involves purchasing a lower-priced call option while simultaneously selling a higher-priced call option with the same expiration date, aiming to profit from a gradual rise in interest rates.

- **Bear Put Spread:** Entails selling a lower-priced put option and buying a higher-priced put option with an identical expiration date, seeking to capitalize on a decline in interest rates.

- **Condor Spread:** Combines four options of different strike prices and expirations to create a narrow range within which the option holder anticipates the underlying interest rate to fluctuate.

The Evolution of Interest Rate Option Trading: Embracing Market Trends

The landscape of interest rate option trading is constantly evolving, influenced by dynamic market conditions and emerging trends. In recent times, the advent of online trading platforms and algorithmic trading has significantly transformed the trading process.

Furthermore, central bank policies and macroeconomic events continue to play a pivotal role in shaping interest rate movements. For instance, interest rate hikes by monetary authorities can lead to increased volatility in the bond market, creating both opportunities and risks for option traders.

Image: br.pinterest.com

Seeking Guidance in Interest Rate Option Trading: Expert Advice

Seasoned investors emphasize the importance of prudence and a well-defined strategy in interest rate option trading. They advocate for thorough research, a comprehensive understanding of market dynamics, and risk mitigation techniques.

Moreover, seeking guidance from financial advisors or experienced traders can prove invaluable for navigating the complexities of this market. Their insights and expertise can assist aspiring option traders in formulating appropriate strategies and managing potential risks.

Frequently Asked Questions (FAQs) on Interest Rate Option Trading

Q: What are the key factors to consider when evaluating interest rate options?

A: Expiration date, strike price, underlying security, and market volatility play crucial roles.

Q: How can I minimize risks associated with interest rate option trading?

A: Implementing risk management strategies like hedging, diversification, and position sizing is essential.

Interest Rate Option Trading Strategies

Image: swing-trading-strategies.com

Conclusion: Embark on the Journey of Interest Rate Option Trading

Interest rate option trading presents a versatile and potentially lucrative investment avenue for those seeking to harness market fluctuations. However, it is imperative to approach this domain with a discerning eye, a comprehensive understanding of market dynamics, and a prudent risk management framework.

Whether you are a seasoned investor or just starting to explore the intricacies of option trading, this article offers a comprehensive foundation. Are you ready to delve deeper into the world of interest rate option trading strategies and potentially elevate your financial acumen?