Introduction:

Image: efinancemanagement.com

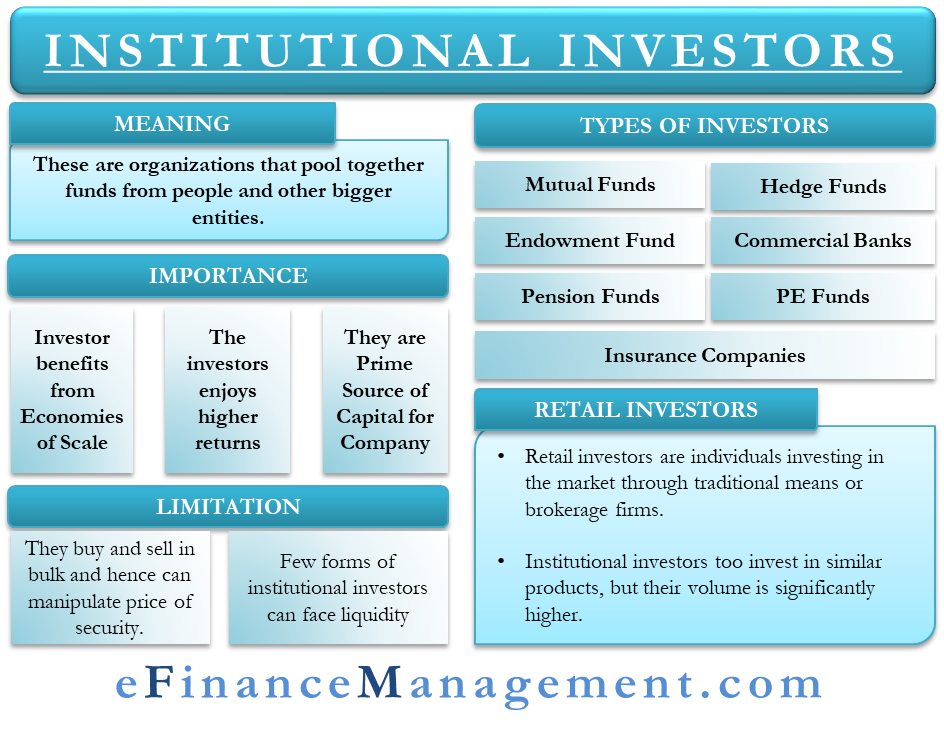

In the realm of financial markets, where fortunes are made and lost, the battleground is often defined by the distinction between individual investors and institutional investors. Both entities play crucial roles in shaping market dynamics, but their motivations, strategies, and risk appetites diverge significantly. When it comes to option trading, these differences become even more pronounced.

Option trading, a complex and potentially lucrative financial instrument, has become increasingly popular among both individual and institutional investors. However, understanding the nuances of option trading and how they apply to different investor profiles is crucial for making informed decisions.

Delving into the Differences:

Individual investors, typically operating with smaller capital bases and a more limited scope of trading operations, often navigate financial markets with a retail-oriented approach. They are typically driven by personal financial goals and may have varying degrees of trading experience and expertise. Institutional investors, on the other hand, represent entities such as hedge funds, pension funds, and investment banks, boasting vast resources and employing sophisticated trading strategies.

One primary distinction between individual and institutional investors is their investment horizon. Individual investors often engage in short-term trading, seeking quick profits or hedging against potential losses. Institutional investors, in contrast, frequently adopt a long-term perspective, investing in options with the goal of generating consistent returns over a more extended period.

Risk Management and Strategy:

Another key difference lies in risk management. Institutional investors have access to advanced risk assessment tools and professional guidance, enabling them to manage risk more effectively. They often employ sophisticated strategies, such as portfolio diversification, hedging, and sophisticated options trading techniques, to minimize potential losses.

Individual investors, on the other hand, may have limited resources for risk management. They rely more on personal judgment and due diligence, which can increase their exposure to risk. Moreover, individual investors often lack the experience and expertise required to fully understand the intricacies of options trading.

Navigating the Emotional Terrain:

Option trading is an emotionally charged endeavor, especially for individual investors. The potential for financial gain or loss can trigger strong emotions, making it crucial to maintain emotional discipline. While greed and fear can lead to impulsive decisions, emotional regulation and a calculated approach are vital for successful option trading.

Institutional investors, with their experience and disciplined approach, are better equipped to handle market volatility and emotional swings. They typically operate with dispassionate decision-making, placing a premium on rational analysis over emotional reactions.

Expert Insights and Practical Guidance:

To navigate the complexities of option trading, it is wise to seek guidance from experts in the field. Consider consulting with financial advisors who have specialized knowledge in options trading and can provide tailored recommendations based on your individual needs and risk tolerance.

For those seeking to delve deeper into option trading, books and online resources abound. However, it is crucial to approach these educational materials with a critical eye, ensuring that the sources are credible and unbiased.

Conclusion:

Understanding the differences between individual investor vs. institutional investor option trading is paramount for making informed decisions. Whether you are an individual investor seeking to augment your financial portfolio or an institutional investor managing vast resources, grasping the distinct characteristics of each investor profile will allow you to navigate the financial battlefield with greater confidence and success.

Remember, option trading is an intricate financial instrument. Approaching it with a disciplined and well-informed mindset is essential. By understanding the risks involved and seeking professional guidance when needed, you can capitalize on the potential opportunities that option trading has to offer.

Embarking on the journey of option trading requires a balanced approach, a willingness to learn, and an unwavering commitment to emotional regulation. Only then can you truly conquer the financial battlefield and emerge victorious.

Image: masterthecrypto.com

Individual Investor Vs Institutional Investor Option Trading

Image: marketbusinessnews.com