An Overview of Capital Gains and Income Taxation

In the realm of option trading, understanding the tax implications of your earnings is crucial. One key distinction you’ll encounter is the classification of income from option trading as either capital gains or ordinary income. Let’s delve into this topic to gain clarity and ensure you navigate the tax landscape seamlessly.

Image: equitymultiple.com

Capital gains, in general, refer to the profit you earn when you sell an asset that has appreciated in value over time. The asset in question here is the option contract you entered into. If you successfully exercise or sell your option at a profit, the difference between the strike price (exercise price) and the prevailing market price at the time of exercise or sale becomes your capital gain.

Capital Gains Taxation: Short-Term vs. Long-Term

The duration of your option holding period has a significant impact on the tax treatment of your capital gains. This period is calculated from the date you acquire the option contract (opening a new position) to the date you sell or exercise it (closing the position).

If you hold your option for a period shorter than 12 months (short-term), the income you earn from its sale or exercise will be taxed as ordinary income. This means it will be subject to your regular income tax rate.

On the other hand, if you hold your option for 12 months or more (long-term), the gains you realize will be taxed at favorable capital gains rates. These rates are typically lower than ordinary income tax rates, offering potential tax savings.

Qualifying as a Trader vs. Investor

Your tax treatment can also depend on whether you qualify as a trader or investor in the eyes of the tax authorities. The Internal Revenue Service (IRS) defines a trader as someone who engages in frequent and substantial option trading activities in order to generate short-term profits. Investors, on the other hand, typically hold options for longer periods, seeking long-term capital appreciation rather than immediate profits.

If you’re classified as a trader, your option trading income will be considered ordinary income, regardless of the holding period. However, if you’re deemed an investor, you can take advantage of the long-term capital gains rates if you hold your options for 12 months or more.

Maximizing Your Gains

To optimize your tax savings on option trading income, consider these expert tips:

- Hold your options for at least 12 months to qualify for long-term capital gains rates.

- Research and choose option contracts with high growth potential but manageable risk.

- Diversify your portfolio by investing in multiple option contracts. This reduces your overall risk.

- Consider using a long-term investment strategy instead of frequent trading to potentially reduce your tax burden.

- Track your option trades meticulously to accurately calculate your capital gains and tax liability.

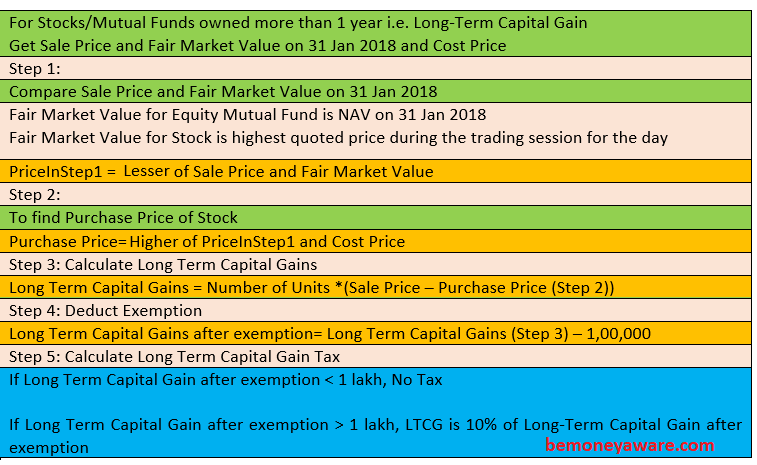

Image: bemoneyaware.com

Frequently Asked Questions (FAQs)

Q: Are all option trading gains taxed as capital gains?

A: No, the taxation of option trading gains depends on the holding period and whether you’re classified as a trader or investor.

Q: How can I prove my status as an investor rather than a trader?

A: Maintain a long-term investment strategy, hold options for extended periods, and avoid excessive trading activity.

Q: What are some strategies to minimize option trading tax liability?

A: Hold options long-term, consider tax-advantaged accounts, optimize deductions and credits, and seek professional tax advice.

Income From Option Trading Is Capital Gains

Image: www.transformproperty.co.in

Conclusion

Understanding the tax implications of option trading income is essential to make informed financial decisions. By grasping the concepts of capital gains and the distinctions between short-term and long-term holdings, you can effectively navigate this topic and maximize your returns while minimizing tax liability.

Are you keen on learning more about the nuances of option trading and capital gains taxation? Let’s continue the conversation and empower you with valuable insights. Connect with us today!