Introduction

In the ever-evolving world of finance, options trading has emerged as a powerful tool that can enable traders to amplify their profits and hedge against potential losses. Robinhood, a popular mobile trading platform, has made options trading accessible to a wider audience, empowering everyday investors to tap into the potential of this dynamic financial instrument.

Image: www.youtube.com

In this comprehensive guide, you’ll embark on a journey into the realm of options trading on Robinhood, delving into its nuances, uncovering effective strategies, and providing you with the knowledge and confidence to navigate this multifaceted marketplace.

Understanding Options Trading

Simply put, options are contracts that give you the right, but not the obligation, to buy or sell an underlying asset at a specified price within a predetermined period. These contracts are typically associated with stocks, but you’ll find options for various underlying assets, such as ETFs, indices, and commodities.

Call Options and Put Options: Your Options Explained

Options come in two primary flavors: call options and put options. Call options grant you the right to buy the underlying asset at a specific price (the strike price). Put options, on the other hand, give you the right to sell the underlying asset at the strike price.

Strategies for Successful Options Trading on Robinhood

Mastering options trading involves not just understanding the basics but also employing effective strategies. Here are three popular approaches:

-

Covered Calls: Write (sell) a call option against the underlying asset you own. This strategy aims to generate income from the premiums received from selling the option while leveraging your ownership of the underlying.

-

Cash-Secured Puts: Similar to covered calls, this strategy involves selling (writing) a put option but instead of owning the underlying asset, you must hold cash in your account to potentially purchase it.

-

Bullish Spreads: A combination of buying and selling call options with different strike prices. Bullish spreads allow you to profit from a rise in the underlying asset’s price while limiting your potential losses.

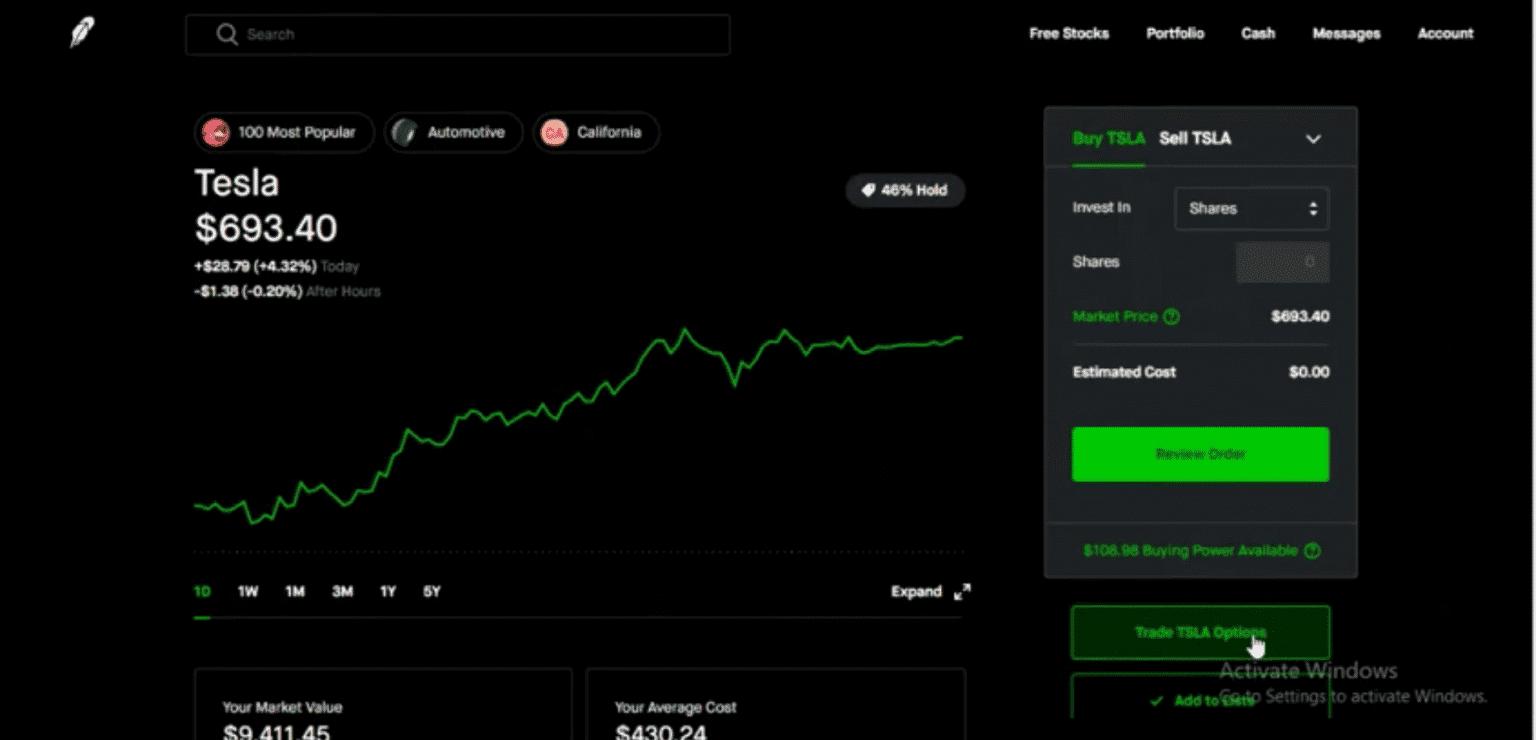

Image: www.youtube.com

The Power of Robinhood and the Robinhood Mobile App

Robinhood has played a transformative role in democratizing options trading. Its intuitive mobile app provides a seamless platform for investors to access real-time market data, place trades, and monitor their positions anytime, anywhere.

Robinhood’s user-friendly interface and educational resources make it a compelling choice for beginners and experienced traders alike. The platform’s “Learn & Earn” program further empowers users with invaluable insights into various aspects of investing and trading.

How To Options Trading On Robinhood

Image: marketxls.com

Conclusion

Embarking on the path of options trading on Robinhood opens up a world of possibilities for your financial endeavors. Understanding the basics, adopting effective strategies, and leveraging the power of the Robinhood platform will equip you to navigate this dynamic marketplace with confidence and unlock the potential for significant gains.

Remember, options trading involves both rewards and risks. It’s crucial to approach it with a solid understanding, carefully consider your investment objectives, and manage your risk exposure prudently. By embracing a proactive and well-informed mindset, you’ll be well-positioned to reap the benefits and mitigate potential pitfalls in the world of options trading on Robinhood.