Delta option trading, a sophisticated financial maneuver, holds immense potential for savvy investors. As the name suggests, a delta option is an option strategy in which an investor simultaneously buys one call option and one put option, each with the same strike price but different expiration dates. This strategy exploits the likelihood of a stock’s price movement and aims to generate substantial returns.

Image: www.scribd.com

Key Concepts and Mechanisms

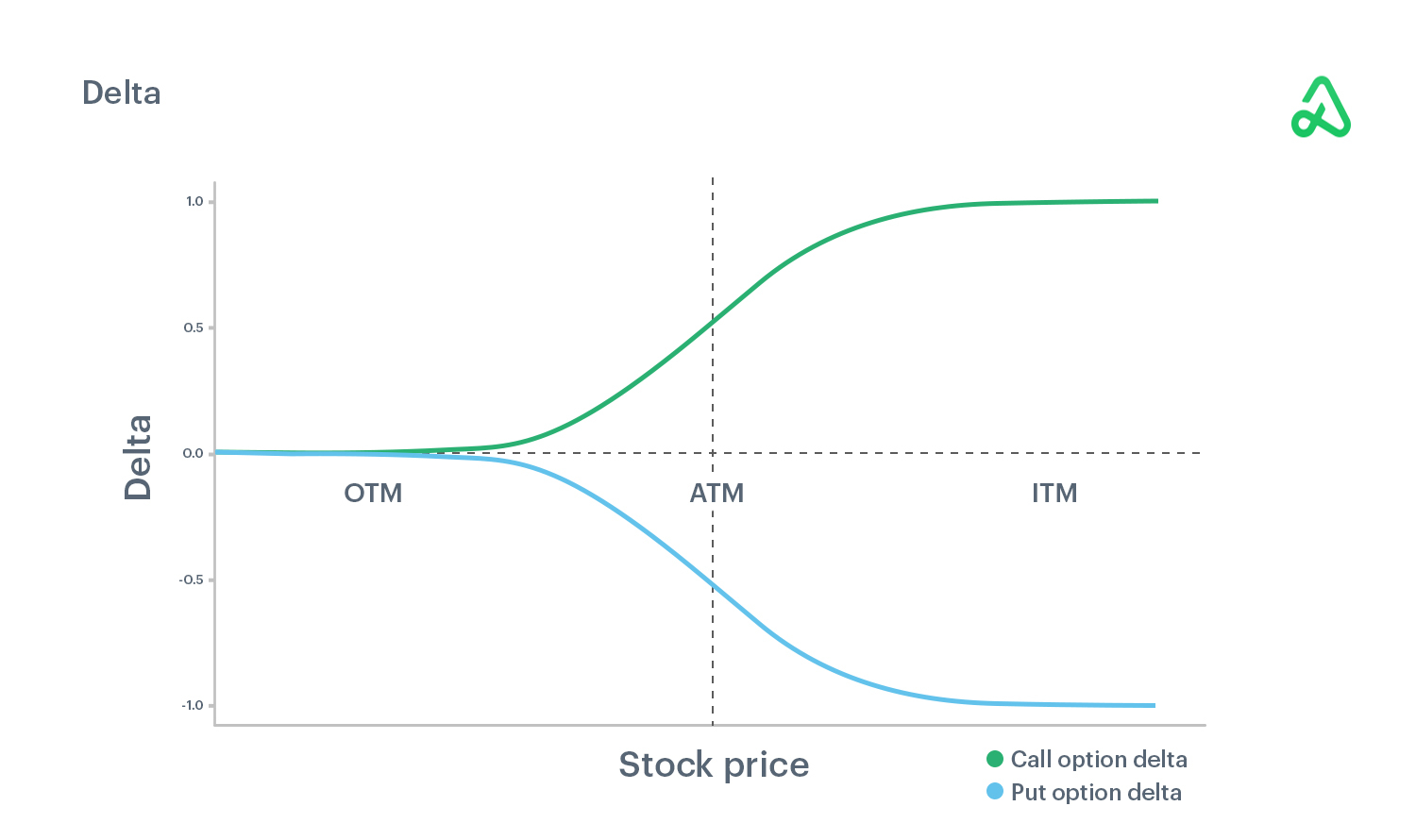

Delta, a Greek letter (Δ), measures the rate of change in an option’s price relative to the underlying asset’s price. In delta option trading, the call option and put option have a positive delta and negative delta, respectively. This implies that the value of the call option increases (decreases) when the underlying asset’s price goes up (down), while the value of the put option does the opposite. When both options are in-the-money at the time of purchase, the net delta of the position is close to zero, making it a neutral or balanced strategy.

The effectiveness of a delta option trading strategy hinges on selecting appropriate expiration dates. The duration of the strategy’s existence is highly influenced by this decision. Shorter-term expiration dates provide exposure to higher volatility in the underlying asset’s price. The time value of a short-term delta option strategy decays more quickly than a long-term delta option strategy, meaning its profit potential diminishes as the expiration date approaches.

Types of Delta Option Trading Strategies

Various delta option trading strategies exist, tailored to specific objectives and risk tolerance levels. Some common strategies include:

- Bullish Call Delta: Investors expect the underlying asset’s price to increase and purchase a set number of call options. In return for this bullish outlook, they collect an option premium.

- Bearish Put Delta: Investors anticipate a stock’s decline and purchase a set number of put options. They receive a higher premium due to their bearish sentiment.

- Neutral Delta: This strategy suits investors who foresee little change in the underlying asset’s price. By striking a balance between call and put options, the delta is close to zero.

- Directional Delta: Suitable for investors with high conviction in the direction of an underlying asset’s price movement, directional delta strategies involve buying call options (for bullish strategies) or put options (for bearish strategies).

- Synthetic Delta: Mimicking the delta of an underlying asset, delta option trading strategies combine long positions in call options and short positions in put options.

Using Delta Option Trading Strategies Effectively

Harnessing the power of delta option trading strategies requires careful consideration of several factors:

- Volatility: High volatility in the underlying asset’s price enhances profit potential while also increasing risk. Options with shorter expirations are more sensitive to changes in volatility.

- Trend Analysis: A thorough assessment of underlying price trends can substantiate the effectiveness of delta option trading strategies. Trading with the trend is more likely to yield favorable outcomes.

- Time to Expiration: Selecting appropriate expiration dates for delta option trading strategies is critical. Longer-term strategies offer more limited profit potential but come with reduced decay, while shorter-term strategies offer the potential for greater returns but involve accelerated decay.

Image: optionalpha.com

Real-World Example

Consider the following example: A delta option trader anticipates a rise in XYZ Corp shares. They execute a bullish call delta strategy by purchasing one call option and one put option both with a strike price of $100. The call option has a duration of 90 days and the put option expires in 30 days.

As the price of XYZ Corp shares ascends, the call option will increase in value due to its positive delta. Simultaneously, the put option’s value will diminish owing to its negative delta. The proximity of the put option’s expiration date results in rapid decay in its time value. When both options are in-the-money, the neutral delta position limits exposure to significant losses.

Delta Option Trading Strategies

Image: www.pinterest.com

Conclusion

Delta option trading strategies present investors with a powerful tool for capturing opportunities and mitigating risks in the financial markets. Understanding the intricacies of delta, selecting appropriate expiration dates, and adopting a sound strategy are essential for successful implementation. By embracing the principles outlined in this guide, investors can increase their odds of profiting from the dynamic world of delta option trading.