Options trading has emerged as a compelling way for investors to amplify their earning potential while effectively managing risk. If you’re among the millions of users leveraging the user-friendly interface of the Robinhood app, accessing the world of options trading is now within your reach—and this comprehensive guide will illuminate the steps involved in unlocking this exciting realm.

Image: tribuneonlineng.com

Delving into the Basics of Options Trading

Options contracts confer the right, not the obligation, to buy (call option) or sell (put option) a stock at a predetermined price (strike price) on or before a specified date (expiration date). Unlike traditional stock purchases, options provide inherent leverage, enabling potential gains that significantly outpace direct stock investments.

Enabling Options Trading on Robinhood

Before embarking on your options trading journey, ensure you meet Robinhood’s eligibility criteria. Once you’ve verified your identity and provided the necessary financial information, navigate to the ‘Account’ tab and proceed to ‘Investing.’ Within this section, select ‘Options’ and subsequently ‘Enable Options Trading.’ Robinhood will then evaluate your investment experience and holdings to gauge your comprehension of options trading’s intricacies.

Executing Your First Options Trade

Once approved, explore the vast array of available options through the Robinhood app’s user-friendly interface. Begin by searching for the underlying stock you wish to trade. The ‘Options’ tab displays various options contracts, each defined by its strike price, expiration date, and premium (price).

Carefully consider your investment strategy, whether pursuing a bullish (call option) or bearish (put option) stance on the underlying stock. Execute your trade with precision, specifying the number of contracts, strike price, expiration date, and order type.

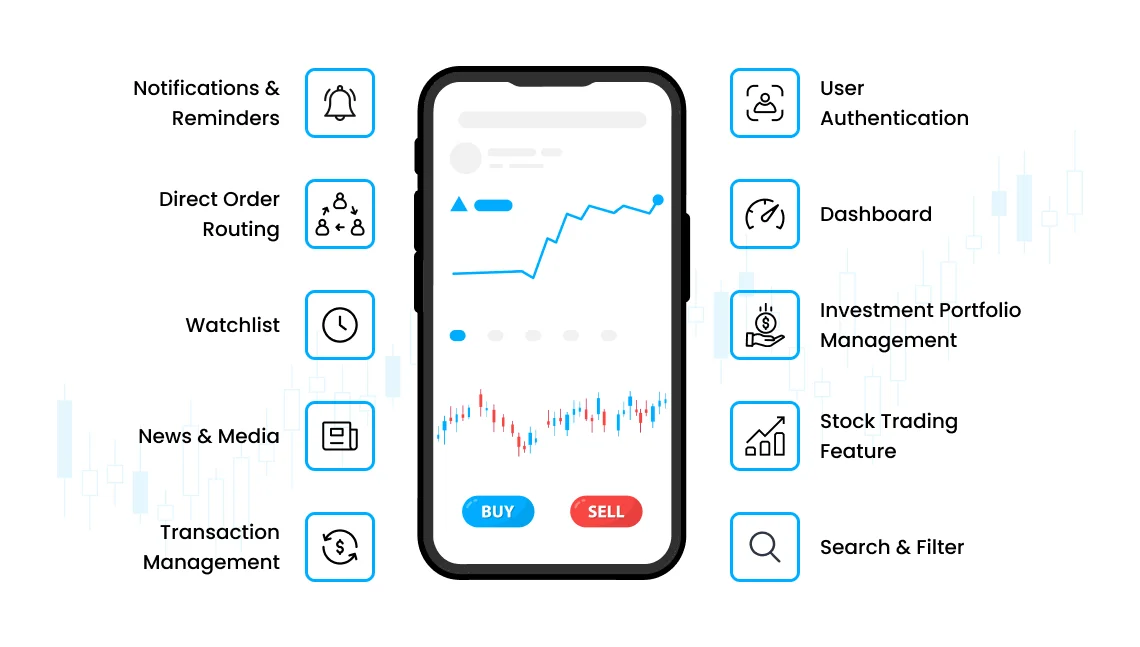

Image: www.mindinventory.com

Understanding the Risks Involved

As with any investment endeavor, options trading carries inherent risks. The potential for significant gains is balanced by the possibility of incurring substantial losses. Thoroughly comprehend the mechanics of options contracts, including their time decay and volatility sensitivity, before venturing into the market. Exercise prudence in managing your risk appetite and adhere to a sound trading plan.

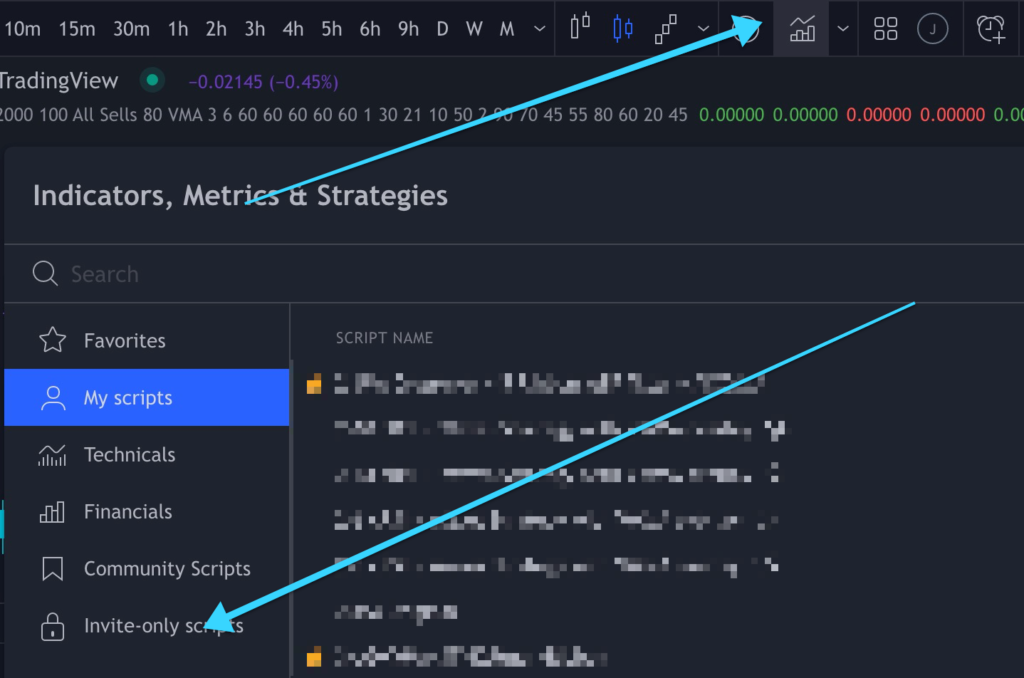

Beyond Robinhood: Expanding Your Options Trading Horizons

While Robinhood offers a convenient entry point into options trading, discerning investors may seek platforms that cater to more experienced traders. These specialized platforms often provide advanced features such as complex order types, technical analysis tools, and options chains for comprehensive market analysis.

Embracing the Evolving Landscape of Options Trading

The realm of options trading is constantly evolving, with new strategies and products emerging to meet the needs of sophisticated investors. Stay abreast of the latest developments by regularly consulting reputable financial sources and engaging in ongoing education. This proactive approach will empower you to navigate the ever-changing landscape effectively.

How To Add Options Trading On Thevrobinhood App

Image: thetradingbot.com

Conclusion

Options trading on the Robinhood app opens up a world of financial opportunities, enabling investors to pursue amplified returns while managing risk. By comprehending the basics, meeting eligibility criteria, and diligently executing trades, you can leverage the platform’s user-friendliness to unlock the potential of this exciting market. Remember, though, options trading is not without risks, so proceed with prudence and an insatiable thirst for knowledge. The path to financial success in options trading lies in continuous learning, calculated risk-taking, and a laser-sharp focus on the ever-evolving landscape.