Unleashing the Power of Simulated Trading for Profitable Investment Decisions

In today’s complex financial landscape, options trading has emerged as a sophisticated investment strategy that requires a deep understanding of market dynamics and risk management. However, the high stakes involved in real-time trading can be daunting for beginners and seasoned traders alike. Enter the innovative option paper trading app, a game-changer for learning and honing your trading skills without risking actual capital.

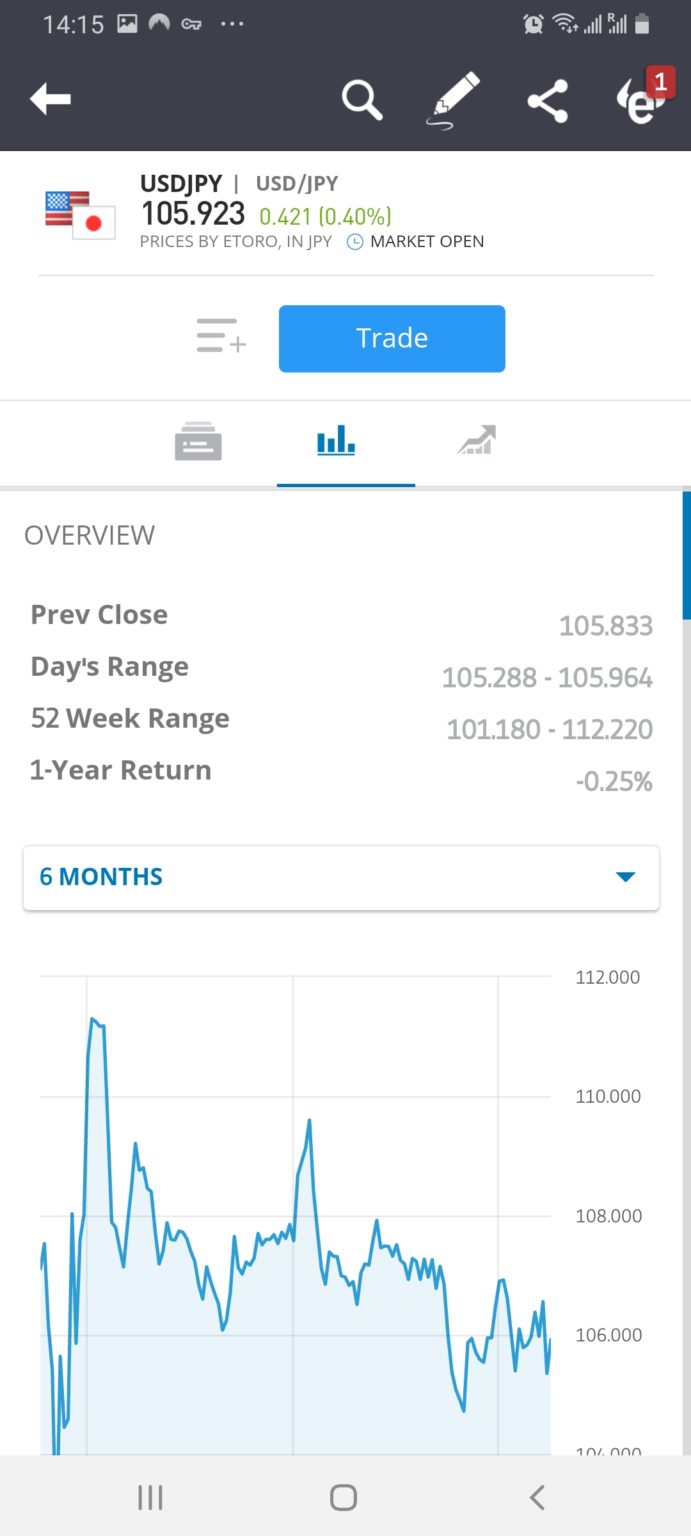

Image: stockapps.com

What is an Option Paper Trading App?

An option paper trading app is a software that simulates the real-world trading experience, allowing users to practice buying and selling options contracts without committing any money. It provides a realistic marketplace where traders can test their strategies, develop their intuition, and master the art of risk management. The app offers a simulated portfolio where traders can trade virtual funds, experiment with different strategies, and analyze market behavior in a safe and controlled environment.

The Allure of Option Paper Trading

The benefits of option paper trading are numerous. First and foremost, it eliminates the financial risk associated with real-time trading. This risk-free environment empowers traders to experiment with advanced strategies, such as complex spreads and multi-leg positions, without the fear of incurring losses. The app provides valuable feedback on trade performance, enabling traders to identify areas of improvement and fine-tune their techniques.

Moreover, option paper trading apps serve as a powerful educational tool. They offer comprehensive educational resources, including tutorials, webinars, and market analysis tools, that help traders grasp the intricacies of options trading. By simulating real-world market conditions, the app accelerates the learning curve, allowing traders to gain valuable practical experience that traditional textbooks and online courses cannot match.

The Intricacies of Option Trading

Options trading involves buying or selling contracts that give the holder the right, but not the obligation, to buy or sell an underlying asset at a specified price on a set date. Call options represent the right to buy, while put options represent the right to sell. The value of an option is determined by factors such as the underlying asset price, strike price, expiration date, and implied volatility.

Understanding these complexities can be challenging, but option paper trading apps simplify the process by providing user-friendly interfaces and intuitive trading tools. Traders can effortlessly create and modify orders, track market movements, and analyze historical data to refine their strategies.

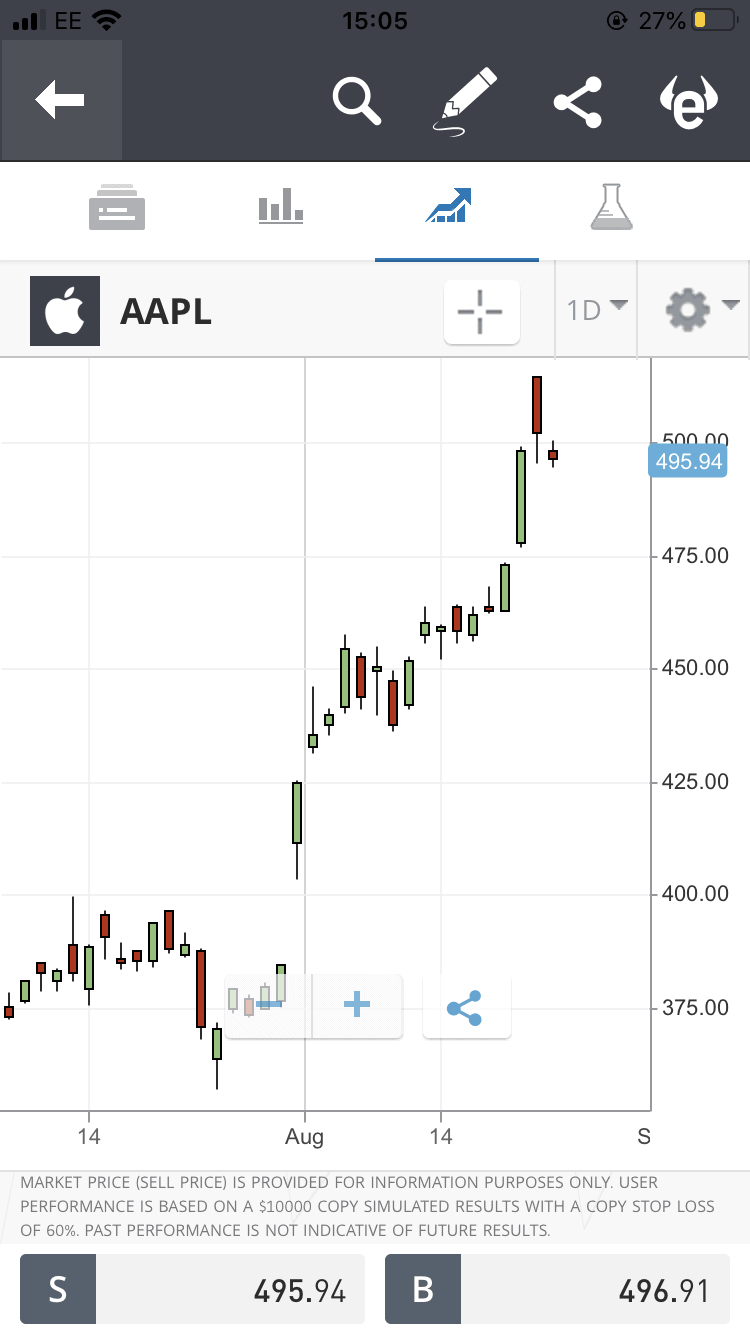

Image: stockapps.com

Strategies for Successful Option Trading

There are countless option trading strategies available, each with its unique risk and reward profile. Some of the most popular strategies include:

- Covered calls: Selling a call option against an underlying asset already owned.

- Protective puts: Buying a put option to protect an underlying asset from downside risk.

- Iron condors: Combining a bull call and bear put spread to profit from a narrow trading range.

- Straddles and strangles: Buying both a call and a put option with the same expiration date and different strike prices.

Option paper trading apps facilitate the exploration of these strategies and allow traders to experiment with different scenarios to maximize profitability while minimizing risk.

Option Paper Trading App

Conclusion

The option paper trading app has revolutionized the world of options trading by providing a risk-free environment for traders of all levels. With its comprehensive educational resources, realistic market simulations, and advanced trading tools, the app empowers traders to master option strategies, optimize their decision-making, and secure their financial future. Embrace the potential of this innovative platform and embark on a journey to financial empowerment today.