Are you an ambitious investor eager to venture beyond traditional stock trading? Options trading offers a unique opportunity to amplify your financial gains, but it requires careful understanding and activation within your brokerage account. One of the most popular platforms for options trading is Robinhood, known for its user-friendly interface and zero-commission structure. This article will guide you through the process of enabling options trading in Robinhood, empowering you to harness the potential of this powerful financial instrument.

Image: www.youtube.com

Introducing Options Trading: A World of Possibilities

Options trading involves entering into contracts that give you the right, but not the obligation, to buy or sell an underlying asset at a specified price and time. By predicting future price movements and leveraging these contracts, options traders can potentially generate substantial returns. However, due to their inherent risk, options trading should be approached with a comprehensive understanding of their nuances.

Accessing Options Trading in Robinhood: A Step-by-Step Guide

To activate options trading in Robinhood, follow these simple steps:

-

Eligibility Check: Ensure you meet Robinhood’s eligibility criteria, which typically includes being over 18, a resident of the United States, and possessing a valid Social Security number.

-

Account Type: Options trading is not available in all account types. Verify that you have upgraded to a Robinhood Margin account.

-

Quiz Time: You will be required to pass a short quiz to assess your understanding of options trading concepts. Make sure to prepare adequately.

-

Approval Process: Once you submit your request, Robinhood will review your application. Approval usually takes one to two business days.

Delving into the Options Trading Universe

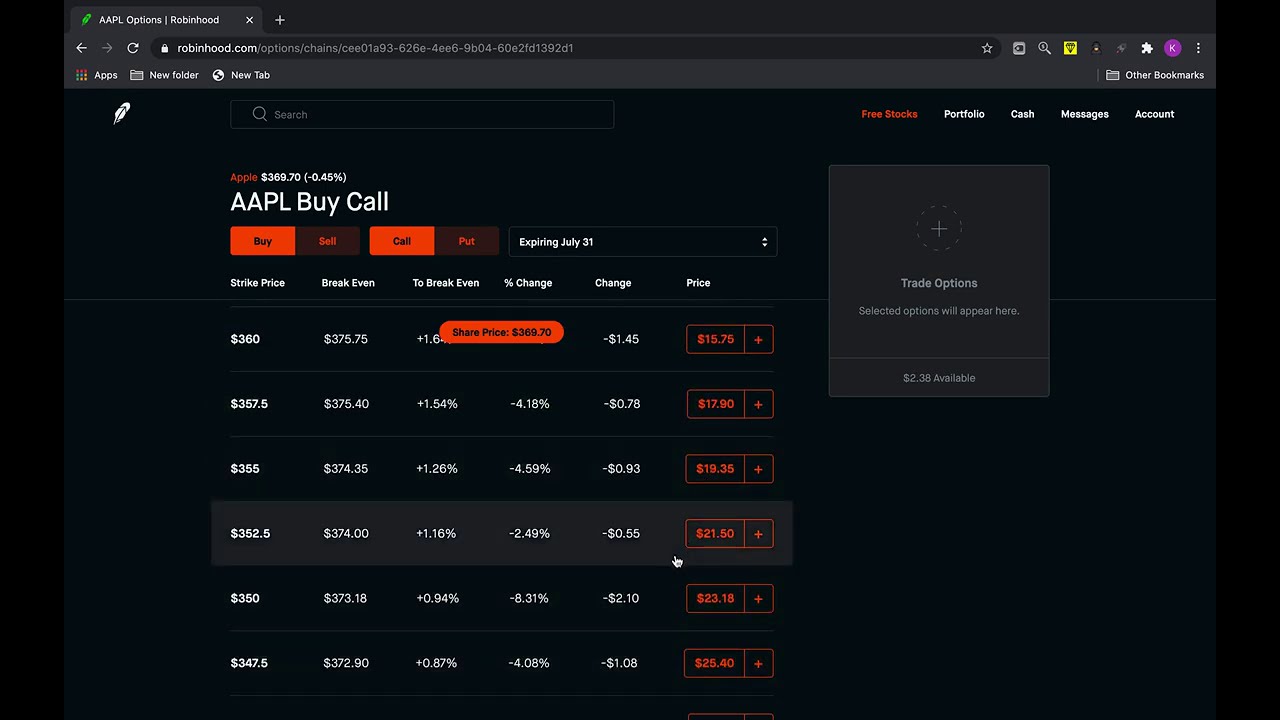

Once your Robinhood account is approved for options trading, you will have a wide range of contracts available. Options contracts specify the following key parameters:

-

Underlying Asset: The stock, exchange-traded fund (ETF), or other security you are trading.

-

Strike Price: The price at which you can exercise your right to buy or sell the underlying asset.

-

Expiration Date: The date on which the option contract expires and becomes worthless.

-

Premium: The price you pay upfront to acquire the option contract.

Image: www.youtube.com

Understanding Call and Put Options: A Foundation for Success

Options contracts come in two main flavors: call options and put options.

-

Call Options: Grant you the right but not the obligation to buy the underlying asset at the strike price on or before the expiration date.

-

Put Options: Confer the right but not the obligation to sell the underlying asset at the strike price on or before the expiration date.

Maximizing Your Options Trading Potential

To maximize your options trading success, consider the following strategies:

-

Do Your Research: Thoroughly research the underlying asset, market conditions, and option strategies before making any trades.

-

Manage Your Risk: Options trading carries inherent risk. Determine your risk tolerance and invest accordingly.

-

Start Small: Begin with a small position size to gain experience and confidence.

-

Learn from the Pros: Seek guidance from reputable sources, attend webinars, and consult with experienced options traders.

-

Practice First: Consider using a paper trading simulator to test your strategies in a risk-free environment.

Turn On Options Trading Robinhood

Conclusion: Embracing the Power of Options Trading

Enabling options trading in Robinhood opens up a world of financial opportunities. By embracing the principles outlined in this guide and continually seeking knowledge, you can harness the power of this instrument to amplify your investment returns. Remember, options trading comes with inherent risk, but with proper risk management and a commitment to learning, it can be a rewarding endeavor. Unlock the potential of options trading and embark on a journey of financial growth and empowerment.