Embarking on a Journey into the World of Options

Have you ever pondered the intricacies of options trading, captivated by the thrill of potential profits but hesitant due to its perceived complexity? Fear not, intrepid adventurer, for the Mathematics of Options Trading Reehl PDF stands as a beacon of illumination, guiding you through the labyrinthine depths of this financial frontier.

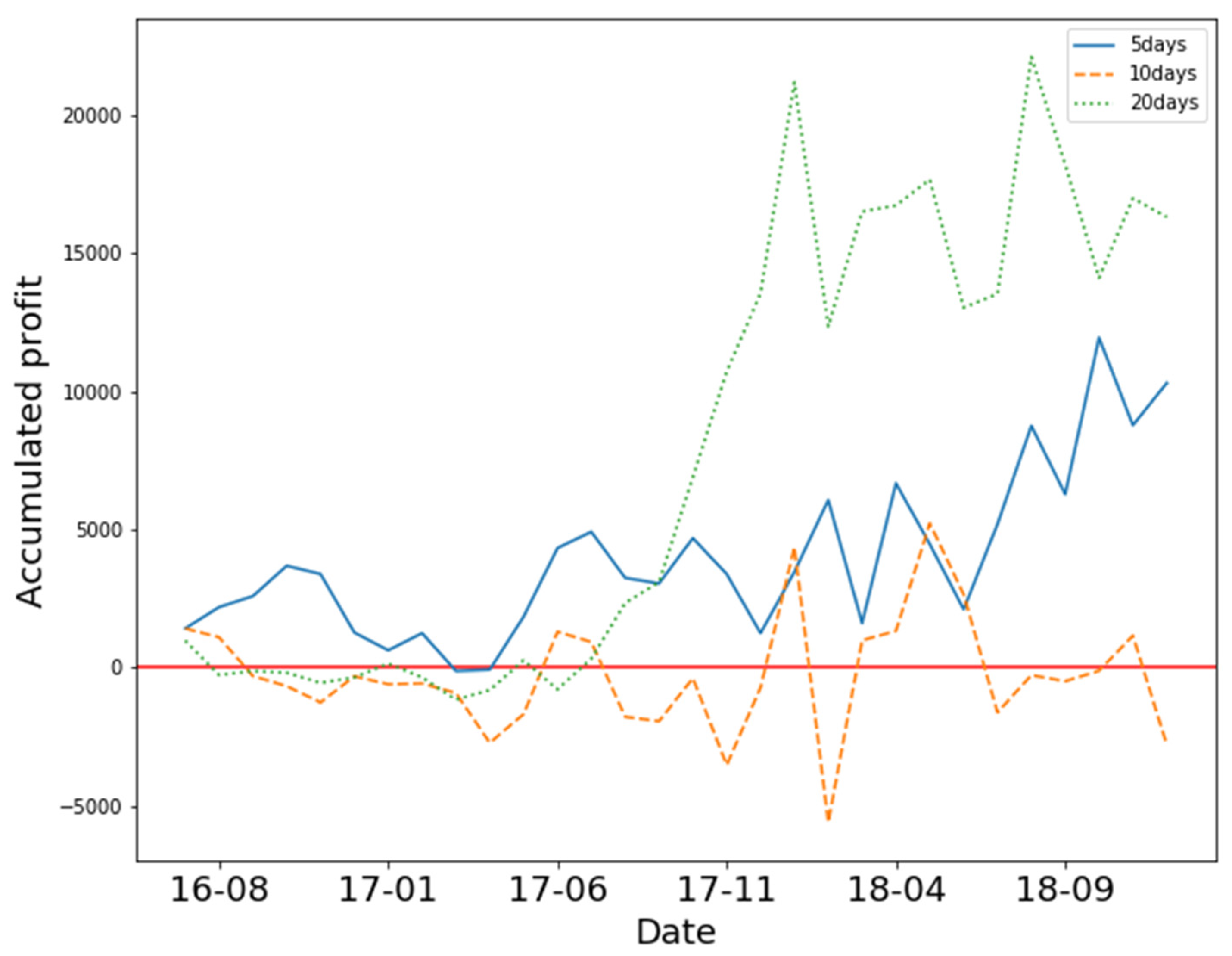

Image: www.mdpi.com

This comprehensive tome unravels the enigmatic tapestry of options trading, weaving together a vibrant narrative of mathematical principles and practical insights. Immerse yourself in this invaluable resource and emerge empowered, ready to seize opportunities in the ever-evolving markets.

The Essence of Options Trading

Options trading presents a beguiling realm of leveraging knowledge and strategy to navigate the uncharted waters of financial volatility. By purchasing options contracts, traders acquire the right, but not the obligation, to buy (call option) or sell (put option) an underlying asset at a predetermined price, known as the strike price, within a specified time frame.

The Black-Scholes Model

At the core of options pricing lies the Black-Scholes-Merton model, a groundbreaking mathematical model that calculates the fair value of an option contract. This model incorporates crucial parameters such as the underlying asset’s price, the strike price, time to expiration, volatility, and risk-free interest rate to provide a theoretical valuation.

While the Black-Scholes model offers a foundational framework, it’s important to recognize its limitations. Real-world markets are teeming with complexities and uncertainties, and traders must exercise prudence and discernment in applying this model.

Greek Letters and Option Sensitivities

The mathematics of options trading extends beyond pricing models, encompassing a deeper exploration into option sensitivities. These sensitivities, represented by Greek letters, quantify the impact of various factors on option prices. Understanding these sensitivities empowers traders to refine their strategies and mitigate risks effectively.

Delta, gamma, theta, vega, and rho represent the key Greek letters, each measuring the sensitivity of an option’s price to changes in underlying asset price, time to expiration, volatility, interest rates, and dividends, respectively.

Image: www.goodreads.com

Expert Insights and Practical Tips

As you navigate the turbulent waters of options trading, it’s imperative to harness the wisdom gleaned from seasoned experts. Their insights and practical tips serve as invaluable navigational aids, helping you navigate the complexities of this dynamic landscape.

Understanding Volatility

Volatility, a measure of an asset’s price fluctuations, plays a crucial role in options trading. Higher volatility translates to greater potential profits but also elevated risks. Traders must meticulously assess and incorporate volatility estimates into their option strategies to optimize outcomes.

Risk Management Strategies

Risk management is the cornerstone of prudent options trading. Employ robust risk management techniques such as diversification, position sizing, and hedging to minimize potential losses and preserve capital. Never underestimate the importance of managing risk effectively.

FAQ on Options Trading

Q: What’s the difference between a call option and a put option?

A: A call option grants the buyer the right to buy the underlying asset at a specified price, while a put option gives the buyer the right to sell the underlying asset at a specified price.

Q: How do I determine the premium for an option contract?

A: The option premium is the price paid to the seller of the option contract and is determined by factors such as the strike price, time to expiration, underlying asset price, volatility, and interest rates.

Mathematics Of Options Trading Reehl Pdf

Image: issuu.com

In Closing: Embracing the Mathematics of Options Trading

The Mathematics of Options Trading Reehl PDF unveils the intricate tapestry of options trading, empowering you with the mathematical principles and practical insights essential for success in this dynamic financial arena. Embrace the knowledge contained within its pages, and you’ll find yourself equipped with the tools to navigate the complexities of the market, seize opportunities, and reap the potential rewards that await.

Is the topic of mathematics of options trading reehl pdf interesting to you? Share your thoughts and experiences in the comments section below.