In the realm of financial markets, options trading holds immense power, enabling investors to hedge against risk or amplify potential gains. Among the vast array of options available, foreign exchange (FX) options stand out as a crucial instrument for managing currency exposure and capitalizing on currency fluctuations. This in-depth tutorial will guide you through the fundamentals of FX option trading, empowering you to navigate this dynamic market.

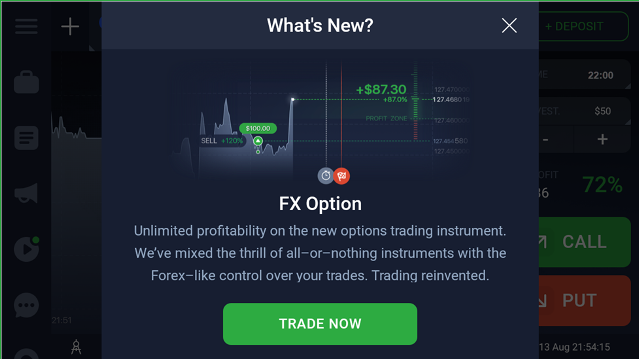

Image: www.freebinaryoptions.one

Understanding FX Options

An FX option is a contract that grants the buyer the right, but not the obligation, to buy or sell a predetermined amount of a foreign currency at a specified exchange rate on a specific date. The buyer of an FX option pays a premium to the seller of the option in exchange for this right.

Types of FX Options

Two primary types of FX options exist: call options and put options. A call option allows the buyer to purchase the underlying currency, while a put option grants the buyer the right to sell it. Call options are typically used when the buyer expects the value of the foreign currency to rise, while put options are utilized when the buyer anticipates a decline in its value.

Key Concepts

- Expiration Date: The date on which the FX option contract expires.

- Strike Price: The predetermined exchange rate at which the buyer may purchase or sell the underlying currency.

- Premium: The amount paid by the buyer of an FX option to the seller.

- In-the-Money and Out-of-the-Money: A call option is said to be “in-the-money” if the underlying currency’s value exceeds the strike price, while a put option is “in-the-money” if the underlying currency’s value falls below the strike price.

Image: www.pinterest.com

Benefits of FX Option Trading

- Hedging Risk: FX options effectively reduce the potential for losses by allowing investors to offset currency fluctuations.

- Profiting from Currency Movements: By anticipating market trends, traders can capitalize on currency appreciation or depreciation.

- Leverage: FX options provide a way to gain exposure to large amounts of currency with a relatively small investment.

How to Trade FX Options

- Open an Account: Choose a reputable broker that offers FX options trading.

- Understand Market Dynamics: Research the currency pair you intend to trade and monitor economic indicators and news events.

- Risk Management: Determine your risk tolerance and invest accordingly, setting stop-loss orders to mitigate potential losses.

- Execute the Trade: Select the type of FX option (call or put), specify the strike price, expiration date, and amount.

Expert Insights

- “In the FX options market, it’s crucial to remain patient and disciplined,” advises seasoned trader Mark Jenkins. “Avoid overly leveraged positions and let the market trends guide your decisions.”

- “Technical indicators such as moving averages and RSI can provide valuable insights into market behavior,” adds financial analyst Jessica Benson. “However, always consider them in conjunction with fundamental factors.”

Fx Option Trading Tutorial

Image: www.forexcrunch.com

Conclusion

FX option trading presents a formidable yet rewarding opportunity for experienced investors. By grasping the core concepts, embracing expert insights, and implementing sound risk management strategies, traders can harness the power of FX options to navigate currency fluctuations and enhance their financial portfolios.

Remember, knowledge and discipline are the keys to success in the dynamic world of FX options trading. Embrace this comprehensive tutorial as a beacon, guiding your journey towards financial mastery.