Unlocking the Power of Simulation for Informed Trading Decisions

In the world of options trading, understanding market dynamics and making informed decisions can be a daunting task. Enter Monte Carlo simulation, a powerful tool that allows you to simulate thousands of potential scenarios to assess the probability of different outcomes. In this comprehensive guide, we’ll delve into the ins and outs of Monte Carlo simulation for options trading, empowering you with vital knowledge to navigate the complexities of the market.

Image: tradingtuitions.com

Simulated Markets: Unlocking Hidden Opportunities

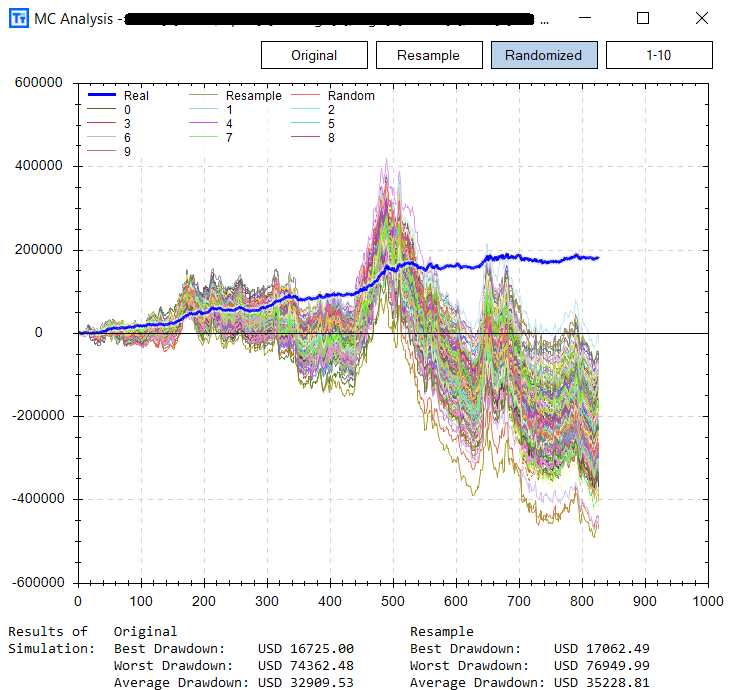

Monte Carlo simulation is a stochastic method that simulates market conditions by randomly generating possible paths for the underlying asset. This process allows traders to model various scenarios and analyze potential market outcomes under different conditions. By simulating thousands or even millions of scenarios, traders gain invaluable insights into the distribution of possible returns and the likelihood of achieving different outcomes.

In options trading, Monte Carlo simulation can be used to assess strategies such as covered calls, protective puts, and multi-leg strategies. By simulating the performance of these strategies under various market conditions, traders can make informed decisions about position sizing, strike prices, and expiration dates, optimizing their risk-reward profiles.

Harnessing Market Data for Accurate Simulations

The accuracy of Monte Carlo simulations relies heavily on the input data used. Historical data can provide a solid foundation for simulating market movements, but it’s essential to consider factors such as market volatility, seasonality, and current market trends. By incorporating up-to-date market information and adjusting parameters accordingly, traders can enhance the reliability of their simulations.

Furthermore, traders can employ Monte Carlo simulation to stress test options strategies and identify potential weaknesses. By simulating extreme market conditions, such as sharp movements or sudden volatility spikes, traders can assess the resilience of their strategies and make adjustments to mitigate risks and maximize returns.

Navigating the Technicalities: Expert Insights

Mastering Monte Carlo simulation in options trading requires a strong understanding of technical aspects. Here are some tips and expert advice to help you maximize the effectiveness of your simulations:

- Define Clear Objectives: Before running a simulation, establish specific goals and objectives.

- Choose Appropriate Assumptions: Align simulation assumptions with market conditions and trading strategies.

- Test and Validate: Conduct sensitivity analysis to ensure the robustness of simulation results.

- Interpret Results Wisely: Analyze simulation outcomes critically, considering uncertainties and probabilistic nature of results.

- Integrate with Trading Tools: Utilize software tools that automate simulation processes and facilitate data analysis.

By incorporating these expert recommendations into your Monte Carlo simulations, you can enhance the accuracy and reliability of your market analysis, leading to more informed options trading decisions.

Image: www.seeitmarket.com

Frequently Asked Questions

What is the purpose of Monte Carlo simulation in options trading?

Monte Carlo simulation allows traders to simulate potential market scenarios and assess the probability of different outcomes, providing valuable insights for informed strategy development.

How do you incorporate current market conditions into a Monte Carlo simulation?

Input data for simulations should include up-to-date market information such as volatility levels, historical trends, and current market events to ensure accurate modeling of market conditions.

What are the limitations of using Monte Carlo simulation in options trading?

Monte Carlo simulation relies on assumptions, and actual market behavior may differ from simulated outcomes. Additionally, it requires a significant amount of computing power for complex simulations.

Monte Carlo Simulation Options Trading

Image: www.linkedin.com

Conclusion

Monte Carlo simulation is a powerful tool that empowers options traders with the ability to navigate market uncertainties and make informed trading decisions. By simulating thousands of potential scenarios, traders gain valuable insights into the probabilistic behavior of options strategies. However, it’s essential to approach Monte Carlo simulation with a solid understanding of its technicalities and limitations. By embracing the tips and advice presented in this article, aspiring traders can harness the power of Monte Carlo simulation to unlock hidden opportunities and make the most of the options trading marketplace.

Are you ready to delve deeper into the realm of Monte Carlo simulation for options trading and unlock the potential for exceptional market returns? Join the conversation today by leaving your comments and questions below.