Introduction

In the realm of financial markets, options trading presents a powerful tool for investors seeking to mitigate risk and capitalize on market fluctuations. Among the versatile options trading strategies, Monte Carlo simulations stand out as a robust and adaptable approach, providing traders with valuable insights and decision-making capabilities. In this comprehensive guide, we will explore the intricacies of Monte Carlo options trading, including its history, concepts, applications, and advanced techniques.

Image: sissoftwarefactory.com

Monte Carlo Simulations in Options Trading

Monte Carlo simulations, named after the famous casino in Monaco, are computational techniques that utilize random sampling to evaluate the potential outcomes of complex financial models. In options trading, Monte Carlo simulations allow traders to estimate the probability distribution of option prices under different market scenarios, considering factors such as volatility, interest rates, and underlying asset prices.

History and Development

The roots of Monte Carlo methods can be traced back to the early 20th century, when physicists Enrico Fermi and John von Neumann employed the technique to model the behavior of neutrons in nuclear reactors. In the 1960s, the concept was adapted to finance, and its application in options pricing gained prominence with the pioneering work of Paul Samuelson and Fischer Black.

Basic Concepts

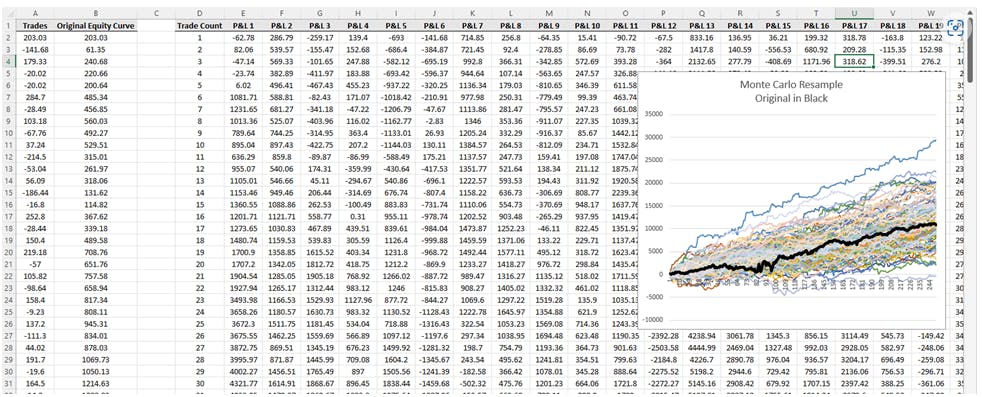

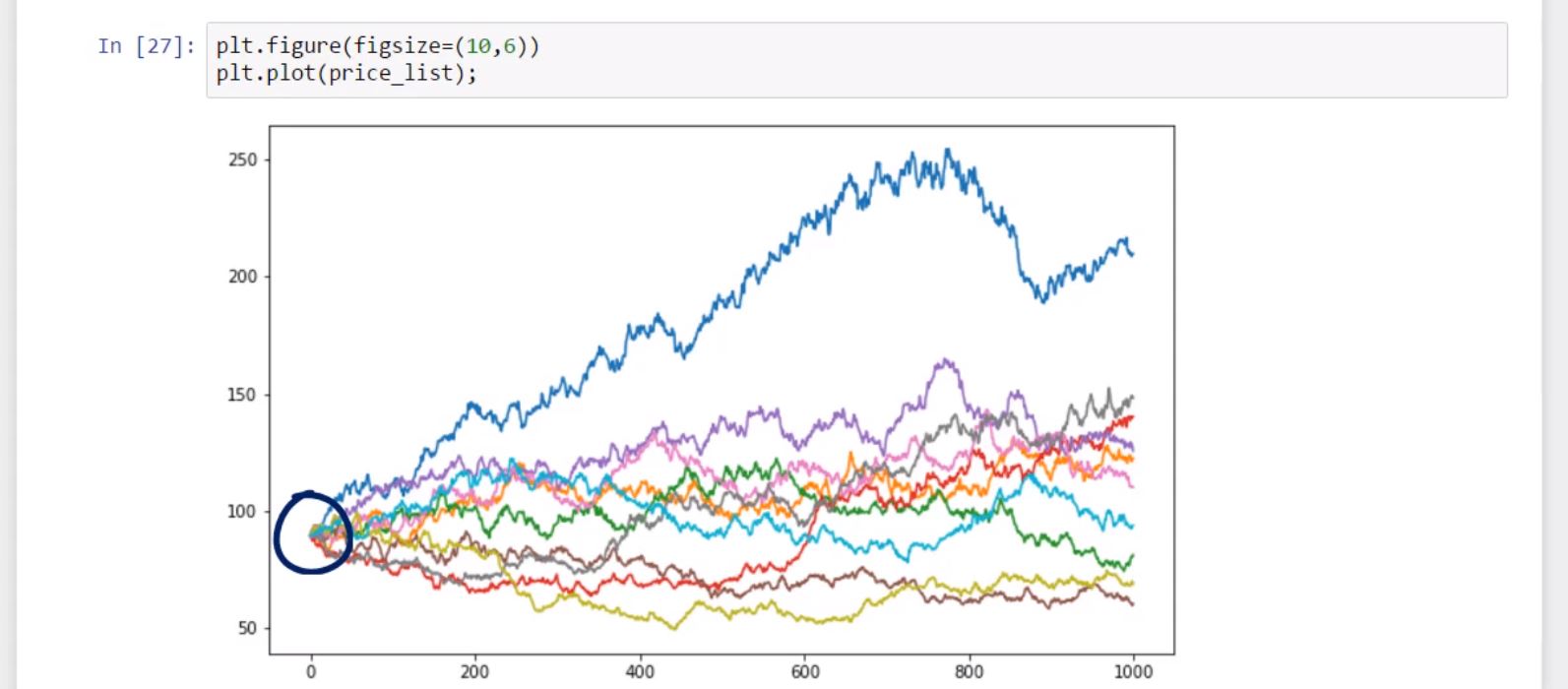

The cornerstone of Monte Carlo options trading lies in generating a large number of random paths for the underlying asset price over a specified time horizon. These paths are drawn from a probability distribution that reflects the expected behavior of the asset. For each path, the option’s payoff is calculated, and the distribution of these payoffs constitutes the probability distribution of the option price.

Image: elvinarjuna.blogspot.com

Real-World Applications

Monte Carlo simulations find widespread use in options trading for various purposes:

- Option Pricing: Determining the fair value of options by simulating the evolution of the underlying asset and calculating the option payout over numerous iterations.

- Risk Management: Assessing the risk associated with options positions, including potential profit and loss scenarios under changing market conditions.

- Strategy Optimization: Identifying the optimal trading strategies by evaluating the performance of different options strategies across multiple market simulations.

Advantages and Limitations

Advantages of Monte Carlo simulations:

- Flexibility: Can accommodate complex models and incorporate multiple factors affecting option prices.

- Accuracy: Provides precise estimates and probabilistic assessments of option prices and risks.

- Adaptability: Applicable to a wide range of options, including exotic options with non-standard payoffs.

Limitations of Monte Carlo simulations:

- Computational Cost: Simulating a large number of paths can be time-consuming and computationally intensive.

- Accuracy: The accuracy of the simulation depends on the quality of the underlying model and the number of paths generated.

- Complexity: Understanding and implementing Monte Carlo simulations requires technical proficiency and a deep understanding of financial mathematics.

Advanced Techniques

In addition to basic Monte Carlo simulations, advanced techniques have been developed to enhance accuracy and efficiency:

- Quasi-Monte Carlo: Utilizes low-discrepancy sequences instead of random sampling to reduce the number of paths required for convergence.

- Importance Sampling: Focuses the simulation on regions of the input distribution where the option payoff is most sensitive, leading to better estimates with fewer paths.

- Antithetic Variates: Creates pairs of simulations with opposite random number sequences to reduce variance and improve accuracy.

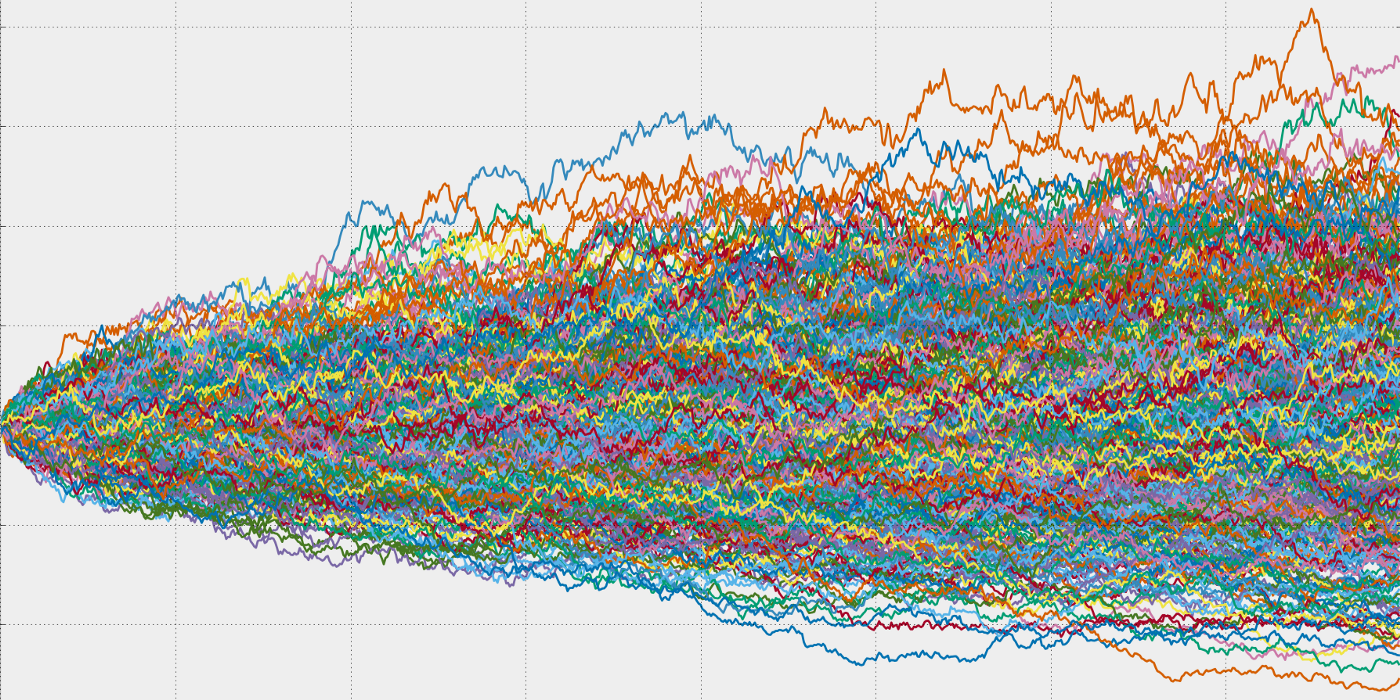

Monte Carlo Options Trading

Image: sissoftwarefactory.com

Conclusion

Monte Carlo simulations represent a powerful tool in the arsenal of options traders, providing a versatile framework for assessing option prices and managing risk. By incorporating sophisticated mathematical techniques and advanced computing power, traders can gain valuable insights into the intricacies of financial markets. Understanding the concepts, applications, and limitations of Monte Carlo options trading empowers investors to make informed decisions, navigate market uncertainties, and optimize their trading strategies effectively.