Demystifying the World of Derivatives

In the intricate realm of finance, futures and options stand as powerful tools for investors seeking to harness market volatility and manage risk. These derivative instruments offer traders a unique opportunity to speculate on future price movements, mitigate risk, and potentially generate substantial returns. Unraveling the complexities of futures and options trading can empower you to navigate these markets with confidence and reap their lucrative rewards.

Image: www.indiratrade.com

Futures: A Window into Tomorrow’s Market

Futures contracts are legally binding agreements to buy or sell a specific asset at a preset price on a predetermined future date. They provide traders with the ability to lock in a today’s price for a future transaction, insulating themselves from potential price fluctuations. Farmers, for instance, use futures contracts to secure a fixed price for their upcoming harvest, ensuring they receive a fair return regardless of market movements.

Options: Embracing Flexibility and Risk Management

Options contracts, on the other hand, grant the holder the right, but not the obligation, to buy or sell an underlying asset at a specified price before a set expiration date. They offer greater flexibility compared to futures, as the holder can choose whether or not to exercise the option based on market conditions. Options play a crucial role in risk management, enabling traders to hedge their positions and limit potential losses.

Examples that Paint a Vivid Picture

To illustrate the practical applications of futures and options, consider the following real-world scenarios:

● An airline anticipates a surge in fuel prices and purchases futures contracts to secure a fixed price for its future fuel needs. This protects the airline from the risk of rising jet fuel costs.

● An investor believes the stock market is poised for a rebound but wants to limit their risk. They purchase a call option, which gives them the right to buy the stock at a specific price. If the stock price rises above the strike price, the investor can exercise the option and potentially profit.

Image: www.quora.com

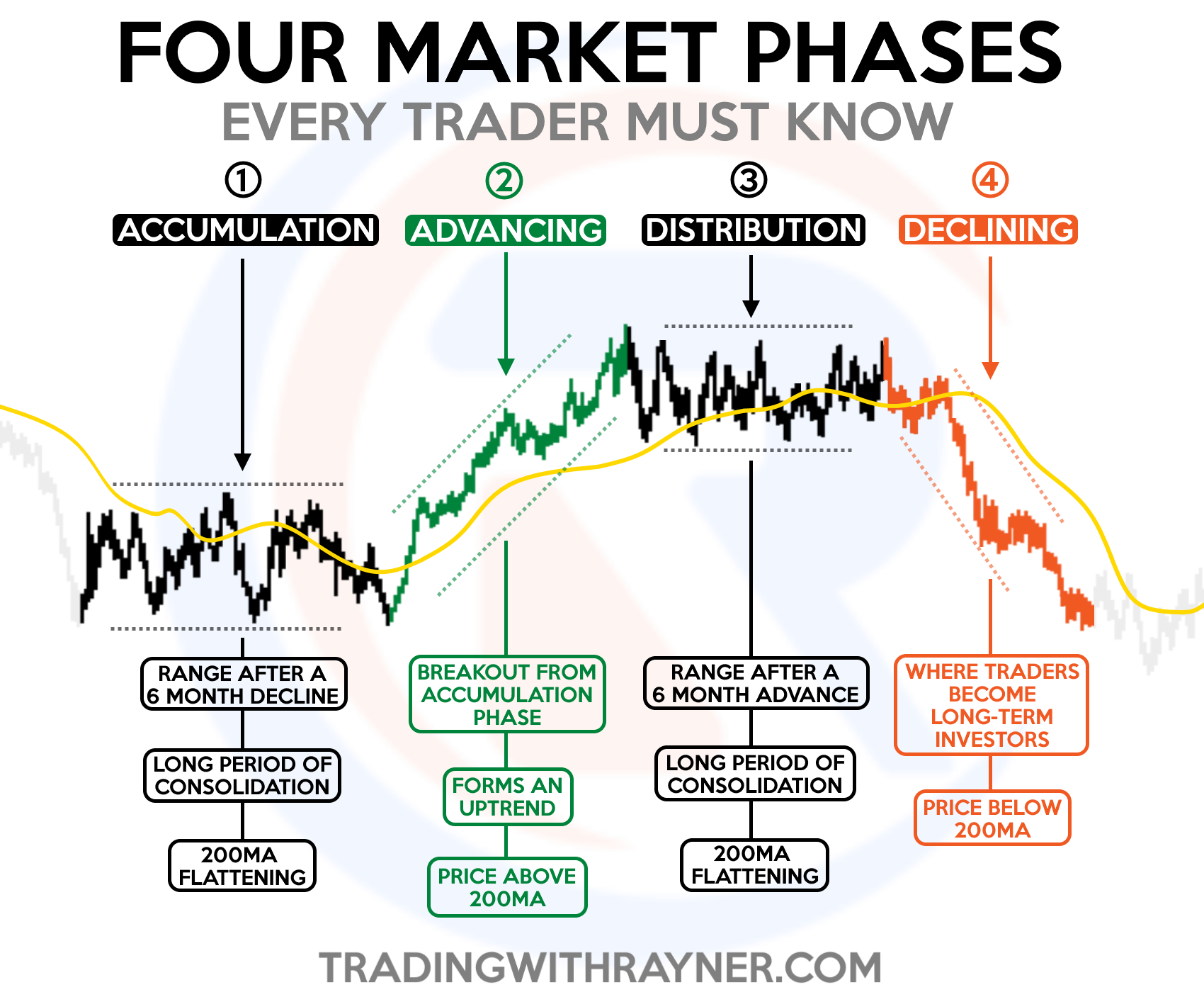

Exploring the Latest Developments

The world of futures and options trading is constantly evolving, with new strategies and advancements emerging. One notable trend is the rise of electronic trading platforms, which offer increased speed, transparency, and accessibility. Additionally, the introduction of index options and volatility futures has expanded the options available to traders.

Futures And Options Trading Examples

Image: qyrruvatvv.blogspot.com

The Call to Action

Delving into futures and options trading can be an enriching journey, offering the potential for financial growth and loss mitigation. As you navigate these complex markets, remember the importance of conducting thorough research, understanding the risks involved, and seeking guidance from experienced professionals when necessary. By embracing these principles, you can unlock the full potential of futures and options trading and harness its power to achieve your financial goals.