In the realm of financial markets, option trading stands out as a powerful tool for investors seeking to navigate risk and enhance returns. Among the various option markets, US option trading holds a prominent position due to its liquidity and the vast array of opportunities it offers. This comprehensive guide delves into the intricacies of US option trading, shedding light on its history, fundamental concepts, and practical applications.

Image: www.interactivebrokers.com

A Historical Overview: The Genesis of Option Trading

The origins of option trading can be traced back to 17th-century Amsterdam, where traders sought a means to hedge against price fluctuations in tulip bulbs. Over time, options evolved into sophisticated financial instruments, eventually finding their way to the Chicago Mercantile Exchange (CME) in 1973. The CME’s standardization of option contracts revolutionized the industry, paving the way for the modern US option trading market.

Deciphering the Basics: Core Concepts and Terminology

At its core, an option contract grants the holder the right, but not the obligation, to buy (call option) or sell (put option) an underlying asset at a predetermined price (strike price) within a specified timeframe (expiration date). Options are typically priced based on factors such as the underlying asset’s price, volatility, time to expiration, and prevailing interest rates.

Understanding key option trading terms is essential. The premium represents the price paid by the option buyer to acquire the contract. In the money (ITM) options have intrinsic value, meaning their exercise would result in a profit. At the money (ATM) options break even at the current asset price, while out of the money (OTM) options have no intrinsic value.

Navigating the Option Markets: Types and Strategies

US option trading encompasses a wide range of contract types. Equity options grant the right to buy or sell individual stocks. Index options provide exposure to entire market sectors or asset classes, while currency options facilitate trading in foreign exchange markets. Additionally, volatility options allow investors to speculate on future price fluctuations.

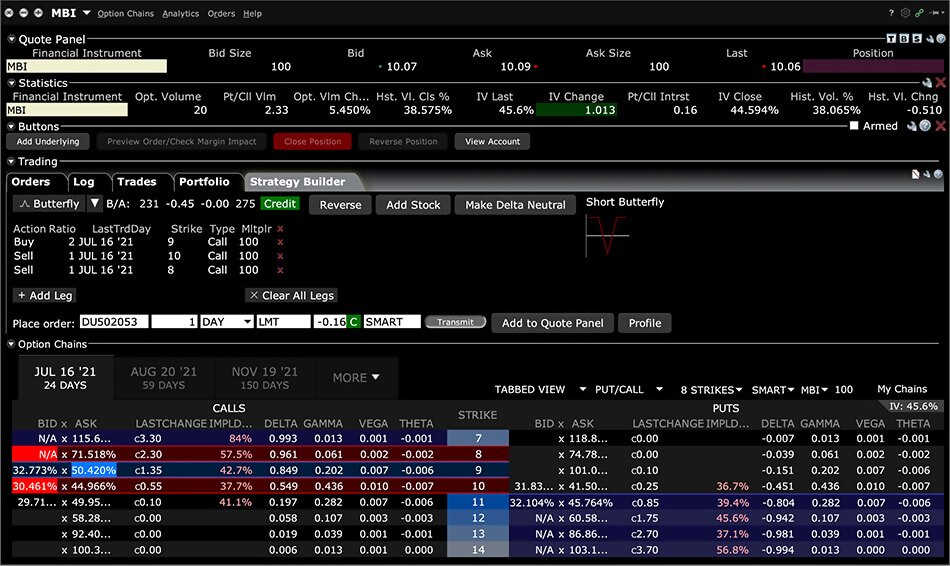

In terms of trading strategies, scalping involves exploiting small price movements over short time frames. Swing trading aims to capture moderate price fluctuations over days or weeks. Day trading focuses on closing all positions before the end of each trading day. More advanced strategies like options spreads and butterfly spreads involve combining multiple option contracts to create customized trading positions.

Image: tradeproacademy.com

Practical Applications: Hedging, Income Generation, and Speculation

US option trading finds diverse applications across financial domains. Hedging strategies enable investors to minimize risk by offsetting potential losses in one investment with gains in another. Options can also be leveraged for income generation through selling premiums or collecting dividends on underlying assets. Speculators, on the other hand, employ options to capitalize on anticipated price movements, seeking to generate high returns with potentially higher risks.

Us Option Trading

Image: meta-formula.com

Conclusion: Exploring Endless Possibilities

US option trading offers countless opportunities for savvy investors. Whether it’s hedging against uncertainty, pursuing income streams, or engaging in strategic speculation, options provide a versatile medium to navigate complex financial markets. With a thorough understanding of the underlying concepts and trading strategies, investors can harness the power of US option trading to achieve their financial objectives.