Introduction

In the labyrinthine world of financial markets, options trading stands out as an enigmatic strategy that offers both the potential for lucrative rewards and the risk of substantial losses. At its core, options trading revolves around the concept of expected return—a multifaceted metric that encapsulates both the probability of profit and the magnitude of potential gains. Understanding this crucial concept is paramount for navigating the complexities of options trading.

Image: www.longdom.org

As we embark on this educational journey, we will unravel the intricacies of expected return, uncovering its role in options trading. From defining foundational concepts to exploring practical applications and expert insights, we aim to equip you with the knowledge and confidence to make informed decisions in the ever-evolving world of finance.

Delving into Expected Return

Expected return in options trading is akin to a compass guiding investors through the choppy waters of uncertainty. It estimates the average profit or loss an investor can expect to make over a specific period. Unlike traditional investments like stocks, which offer a linear return profile, options trading introduces the concept of leverage, amplifying both profits and losses. This heightened potential for gain or loss underscores the importance of meticulously evaluating expected return.

To calculate expected return in options trading, a plethora of factors must be considered, including:

- Underlying asset’s price: The price of the underlying asset, such as a stock or index, significantly influences the value of options contracts.

- Option type: Call options confer the right to buy the underlying asset, while put options grant the right to sell. The type of option chosen depends on the investor’s expectations of the underlying asset’s price movement.

- Strike price: The strike price represents the price at which the investor can purchase or sell the underlying asset.

- Time to expiration: Options contracts have a finite lifespan, and their value decays over time. The time remaining until expiration impacts the option’s expected return.

- Volatility: Market volatility measures the extent of price fluctuations in the underlying asset. Higher volatility increases the potential return, but it also elevates the risk.

Navigating the Expected Return Landscape

Expert Insights

Distinguished experts in the field of options trading emphasize the crucial role of expected return in decision-making. Renowned investor Mark Mobius stresses the need for rigorous due diligence, asserting that “Understanding expected return is the cornerstone of successful options trading.”

Similarly, prominent trader Peter Thiel imparts valuable advice: “It’s not about chasing high returns; it’s about identifying opportunities where the expected return is favorable and managing risk accordingly.”

Practical Applications

The concept of expected return finds practical application in various scenarios:

- Risk Management: By quantifying expected return, investors can assess the potential risks and rewards associated with an options trade.

- Profit Optimization: Expected return guides investors toward trades with a higher probability of generating profits.

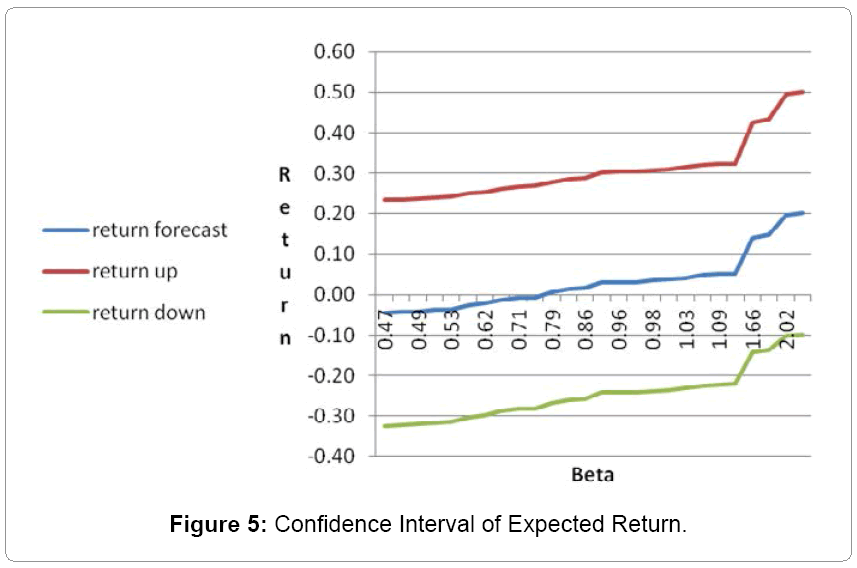

- Scenario Analysis: By considering multiple market scenarios, investors can estimate the range of potential returns and make informed decisions.

Image: www.thetilt.com

Expected Return Options Trading

Image: support.tastyworks.com

Conclusion

Expected return is a compass that illuminates the complexities of options trading. By understanding this metric, investors can assess the potential rewards and risks, optimize their strategies, and make informed decisions amidst the ever-changing market landscape.

Embracing the wisdom of industry experts, we embark on our trading journey with a keen eye for expected return. It is not a guarantee of success but rather a tool to navigate the turbulent waters of the financial markets. As we explore further, we will unveil the myriad facets of options trading and empower you to harness its potential for financial empowerment.